Read case seven entitled "The Upper Big Branch Mine Disaster" at page 500 of your book and discuss the costs and benefits to stakeholders of the action taken by Massey Energy and its managers

NOTE: I JUST NEED 2 PARAGRAPHS PLEASEEEEEEEE

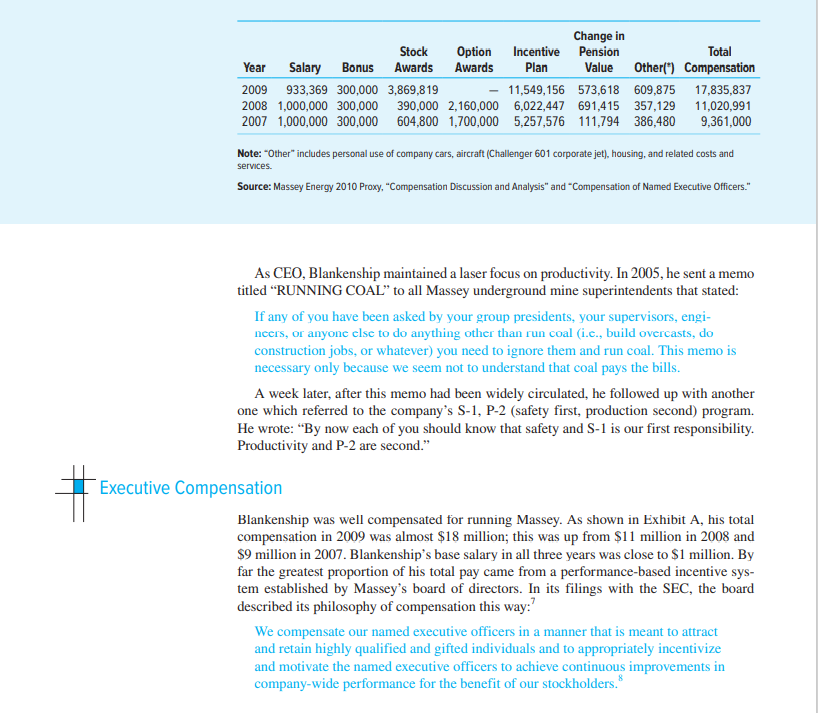

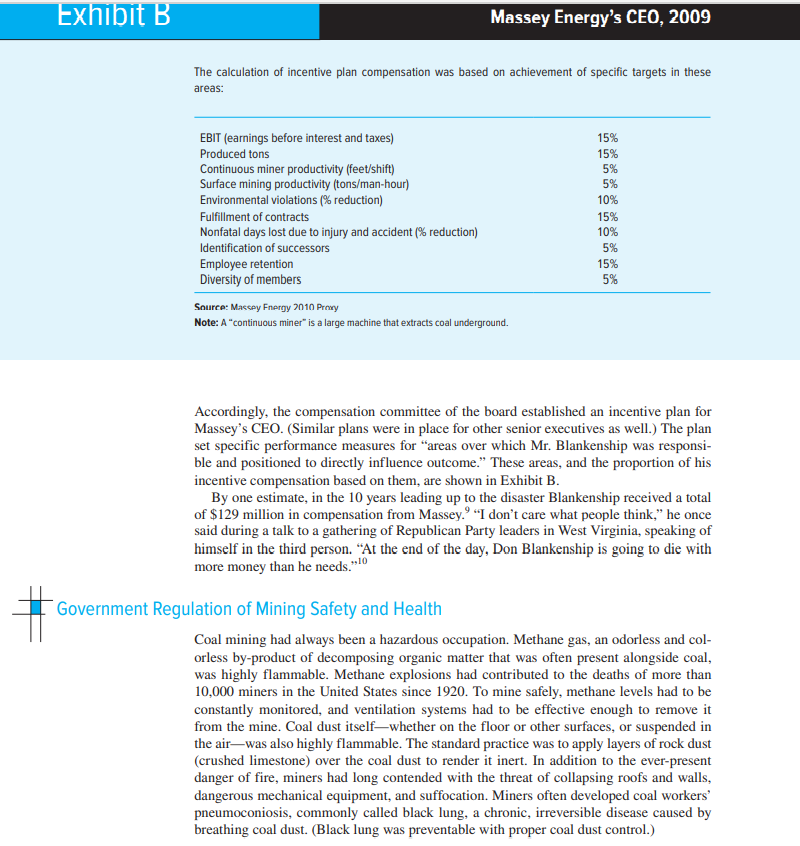

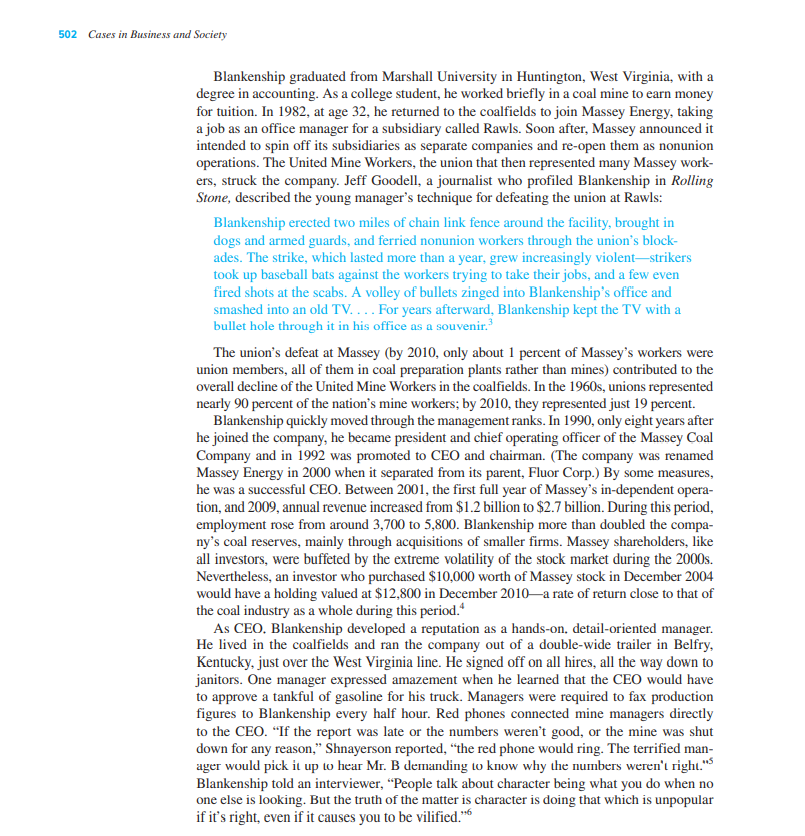

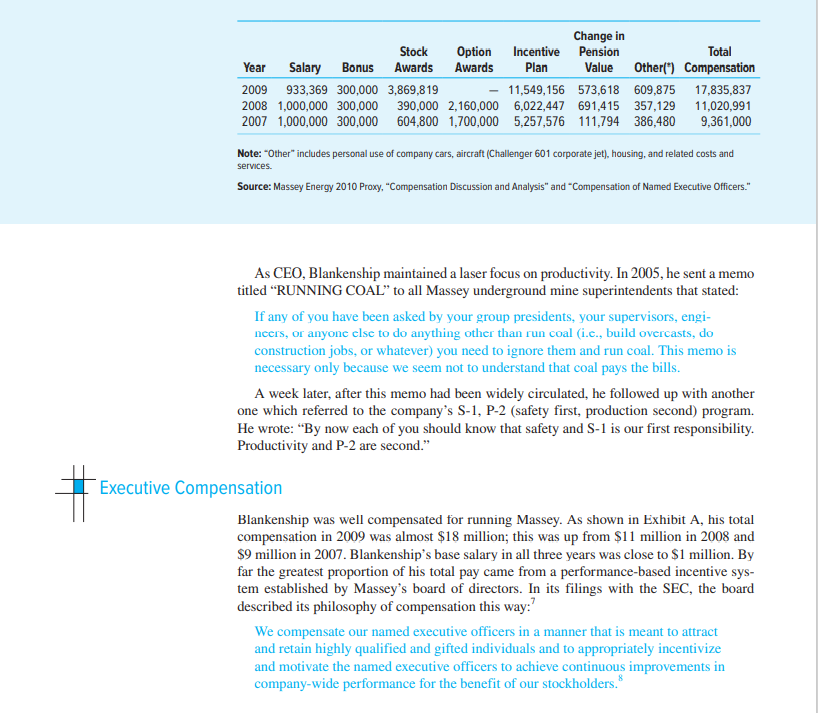

The Upper Big Branch Mine Disaster On Monday, April 5, 2010, just before 3:00 in the afternoon, miners at Massey Energy Corporation's Upper Big Branch coal mine in southern West Virginia were in the process of a routine shift change. Workers on the evening shift were climbing aboard mantrips," low-slung electric railcars that would carry them into the sprawling, three-mile-wide drift mine, cut horizontally into the side of a mountain. Many day shift workers inside the mine had begun packing up and were preparing to leave, and some were already on their way to the portals. At one of the mine's main "longwalls," one thousand feet below the surface, a team of four highly experienced miners was operating a shearer, a massive machine that cut coal from the face with huge rotating blades. The shearer had been shut down for part of the day because of mechanical difficulties, and the miners were making one last pass before the evening shift arrived to take their places. Suddenly, a spark thrown off as the shearer's blades cut into hard sandstone ignited a small pocket of flammable methane gas. One of the operators immediately switched off the high-voltage power to the machine. Seconds later, the flame reached a larger pocket of methane, creating a small fireball. Apparently recognizing the danger, the four miners on the longwall crew began running for the exit opposite the fire. They had traveled no more than 400 feet when coal dust on the ground and in the air ignited violently, setting off a wave of powerful explosions that raced through the mine's seven miles of underground tunnels. When it was over three minutes later, 29 miners (including all four members of the longwall crew) were dead, and two were seriously injured. Some had died from inju- ries caused by the blast itself, others from carbon monoxide suffocation as the explosion sucked the oxygen out of the mine. It was the worse mining disaster in the United States in almost 40 years. An evening shift miner who had just entered the mine and boarded a mantrip for the ride to the coal face later told investigators what he had experienced: All of a sudden you heard this big roar, and that's when the air picked up. I'd say it was probably 60-some miles per hour. Instantly black. It took my hardhat and ripped it off my head, it was so powerful. This miner and the rest of his group abandoned the mantrip and ran for the entrance, clutching each other in the darkness. On the outside, stunned and shaken, they turned to the most senior member of their crew for an explanation. Boys ..., I've been in the mines a long time, the veteran miner said That [was) no [roof] fall.... The place blew up." Case 7 The Upper Big Branch Mine Disaster 501 Massey Energy Corporation At the time of the explosion, Massey Energy Corporation, the owner and operator of the Upper Big Branch mine, was one of the leading coal producers in the United States. The company, which specialized in the production of high-grade metallurgical coal, described itself as "the most enduring and successful coal company in central Appalachia," where it owned one-third of the known coal reserves. Massey extracted 37 million tons of coal a year, ranking it sixth among U.S. producers in tonnage. The company sold its coal to more than a hundred utility, metallurgical, and industrial customers (mostly on long-term contracts) and exported to 13 countries. In 2009, Massey earned $227 million on revenue of $2.7 billion. The company and its subsidiaries employed 5,800 people in 42 underground and 14 surface mines and several coal processing facilities in West Virginia, Kentucky, and Virginia. Massey maintained that it brought many benefits to the nation as a whole and to the Appa- lachian region. The coal industry in the United States, of which Massey was an important part, provided the fuel for about half of the electricity generated in the United States, lessening the country's reliance on imported oil. The company provided thousands of relatively well- paying jobs in a region that had long been marked by poverty and unemployment. Economists estimated that for every job in the coal industry, around three and a half jobs were created elsewhere. The company donated to scholarship programs, partnered with local schools, and provided emergency support during natural disasters, such as severe flooding in West Vir- ginia in May 2009. "We recognize that it takes healthy and viable communities for our com- pany to continue to grow and succeed," Massey declared in its 2009 report to shareholders. But critics saw a darker side of Massey. The company was one of the leading practi- tioners of mountaintop removal mining, in which explosives were used to blast away the tops of mountains to expose valuable seams of coal. The resulting waste was frequently dumped into adjacent valleys, polluting streams, harming wildlife, and contaminating drinking water. In 2008, Massey paid $20 million to resolve violations of the Clean Water Act, the largest-ever settlement under that law. In an earlier incident, toxic mine sludge spilled from an impoundment operated by the company in Martin County, Kentucky, con- taminating hundreds of miles of the Big Sandy and Ohio rivers, necessitating a $50 million cleanup. Worker safety was also a concern. An independent study found that Massey had the worst fatality rate of any coal company in the United States. For example, in the decade leading up to the Upper Big Branch disaster, Peabody Coal (the industry leader in tons produced) had one fatality for every 296 million tons of coal mined; Massey's rate was one fatality per 18 million tonsmore than 16 times as high. Donald L. Blankenship At the time of the Upper Big Branch mine disaster, the chief executive officer and undisputed boss of Massey Energy was Don Blankenship. A descendant of the McCoy family of the famous warring clans the Hatfields and the McCoys, Blankenship was raised by a single mother in a trailer in Delorme, a railroad depot in the coalfields of West Virginia. His mother supported the family by working 6 days a week, 16 hours a day, running a convenience store and gas station. Michael Shnayerson, who wrote about Blankenship in his book, Coal River, reported that the executive had absorbed from his mother the value of hard workas well as contempt for others who might be less fortunate. Anyone who didn't work as hard as she did deserved to fail, Shnayerson wrote. Sympathy appeared to play no part in her reckonings."2 502 Cases in Business and Society Blankenship graduated from Marshall University in Huntington, West Virginia, with a degree in accounting. As a college student, he worked briefly in a coal mine to earn money for tuition. In 1982, at age 32, he returned to the coalfields to join Massey Energy, taking a job as an office manager for a subsidiary called Rawls. Soon after, Massey announced it intended to spin off its subsidiaries as separate companies and re-open them as nonunion operations. The United Mine Workers, the union that then represented many Massey work- ers, struck the company. Jeff Goodell, a journalist who profiled Blankenship in Rolling Stone, described the young manager's technique for defeating the union at Rawls: Blankenship erected two miles of chain link fence around the facility, brought in dogs and armed guards, and ferried nonunion workers through the union's block- ades. The strike, which lasted more than a year, grew increasingly violent-strikers took up baseball bats against the workers trying to take their jobs, and a few even fired shots at the scabs. A volley of bullets zinged into Blankenship's office and smashed into an old TV.... For years afterward, Blankenship kept the TV with a bullet hole through it in his office as a souvenir. The union's defeat at Massey (by 2010, only about 1 percent of Massey's workers were union members, all of them in coal preparation plants rather than mines) contributed to the overall decline of the United Mine Workers in the coalfields. In the 1960s, unions represented nearly 90 percent of the nation's mine workers; by 2010, they represented just 19 percent. Blankenship quickly moved through the management ranks. In 1990, only eight years after he joined the company, he became president and chief operating officer of the Massey Coal Company and in 1992 was promoted to CEO and chairman. (The company was renamed Massey Energy in 2000 when it separated from its parent, Fluor Corp.) By some measures, he was a successful CEO. Between 2001, the first full year of Massey's in-dependent opera- tion, and 2009, annual revenue increased from $1.2 billion to $2.7 billion. During this period, employment rose from around 3,700 to 5,800. Blankenship more than doubled the compa- ny's coal reserves, mainly through acquisitions of smaller firms. Massey shareholders, like all investors, were buffeted by the extreme volatility of the stock market during the 2000s. Nevertheless, an investor who purchased $10,000 worth of Massey stock in December 2004 would have a holding valued at $12,800 in December 2010a rate of return close to that of the coal industry as a whole during this period." As CEO. Blankenship developed a reputation as a hands-on detail-oriented manager. He lived in the coalfields and ran the company out of a double-wide trailer in Belfry, Kentucky, just over the West Virginia line. He signed off on all hires, all the way down to janitors. One manager expressed amazement when he learned that the CEO would have to approve a tankful of gasoline for his truck. Managers were required to fax production figures to Blankenship every half hour. Red phones connected mine managers directly to the CEO. "If the report was late or the numbers weren't good, or the mine was shut down for any reason," Shnayerson reported, "the red phone would ring. The terrified man- ager would pick it up to hear Mr. B demanding to know why the numbers weren't right."S Blankenship told an interviewer, People talk about character being what you do when no one else is looking. But the truth of the matter is character is doing that which is unpopular if it's right, even if it causes you to be vilified."** Change in Stock Option Incentive Pension Total Year Salary Bonus Awards Awards Plan Value Other(*) Compensation 2009 933,369 300,000 3,869,819 11,549,156 573,618 609,875 17,835,837 2008 1,000,000 300,000 390,000 2,160,000 6,022,447 691,415 357,129 11,020,991 2007 1,000,000 300,000 604,800 1,700,000 5,257,576 111,794 386,480 9,361,000 Note: "Other" includes personal use of company cars, aircraft (Challenger 601 corporate jet), housing, and related costs and services. Source: Massey Energy 2010 Proxy, "Compensation Discussion and Analysis" and "Compensation of Named Executive Officers." As CEO, Blankenship maintained a laser focus on productivity. In 2005, he sent a memo titled RUNNING COAL" to all Massey underground mine superintendents that stated: If any of you have been asked by your group presidents, your supervisors, engi- neers, or anyone else to do anything other than run coal (i.c., build overcasts, do construction jobs, or whatever) you need to ignore them and run coal. This memo is necessary only because we seem not to understand that coal pays the bills. A week later, after this memo had been widely circulated, he followed up with another one which referred to the company's S-1, P-2 (safety first, production second) program. He wrote: By now each of you should know that safety and S-1 is our first responsibility. Productivity and P-2 are second. Executive Compensation Blankenship was well compensated for running Massey. As shown in Exhibit A, his total compensation in 2009 was almost $18 million; this was up from $11 million in 2008 and $9 million in 2007. Blankenship's base salary in all three years was close to $1 million. By far the greatest proportion of his total pay came from a performance-based incentive sys- tem established by Massey's board of directors. In its filings with the SEC, the board described its philosophy of compensation this way:? We compensate our named executive officers in a manner that is meant to attract and retain highly qualified and gifted individuals and to appropriately incentivize and motivate the named executive officers to achieve continuous improvements in company-wide performance for the benefit of our stockholders." Exhibit B Massey Energy's CEO, 2009 The calculation of incentive plan compensation was based on achievement of specific targets in these areas: EBIT (earnings before interest and taxes) Produced tons Continuous miner productivity (feet/shift) Surface mining productivity (tons/man-hour) Environmental violations (% reduction) Fulfillment of contracts Nonfatal days lost due to injury and accident (% reduction) Identification of successors Employee retention Diversity of members Source: Massey Fnergy 2010 Prowy Note: A continuous miner" is a large machine that extracts coal underground. 15% 15% 5% 5% 10% 15% 109 5% 15% 5% Accordingly, the compensation committee of the board established an incentive plan for Massey's CEO. (Similar plans were in place for other senior executives as well.) The plan set specific performance measures for "areas over which Mr. Blankenship was responsi- ble and positioned to directly influence outcome. These areas, and the proportion of his incentive compensation based on them, are shown in Exhibit B. By one estimate, in the 10 years leading up to the disaster Blankenship received a total of $129 million in compensation from Massey. "I don't care what people think, he once said during a talk to a gathering of Republican Party leaders in West Virginia, speaking of himself in the third person. At the end of the day, Don Blankenship is going to die with more money than he needs.9.0 Government Regulation of Mining Safety and Health Coal mining had always been a hazardous occupation. Methane gas, an odorless and col- orless by-product of decomposing organic matter that was often present alongside coal, was highly flammable. Methane explosions had contributed to the deaths of more than 10,000 miners in the United States since 1920. To mine safely, methane levels had to be constantly monitored, and ventilation systems had to be effective enough to remove it from the mine. Coal dust itselfwhether on the floor or other surfaces, or suspended in the airwas also highly flammable. The standard practice was to apply layers of rock dust (crushed limestone) over the coal dust to render it inert. In addition to the ever-present danger of fire, miners had long contended with the threat of collapsing roofs and walls, dangerous mechanical equipment, and suffocation. Miners often developed coal workers' pneumoconiosis, commonly called black lung, a chronic, irreversible disease caused by breathing coal dust. (Black lung was preventable with proper coal dust control.) Case 7 The Upper Big Branch Mine Disaster 505 Health and safety in the mining industry had long been regulated at both the federal and state levels. Over the years, lawmakers had periodically strengthened government regula- tory control, mostly in response to mining disasters. In 1910, following an explosion at the Monongah mine in West Virginia in which 362 men died, Congress established the U.S. Bureau of Mines to conduct research on the safety and health of miners. The Federal Coal Mine Health and Safety Act, known as the Coal Actwhich passed in 1969 after the death of 78 miners at the Consol Number 9 mine in Farmington, West Virginia-greatly increased federal enforcement powers. This law established fines for violations and criminal penalties for knowing and willful" violations. It also provided compensation for miners disabled by black lung disease. The 1977 Mine Act further strengthened the rights of miners and established the Mine Safety and Health Administration, MSHA (pronounced "Em-shah) to carry out its reg- ulatory mandates. The law required at least four full inspections of underground mines annually. Then in 2006, after yet another string of mine tragedies focused public attention on the dangers of mining, Congress passed the Mine Improvement and New Emergency Response Act, known at the MINER Act. This law created new rules to help miners survive underground explosions and accidents." States like West Virginia that had significant mining industries also had their own reg- ulatory rules and agencies. Although MSHA was empowered to inspect mines unannounced and to fine operators for violations, the agency had limited authority to shut down a mine if a serious problem was present or if the operator refused to pay its fines. Criminal violations of mine safety laws were normally considered misdemeanors rather than felonies. Over time, fatalities in the industry had declined. At the turn of the 20th century, around 300 to 400 miners died every year in the nation's coal mines; by the 1980s, this number had dropped to less than 50. Injuries and illnesses had also dropped. In part, these declines reflected tougher government regulations. They also reflected the rise of surface mining (mostly in the western United States), which tended to be safer, and the emergence of new technologies that mechanized the process of underground mining. The unionization of the mining industry had also given workers a greater voice and the right to elect safety repre- sentatives in many workplaces. The Upper Big Branch Mine Massey had bought the Upper Big Branch mine in 1993 from Peabody Coal. It was a par- ticularly valuable property because its thick coal seam produced the high-grade metallur- gic coal favored by utilities and the steel industry. Two hundred employees worked there on three, round-the-clock shifts. In 2009, Upper Big Branch produced 1.2 million tons of coal, about 3 percent of Massey's total. The mine, like all of those operated by Massey, was nonunion. The regulatory record revealed a widespread pattern of safety violations at the Upper Big Branch mine and an increasingly contentious relationship between its managers and government regulators. As shown in Exhibit C, government inspectors had issued an increasing number of violations over time, with a sharp spike upward the year before the