Question: Read 3 Math Questions carefully then answer them accordingly. Please answer all the questions and I'll give thumps-up. ***What kind of information do you need?

Read 3 Math Questions carefully then answer them accordingly. Please answer all the questions and I'll give thumps-up. ***What kind of information do you need? I provide all kinds of information here. Please check or mention which math?

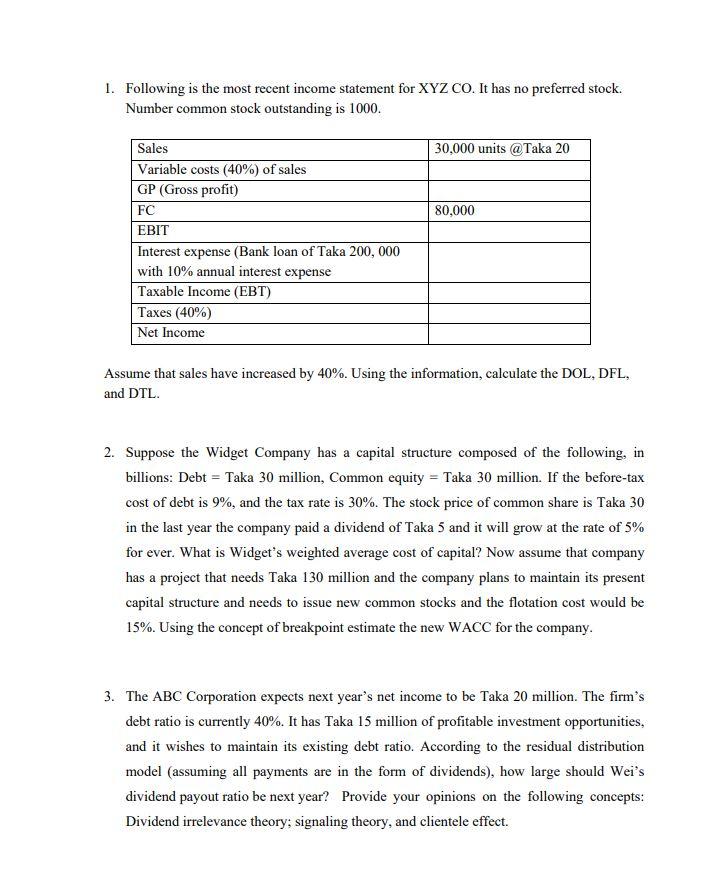

1. Following is the most recent income statement for XYZ CO. It has no preferred stock. Number common stock outstanding is 1000. 30,000 units @ Taka 20 80,000 Sales Variable costs (40%) of sales GP (Gross profit) FC EBIT Interest expense (Bank loan of Taka 200,000 with 10% annual interest expense Taxable Income (EBT) Taxes (40%) Net Income Assume that sales have increased by 40%. Using the information, calculate the DOL, DFL, and DTL. 2. Suppose the Widget Company has a capital structure composed of the following, in billions: Debt = Taka 30 million, Common equity = Taka 30 million. If the before-tax cost of debt is 9%, and the tax rate is 30%. The stock price of common share is Taka 30 in the last year the company paid a dividend of Taka 5 and it will grow at the rate of 5% for ever. What is Widget's weighted average cost of capital? Now assume that company has a project that needs Taka 130 million and the company plans to maintain its present capital structure and needs to issue new common stocks and the flotation cost would be 15%. Using the concept of breakpoint estimate the new WACC for the company. 3. The ABC Corporation expects next year's net income to be Taka 20 million. The firm's debt ratio is currently 40%. It has Taka 15 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wei's dividend payout ratio be next year? Provide your opinions on the following concepts: Dividend irrelevance theory; signaling theory, and clientele effect. 1. Following is the most recent income statement for XYZ CO. It has no preferred stock. Number common stock outstanding is 1000. 30,000 units @ Taka 20 80,000 Sales Variable costs (40%) of sales GP (Gross profit) FC EBIT Interest expense (Bank loan of Taka 200,000 with 10% annual interest expense Taxable Income (EBT) Taxes (40%) Net Income Assume that sales have increased by 40%. Using the information, calculate the DOL, DFL, and DTL. 2. Suppose the Widget Company has a capital structure composed of the following, in billions: Debt = Taka 30 million, Common equity = Taka 30 million. If the before-tax cost of debt is 9%, and the tax rate is 30%. The stock price of common share is Taka 30 in the last year the company paid a dividend of Taka 5 and it will grow at the rate of 5% for ever. What is Widget's weighted average cost of capital? Now assume that company has a project that needs Taka 130 million and the company plans to maintain its present capital structure and needs to issue new common stocks and the flotation cost would be 15%. Using the concept of breakpoint estimate the new WACC for the company. 3. The ABC Corporation expects next year's net income to be Taka 20 million. The firm's debt ratio is currently 40%. It has Taka 15 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wei's dividend payout ratio be next year? Provide your opinions on the following concepts: Dividend irrelevance theory; signaling theory, and clientele effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts