Question: Read and Integrate the CMS Energy Case Study (The Sequel, early 2002 and 2003) and the CMS Energy Case Material (Part 1 and 2) and

Read and Integrate the CMS Energy Case Study (The Sequel, early 2002 and 2003) and the CMS Energy Case Material (Part 1 and 2) and relate it to the "TONE AT THE TOP article below"

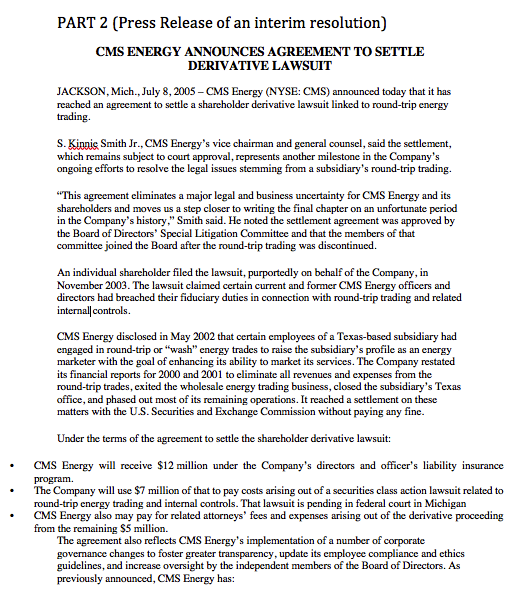

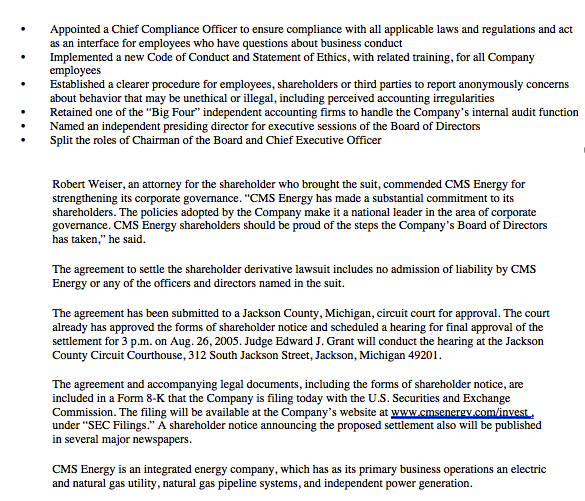

CMS Energy Case Study The Sequel Time to take yet another trip down CMS Energy Memory Lane with Messrs. Whipple (CEO) and Donald (CCO): Recall that the Prodromal-to-Acute Stages of the CMS Energy ethical misconduct disaster started late 2001 / early 2002, but during that period the then CMS Chair and CEO William T. McCormack, Jr. (WTM) was in denial regarding the seriousness of that growing crisis. That led to that "Imperial CEO" WTM being fired by the CMS Board of Directors (BOD) in late May, being replaced by "Interim" Chair / CEO Ken Whipple (aka "Ken", a former Ford exec already on CMS BOD) . So next "compare and contrast" what these two consecutive CMS Chairs / CEOs were telling the Company's shareholders (and indirectly its other stakeholders) via public disclosures during this unique period of "leadership", reflecting a noticeable contrast in Tone at the Top This background will then lead us to evaluate Tone at the Top, Organizational Control Systems and Ethical Leadership Styles. CMS Energy Tone at the Top: early 2002 "The year 2001 was a difficult one which required a major financial restructuring, but it also brought the beginning of a new strategic direction for CMS Energy.... In October, the company announced plans to refocus its growth in North America, where it has extensive assets and has enjoyed a great deal of success. These assets, which are complemented by a respected and growing marketing, services and trading business, are particularly well-positioned to serve the growing U.S. demand for clean-burning natural gas.... Our United States assets, which total $14 billion, already include: ... A leading and growing marketing and energy services company." "Few companies have the integrated energy asset base of CMS Energy, and we believe that the earnings from that base can be further enhanced by our growing and very successful energy marketing, services and trading company.... In summary, we believe our new strategy will lead to more predictable and steadier earnings growth, which will further secure our common stock dividend. We also look forward to a profitable and growing company this year." CMS Energy Tone at the Top: early 2003 "To our shareholders: Across the country, shareholders are receiving annual reports that account for their investments during the past year. Some companies will deliver good news, though less frequently than in most years because of the economy and financial markets. Many others will try to put a good "spin" on a year [2002] that didn't go quite right. I certainly can't make a pretense of doing the first, and I don't believe in the second. Instead, I'll discuss what we have been doing to turn this company around since I became Chairman and CEO in late May." (contemplate the changed tone at the top] "Next, I'll cover the sad chapter on so-called round-trip trading. As most people now know, round-trip trades are simultaneous purchases and sales of electricity and natural gas with the same parties at the same price. They may not be illegal, but they were dumb, and they didn't come close to meeting our ethical standards." "There is one more item that is very important to all of us at this company rebuilding the confidence of investors in our financial and business integrity. On pages 6-7 of this report we have outlined some of the measures in place to ensure sound and credible corporate governance, and to comply with new laws and regulations. But these measures are not just about compliance. We are dead serious about seeing that they are fully embraced in spirit, as well as the letter of the law, by all our employees.... And a commitment to compliance - simply following the letter of the law is not enough. Our standards for corporate governance must also embrace the spirit of the law - doing business in an ethical and compliant manner because it is the right thing to do. Here are some of the measures we have taken to fulfill our commitments: Appointing Donald to the new position of chief compliance officer. [Donald's editorial comment: woohoo / boohool] He will oversee the company's compliance with corporate governance standards and will report directly to the Board of Directors. He also will manage the company's compliance training and will provide advice to employees with questions or concerns about ethical behavior or potential conflicts of interest." CMS ENERGY CASE MATERIALS PART 1 (early press description of initial issue) Round Tripping On Energy Wednesday, CMS Energy admitted that it had booked $4.4 billion from so-called "round trip" transactions in 2000 and 2001 along with fellow energy traders Reliant Energy and Dynegy. Should energy-trading executives be prepared for round trips to prison--with a few Saturday night stay-overs in between? The answer is not yet, but the idea is not so far fetched. The U.S. Securities and Exchange Commission is widening an inquiry into phony revenue- generating practices, The Wall Street Journal reports. It is going beyond Dynegy Reliant and CMS Energy -- and perhaps beyond the energy-trading industry altogether, which is already reeling from scandal and the bankruptcy of Enron, once its leading light The energy traders and their defenders on Wall Street have for a while quietly acknowledged that essentially all energy-trading revenue is phony-even when the sales are not round trip. They are phony not because the sales did not occur, but because nearly all the energy traders book their deals at their gross values. To give a crude example, gross value accounting means that if a trader makes a market in an energy derivative and matches an energy contract to buy energy for $1 million with an offsetting obligation to sell it for $1.01 million, he considers his revenue to be $1.01 million. A securities firm such as Goldman Sachs (making the same deal would book revenue of 0.01 million-$10,000--that is, the spread between the buy price and the sell price. This kind of accounting is what allowed Enron, a company with roughly 24,000 employees, to be universally regaled as the nation's seventh-largest company when measured solely by revenue. Other companies in this revenue class, like IBM and General Electric, have closer to 300,000 employees. But the first thing one asks about a company is how big it is--that is, what its sales are. If you can use a simple accounting trick-and a legal trick to boot--why not do it? In America, looking busy and productive is itself a status symbol. Some people at CMS Energy, Dynegy and Reliant wanted look even bigger, still busier. Thus the sham transactions. For these companies, though, even the legitimate transactions could be as distorting as a mirror in a funhouse. The Dearborn-Mich.-based CMS Energy, for its part, an integrated energy company with just 11,600 employees, recorded $9.6 billion in sales in 2001--up a whopping 57% from 1999 The companies and their defenders on Wall Street will argue that there was no real deception because costs were also booked at gross values, hence the bottom line - profits - - were no different than they might have been. In its press release admitting the round-trip trades, CMS Energy takes this position: "The trades had no effect on the company's earnings, cash flow or balance sheet for 2001 or 2000," it says. In fact, CMS Energy was losing ground in those years when it came to profits. In 1999, it recorded a profit of $277 million, which fell to $36 million in 2000. Last year it had a loss of $545 million. Certainly, there were factors other than energy trading and sham trades at work. But the added volume didn't help. But in another sense the deception seems to have worked well, offering a motive for apparent nonsense. After CMS Energy's share price took a dive in early 2000, it took a steady rise from $15 a share to $27 in early 2001. This was despite its deteriorating profits. Even the massive losses of 2001 didn't lead to a complete collapse, though the share price had been above $40 in late 1998. A month ago, the shares were still trading above $21. Wednesday they closed at $17.23. That's not quite a round trip from two years ago, but it's close. PART 2 (Press Release of an interim resolution) CMS ENERGY ANNOUNCES AGREEMENT TO SETTLE DERIVATIVE LAWSUIT JACKSON, Mich., July 8, 2005-CMS Energy (NYSE: CMS) announced today that it has reached an agreement to settle a shareholder derivative lawsuit linked to round-trip energy trading S. Kinnis Smith Jr., CMS Energy's vice chairman and general counsel, said the settlement, which remains subject to court approval, represents another milestone in the Company's ongoing efforts to resolve the legal issues stemming from a subsidiary's round-trip trading. ""This agreement eliminates a major legal and business uncertainty for CMS Energy and its shareholders and moves us a step closer to writing the final chapter on an unfortunate period in the Company's history." Smith said. He noted the settlement agreement was approved by the Board of Directors' Special Litigation Committee and that the members of that committee joined the Board after the round-trip trading was discontinued. An individual shareholder filed the lawsuit, purportedly on behalf of the Company, in November 2003. The lawsuit claimed certain current and former CMS Energy officers and directors had breached their fiduciary duties in connection with round-trip trading and related internal controls. CMS Energy disclosed in May 2002 that certain employees of a Texas-based subsidiary had engaged in round-trip or "wash" energy trades to raise the subsidiary's profile as an energy marketer with the goal of enhancing its ability to market its services. The Company restated its financial reports for 2000 and 2001 to eliminate all revenues and expenses from the round-trip trades, exited the wholesale energy trading business, closed the subsidiary's Texas office, and phased out most of its remaining operations. It reached a settlement on these matters with the U.S. Securities and Exchange Commission without paying any fine. Under the terms of the agreement to settle the shareholder derivative lawsuit: CMS Energy will receive $12 million under the Company's directors and officer's liability insurance program. The Company will use $7 million of that to pay costs arising out of a securities class action lawsuit related to round-trip energy trading and internal controls. That lawsuit is pending in federal court in Michigan CMS Energy also may pay for related attorneys' fees and expenses arising out of the derivative proceeding from the remaining $5 million. The agreement also reflects CMS Energy's implementation of a number of corporate govemance changes to foster greater transparency, update its employee compliance and ethics guidelines, and increase oversight by the independent members of the Board of Directors. As previously announced, CMS Energy has: . Appointed a Chief Compliance Officer to ensure compliance with all applicable laws and regulations and act as an interface for employees who have questions about business conduct Implemented a new Code of Conduct and Statement of Ethics, with related training, for all Company employees Established a clearer procedure for employees, shareholders or third parties to report anonymously concerns about behavior that may be unethical or illegal, including perceived accounting irregularities Retained one of the "Big Four" independent accounting firms to handle the Company's internal audit function Named an independent presiding director for executive sessions of the Board of Directors Split the roles of Chairman of the Board and Chief Executive Officer Robert Weiser, an attorney for the shareholder who brought the suit, commended CMS Energy for strengthening its corporate governance. "CMS Energy has made a substantial commitment to its shareholders. The policies adopted by the Company make it a national leader in the area of corporate governance. CMS Energy shareholders should be proud of the steps the Company's Board of Directors has taken," he said. The agreement to settle the shareholder derivative lawsuit includes no admission of liability by CMS Energy or any of the officers and directors named in the suit. The agreement has been submitted to a Jackson County, Michigan, circuit court for approval. The court already has approved the forms of shareholder notice and scheduled a hearing for final approval of the settlement for 3 p.m.on Aug. 26, 2005. Judge Edward J. Grant will conduct the hearing at the Jackson County Circuit Courthouse, 312 South Jackson Street, Jackson, Michigan 49201. The agreement and accompanying legal documents, including the forms of shareholder notice, are included in a Form 8-K that the Company is filing today with the U.S. Securities and Exchange Commission. The filing will be available at the Company's website at www.cmsenergy.com/invest, under "SEC Filings." A shareholder notice announcing the proposed settlement also will be published in several major newspapers. CMS Energy is an integrated energy company, which has as its primary business operations an electric and natural gas utility, natural gas pipeline systems, and independent power generation. Tone at the Top: What exactly is it, and [why] does it really matter? So, by now you've noted that "tone at the top" is a course mini-theme, and particularly. But do you really know what the phrase means beyond a vague sense that it is connected to a company leaderships' impact on employees? And once you do really understand what it generally means when used and how does that "tone at the top" (or a lack thereof) relate to the many other course concepts and terms, including "legal compliance vis--vis ethical culture", as well as some "Strategic Approaches ..." either generally referenced or specifically noted on the next slide?| CMS Energy Case Study The Sequel Time to take yet another trip down CMS Energy Memory Lane with Messrs. Whipple (CEO) and Donald (CCO): Recall that the Prodromal-to-Acute Stages of the CMS Energy ethical misconduct disaster started late 2001 / early 2002, but during that period the then CMS Chair and CEO William T. McCormack, Jr. (WTM) was in denial regarding the seriousness of that growing crisis. That led to that "Imperial CEO" WTM being fired by the CMS Board of Directors (BOD) in late May, being replaced by "Interim" Chair / CEO Ken Whipple (aka "Ken", a former Ford exec already on CMS BOD) . So next "compare and contrast" what these two consecutive CMS Chairs / CEOs were telling the Company's shareholders (and indirectly its other stakeholders) via public disclosures during this unique period of "leadership", reflecting a noticeable contrast in Tone at the Top This background will then lead us to evaluate Tone at the Top, Organizational Control Systems and Ethical Leadership Styles. CMS Energy Tone at the Top: early 2002 "The year 2001 was a difficult one which required a major financial restructuring, but it also brought the beginning of a new strategic direction for CMS Energy.... In October, the company announced plans to refocus its growth in North America, where it has extensive assets and has enjoyed a great deal of success. These assets, which are complemented by a respected and growing marketing, services and trading business, are particularly well-positioned to serve the growing U.S. demand for clean-burning natural gas.... Our United States assets, which total $14 billion, already include: ... A leading and growing marketing and energy services company." "Few companies have the integrated energy asset base of CMS Energy, and we believe that the earnings from that base can be further enhanced by our growing and very successful energy marketing, services and trading company.... In summary, we believe our new strategy will lead to more predictable and steadier earnings growth, which will further secure our common stock dividend. We also look forward to a profitable and growing company this year." CMS Energy Tone at the Top: early 2003 "To our shareholders: Across the country, shareholders are receiving annual reports that account for their investments during the past year. Some companies will deliver good news, though less frequently than in most years because of the economy and financial markets. Many others will try to put a good "spin" on a year [2002] that didn't go quite right. I certainly can't make a pretense of doing the first, and I don't believe in the second. Instead, I'll discuss what we have been doing to turn this company around since I became Chairman and CEO in late May." (contemplate the changed tone at the top] "Next, I'll cover the sad chapter on so-called round-trip trading. As most people now know, round-trip trades are simultaneous purchases and sales of electricity and natural gas with the same parties at the same price. They may not be illegal, but they were dumb, and they didn't come close to meeting our ethical standards." "There is one more item that is very important to all of us at this company rebuilding the confidence of investors in our financial and business integrity. On pages 6-7 of this report we have outlined some of the measures in place to ensure sound and credible corporate governance, and to comply with new laws and regulations. But these measures are not just about compliance. We are dead serious about seeing that they are fully embraced in spirit, as well as the letter of the law, by all our employees.... And a commitment to compliance - simply following the letter of the law is not enough. Our standards for corporate governance must also embrace the spirit of the law - doing business in an ethical and compliant manner because it is the right thing to do. Here are some of the measures we have taken to fulfill our commitments: Appointing Donald to the new position of chief compliance officer. [Donald's editorial comment: woohoo / boohool] He will oversee the company's compliance with corporate governance standards and will report directly to the Board of Directors. He also will manage the company's compliance training and will provide advice to employees with questions or concerns about ethical behavior or potential conflicts of interest." CMS ENERGY CASE MATERIALS PART 1 (early press description of initial issue) Round Tripping On Energy Wednesday, CMS Energy admitted that it had booked $4.4 billion from so-called "round trip" transactions in 2000 and 2001 along with fellow energy traders Reliant Energy and Dynegy. Should energy-trading executives be prepared for round trips to prison--with a few Saturday night stay-overs in between? The answer is not yet, but the idea is not so far fetched. The U.S. Securities and Exchange Commission is widening an inquiry into phony revenue- generating practices, The Wall Street Journal reports. It is going beyond Dynegy Reliant and CMS Energy -- and perhaps beyond the energy-trading industry altogether, which is already reeling from scandal and the bankruptcy of Enron, once its leading light The energy traders and their defenders on Wall Street have for a while quietly acknowledged that essentially all energy-trading revenue is phony-even when the sales are not round trip. They are phony not because the sales did not occur, but because nearly all the energy traders book their deals at their gross values. To give a crude example, gross value accounting means that if a trader makes a market in an energy derivative and matches an energy contract to buy energy for $1 million with an offsetting obligation to sell it for $1.01 million, he considers his revenue to be $1.01 million. A securities firm such as Goldman Sachs (making the same deal would book revenue of 0.01 million-$10,000--that is, the spread between the buy price and the sell price. This kind of accounting is what allowed Enron, a company with roughly 24,000 employees, to be universally regaled as the nation's seventh-largest company when measured solely by revenue. Other companies in this revenue class, like IBM and General Electric, have closer to 300,000 employees. But the first thing one asks about a company is how big it is--that is, what its sales are. If you can use a simple accounting trick-and a legal trick to boot--why not do it? In America, looking busy and productive is itself a status symbol. Some people at CMS Energy, Dynegy and Reliant wanted look even bigger, still busier. Thus the sham transactions. For these companies, though, even the legitimate transactions could be as distorting as a mirror in a funhouse. The Dearborn-Mich.-based CMS Energy, for its part, an integrated energy company with just 11,600 employees, recorded $9.6 billion in sales in 2001--up a whopping 57% from 1999 The companies and their defenders on Wall Street will argue that there was no real deception because costs were also booked at gross values, hence the bottom line - profits - - were no different than they might have been. In its press release admitting the round-trip trades, CMS Energy takes this position: "The trades had no effect on the company's earnings, cash flow or balance sheet for 2001 or 2000," it says. In fact, CMS Energy was losing ground in those years when it came to profits. In 1999, it recorded a profit of $277 million, which fell to $36 million in 2000. Last year it had a loss of $545 million. Certainly, there were factors other than energy trading and sham trades at work. But the added volume didn't help. But in another sense the deception seems to have worked well, offering a motive for apparent nonsense. After CMS Energy's share price took a dive in early 2000, it took a steady rise from $15 a share to $27 in early 2001. This was despite its deteriorating profits. Even the massive losses of 2001 didn't lead to a complete collapse, though the share price had been above $40 in late 1998. A month ago, the shares were still trading above $21. Wednesday they closed at $17.23. That's not quite a round trip from two years ago, but it's close. PART 2 (Press Release of an interim resolution) CMS ENERGY ANNOUNCES AGREEMENT TO SETTLE DERIVATIVE LAWSUIT JACKSON, Mich., July 8, 2005-CMS Energy (NYSE: CMS) announced today that it has reached an agreement to settle a shareholder derivative lawsuit linked to round-trip energy trading S. Kinnis Smith Jr., CMS Energy's vice chairman and general counsel, said the settlement, which remains subject to court approval, represents another milestone in the Company's ongoing efforts to resolve the legal issues stemming from a subsidiary's round-trip trading. ""This agreement eliminates a major legal and business uncertainty for CMS Energy and its shareholders and moves us a step closer to writing the final chapter on an unfortunate period in the Company's history." Smith said. He noted the settlement agreement was approved by the Board of Directors' Special Litigation Committee and that the members of that committee joined the Board after the round-trip trading was discontinued. An individual shareholder filed the lawsuit, purportedly on behalf of the Company, in November 2003. The lawsuit claimed certain current and former CMS Energy officers and directors had breached their fiduciary duties in connection with round-trip trading and related internal controls. CMS Energy disclosed in May 2002 that certain employees of a Texas-based subsidiary had engaged in round-trip or "wash" energy trades to raise the subsidiary's profile as an energy marketer with the goal of enhancing its ability to market its services. The Company restated its financial reports for 2000 and 2001 to eliminate all revenues and expenses from the round-trip trades, exited the wholesale energy trading business, closed the subsidiary's Texas office, and phased out most of its remaining operations. It reached a settlement on these matters with the U.S. Securities and Exchange Commission without paying any fine. Under the terms of the agreement to settle the shareholder derivative lawsuit: CMS Energy will receive $12 million under the Company's directors and officer's liability insurance program. The Company will use $7 million of that to pay costs arising out of a securities class action lawsuit related to round-trip energy trading and internal controls. That lawsuit is pending in federal court in Michigan CMS Energy also may pay for related attorneys' fees and expenses arising out of the derivative proceeding from the remaining $5 million. The agreement also reflects CMS Energy's implementation of a number of corporate govemance changes to foster greater transparency, update its employee compliance and ethics guidelines, and increase oversight by the independent members of the Board of Directors. As previously announced, CMS Energy has: . Appointed a Chief Compliance Officer to ensure compliance with all applicable laws and regulations and act as an interface for employees who have questions about business conduct Implemented a new Code of Conduct and Statement of Ethics, with related training, for all Company employees Established a clearer procedure for employees, shareholders or third parties to report anonymously concerns about behavior that may be unethical or illegal, including perceived accounting irregularities Retained one of the "Big Four" independent accounting firms to handle the Company's internal audit function Named an independent presiding director for executive sessions of the Board of Directors Split the roles of Chairman of the Board and Chief Executive Officer Robert Weiser, an attorney for the shareholder who brought the suit, commended CMS Energy for strengthening its corporate governance. "CMS Energy has made a substantial commitment to its shareholders. The policies adopted by the Company make it a national leader in the area of corporate governance. CMS Energy shareholders should be proud of the steps the Company's Board of Directors has taken," he said. The agreement to settle the shareholder derivative lawsuit includes no admission of liability by CMS Energy or any of the officers and directors named in the suit. The agreement has been submitted to a Jackson County, Michigan, circuit court for approval. The court already has approved the forms of shareholder notice and scheduled a hearing for final approval of the settlement for 3 p.m.on Aug. 26, 2005. Judge Edward J. Grant will conduct the hearing at the Jackson County Circuit Courthouse, 312 South Jackson Street, Jackson, Michigan 49201. The agreement and accompanying legal documents, including the forms of shareholder notice, are included in a Form 8-K that the Company is filing today with the U.S. Securities and Exchange Commission. The filing will be available at the Company's website at www.cmsenergy.com/invest, under "SEC Filings." A shareholder notice announcing the proposed settlement also will be published in several major newspapers. CMS Energy is an integrated energy company, which has as its primary business operations an electric and natural gas utility, natural gas pipeline systems, and independent power generation. Tone at the Top: What exactly is it, and [why] does it really matter? So, by now you've noted that "tone at the top" is a course mini-theme, and particularly. But do you really know what the phrase means beyond a vague sense that it is connected to a company leaderships' impact on employees? And once you do really understand what it generally means when used and how does that "tone at the top" (or a lack thereof) relate to the many other course concepts and terms, including "legal compliance vis--vis ethical culture", as well as some "Strategic Approaches ..." either generally referenced or specifically noted on the next slide?|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts