Question: Read ans answer the questions. thanks Harry has worked at a medium-size interior design firm for five years and eams a salary of $4,080 per

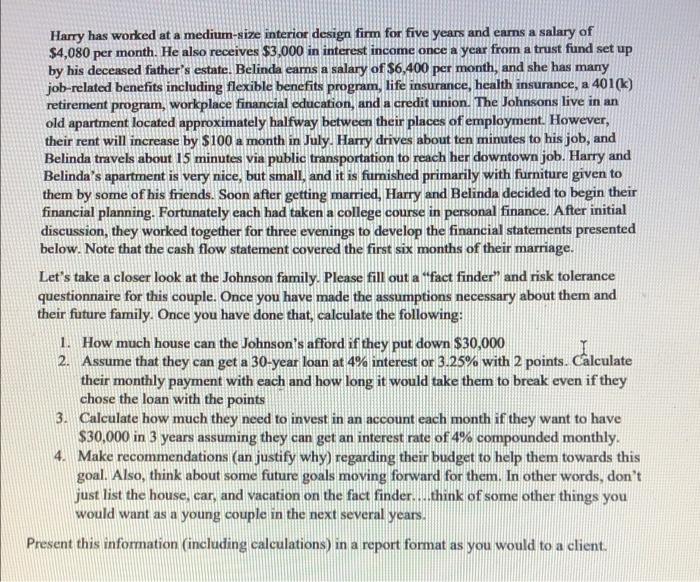

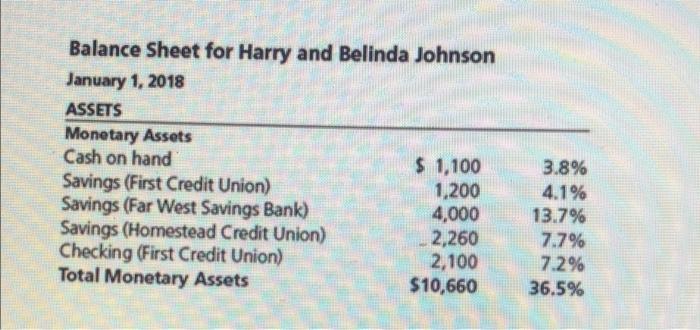

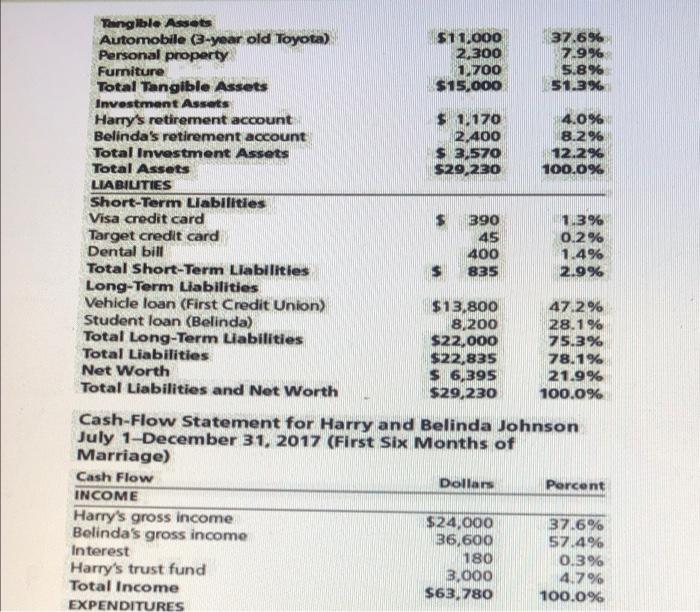

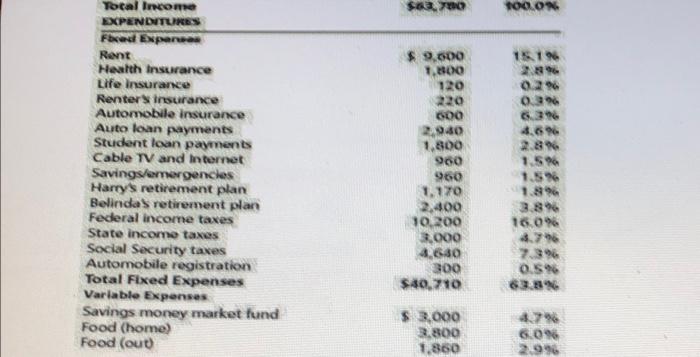

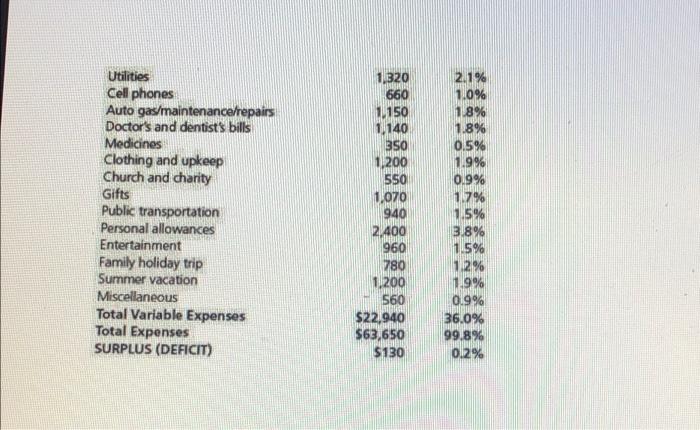

Harry has worked at a medium-size interior design firm for five years and eams a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a trust fund set up by his deceased father's estate. Belinda earns a salary of $6.400 per month, and she has many job-related benefits including flexible benefits program, life insurance, health insurance, a 401(k) retirement program, workplace financial education, and a credit union. The Johnsons live in an old apartment located approximately halfway between their places of employment. However, their rent will increase by $100 a month in July. Harry drives about ten minutes to his job, and Belinda travels about 15 minutes via public transportation to reach her downtown job. Harry and Belinda's apartment is very nice, but small, and it is furnished primarily with furniture given to them by some of his friends. Soon after getting married, Harry and Belinda decided to begin their financial planning. Fortunately each had taken a college course in personal finance. After initial discussion, they worked together for three evenings to develop the financial statements presented below. Note that the cash flow statement covered the first six months of their marriage. Let's take a closer look at the Johnson family. Please fill out a 'fact finder" and risk tolerance questionnaire for this couple. Once you have made the assumptions necessary about them and their future family. Once you have done that, calculate the following: 1. How much house can the Johnson's afford if they put down $30,000 2. Assume that they can get a 30-year loan at 4% interest or 3.25% with 2 points. Calculate their monthly payment with each and how long it would take them to break even if they chose the loan with the points 3. Calculate how much they need to invest in an account each month if they want to have $30,000 3 years assuming they can get an interest rate of 4% compounded monthly. 4. Make recommendations (an justify why) regarding their budget to help them towards this goal. Also, think about some future goals moving forward for them. In other words, don't just list the house, car, and vacation on the fact finder....think of some other things you would want as a young couple in the next several years. Present this information (including calculations) in a report format as you would to a client. Balance Sheet for Harry and Belinda Johnson January 1, 2018 ASSETS Monetary Assets Cash on hand $ 1,100 Savings (First Credit Union) 1,200 Savings (Far West Savings Bank) 4,000 Savings (Homestead Credit Union) 2,260 Checking (First Credit Union) 2,100 Total Monetary Assets $10,660 3.8% 4.1% 13.7% 7.7% 7.2% 36.5% Tangible Assets Automobile (3-year old Toyota) $11,000 37.696 Personal property 2,300 7.9% Furniture 1.700 5.8% Total Tangible Assets $15,000 51.3% Investment Assets Harry's retirement account $ 1170 4.0% Belinda's retirement account 2.400 8.2% Total Investment Assets $ 3.570 12.296 Total Assets $29,230 100.0% LIABILITIES Short-Term Liabilities Visa credit card $ 390 1.3% Target credit card 45 0.2% Dental bill 400 1.4% Total Short-Term Liabilities 835 2.9% Long-Term Liabilities Vehicle loan (First Credit Union) $13.800 47.2% Student loan (Belinda) 8,200 28.1% Total Long-Term Liabilities $22.000 75.3% Total Liabilities $22,835 78.1% Net Worth S 6,395 21.9% Total Liabilities and Net Worth $29,230 100.0% Cash-Flow Statement for Harry and Belinda Johnson July 1-December 31, 2017 (First Six Months of Marriage) Cash Flow Dollars Percent INCOME Harry's gross income $24,000 37.6% Belinda's gross income 36,600 57.4% Interest 180 0.3% Harry's trust fund 3,000 4.7% Total Income $63,780 100.0% EXPENDITURES $60 100.ON 151% 2.2% 0.2% 0.3% 6.3 4.6% Total Income EXPENDITURES Fred Expander Rent Health Insurance Life Insurance Renters Insurance Automobile insurance Auto loan payments Student loan payments Cable TV and Internet Savings/emergencies Harry's retirement plan Belinda retirement plan Federal income taxes State income taxes Social Security taxes Automobile registration Total Fixed Expenses Variable Expenses Savings money market fund Food (home) Food (out) $9,000 1.800 120 220 600 2.940 1,500 900 960 1.170 2,400 10.200 3,000 4.640 300 $40,710 1.5% 1.5% 1.8% 3.8% 16096 4.76 7.3% 0.5% 62% $ 3.000 3.800 1.860 6.0% 2.936 Utilities Cell phones Auto gas/maintenance/repairs Doctor's and dentists bills Medicines Clothing and upkeep Church and charity Gifts Public transportation Personal allowances Entertainment Family holiday trip Summer vacation Miscellaneous Total Variable Expenses Total Expenses SURPLUS (DEFICIT) 1.320 660 1.150 1,140 350 1,200 550 1.070 940 2.400 960 780 1.200 560 $22.940 $63,650 $130 2.1% 1.0% 1.8% 1.8% 0.5% 1.9% 0.9% 1.7% 1.5% 3.8% 1.5% 12% 1.9% 0.9% 36.0% 99.8% 0.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts