Question: Re Requlred: Compute the net pay for Cyra Khan and Kumi Tanaka. Assume that they are paid a ( $ 2 , 5

Re Requlred:

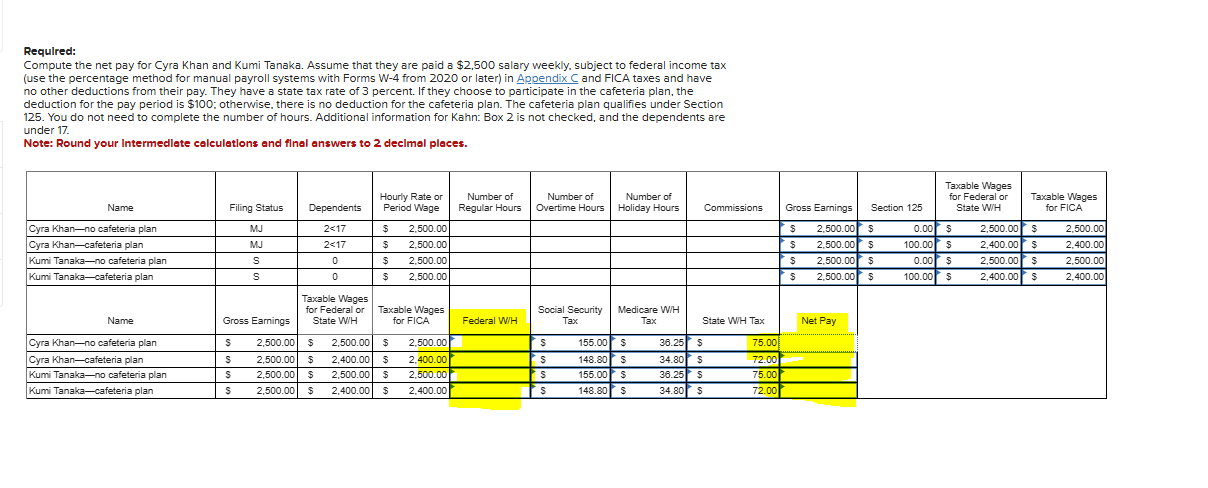

Compute the net pay for Cyra Khan and Kumi Tanaka. Assume that they are paid a $ salary weekly, subject to federal income tax use the percentage method for manual payroll systems with Forms W from or later in Appendix C and FICA taxes and have no other deductions from their pay. They have a state tax rate of percent. If they choose to participate in the cafeteria plan, the deduction for the pay period is $ ; otherwise, there is no deduction for the cafeteria plan. The cafeteria plan qualifies under Section You do not need to complete the number of hours. Additional information for Kahn: Box is not checked, and the dependents are under

Note: Round your Intermediate calculations and final answers to mathbf decimal places.

begintabularllllllllllll

hline Name & Filing Status & Dependents & Hourly Rate or Period Wage & Number of Regular Hours & Number of Overtime Hours & Number of Holiday Hours & Commissions & Gross Earnings & Section & Taxable Wages for Federal or State WH & Taxable Wages for FICA

hline Cyra Khanno cafeteria plan & MJ & & $ & & & & & $ & $ & $ & $

hline Cyra Khancafeteria plan & MJ & & $ & & & & & $ & $ & $ & $

hline Kumi Tanakano cafeteria plan & s & & $ & & & & & $ & $ & $ & $

hline Kumi Tanakacafeteria plan & s & & $ & & & & & $ & $ & $ & $

hline Name & Gross Earnings & Taxable Wages for Federal or State WH & Taxable Wages for FICA & Federal WH & Social Security Tax & Medicare WH Tax & State WH Tax & & multicolumncmultirow

hline Cyra Khanno cafeteria plan & $ & $ & $ & & $ & $ & $ & & & &

hline Cyra Khancafeteria plan & $ & $ & $ & & $ & $ & $ & & & &

hline Kumi Tanakano cafeteria plan & $ & $ & $ & & $ & $ & $ & & & &

hline Kumi Tanakacafeteria plan & $ & $ & $ & & $ & $ & $ & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock