Question: Read Exhibit 2 from the case - Do you agree with Sherron's letter and if you were in Sherron's position, what would you have done

Read "Exhibit 2" from the case - Do you agree with Sherron's letter and if you were in Sherron's position, what would you have done differently?

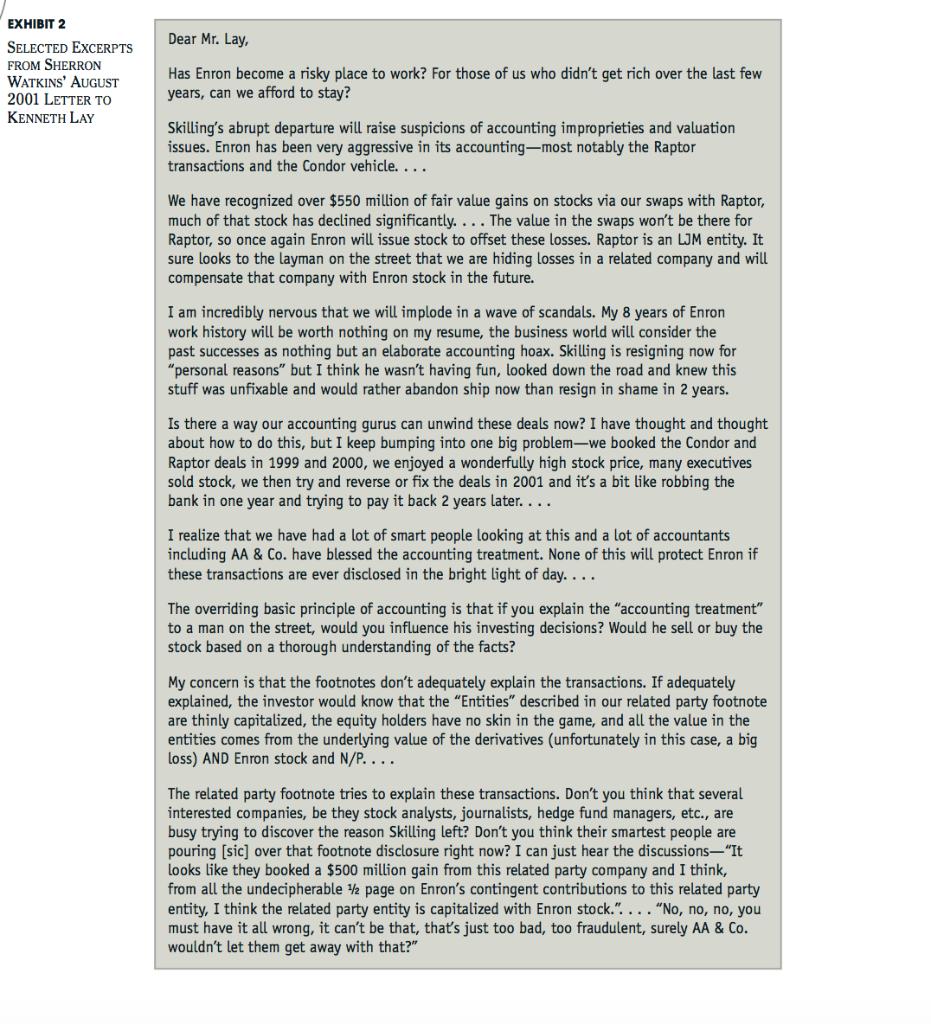

EXHIBIT 2 Dear Mr. Lay, SELECTED EXCERPTS FROM SHERRON WATKINS' AUGUST 2001 LETTER TO KENNETH LAY Has Enron become a risky place to work? For those of us who didn't get rich over the last few years, can we afford to stay? Skilling's abrupt departure will raise suspicions of accounting improprieties and valuation issues. Enron has been very aggressive in its accounting-most notably the Raptor transactions and the Condor vehicle. ... We have recognized over $550 million of fair value gains on stocks via our swaps with Raptor, much of that stock has declined significantly. ... The value in the swaps won't be there for Raptor, so once again Enron will issue stock to offset these losses. Raptor is an LJM entity. It sure looks to the layman on the street that we are hiding losses in a related company and will compensate that company with Enron stock in the future. I am incredibly nervous that we will implode in a wave of scandals. My 8 years of Enron work history will be worth nothing on my resume, the business world will consider the past successes as nothing but an elaborate accounting hoax. Skilling is resigning now for "personal reasons" but I think he wasn't having fun, looked down the road and knew this stuff was unfixable and would rather abandon ship now than resign in shame in 2 years. Is there a way our accounting gurus can unwind these deals now? I have thought and thought about how to do this, but I keep bumping into one big problem-we booked the Condor and Raptor deals in 1999 and 2000, we enjoyed a wonderfully high stock price, many executive sold stock, we then try and reverse or fix the deals in 2001 and it's a bit like robbing the bank in one year and trying to pay it back 2 years later.... I realize that we have had a lot of smart people looking at this and a lot of accountants including AA & Co. have blessed the accounting treatment. None of this will protect Enron if these transactions are ever disclosed in the bright light of day.... The overriding basic principle of accounting is that if you explain the "accounting treatment" to a man on the street, would you influence his investing decisions? Would he sell or buy the stock based on a thorough understanding of the facts? My concern is that the footnotes don't adequately explain the transactions. If adequately explained, the investor would know that the "Entities" described in our related party footnote are thinly capitalized, the equity holders have no skin in the game, and all the value in the entities comes from the underlying value of the derivatives (unfortunately in this case, a big loss) AND Enron stock and N/P. ... The related party footnote tries to explain these transactions. Don't you think that several interested companies, be they stock analysts, journalists, hedge fund managers, etc., are busy trying to discover the reason Skilling left? Don't you think their smartest people are pouring [sic] over that footnote disclosure right now? I can just hear the discussions-"It looks like they booked a $500 million gain from this related party company and I think, from all the undecipherable 2 page on Enron's contingent contributions to this related party entity, I think the related party entity is capitalized with Enron stock.". ... "No, no, no, you must have it all wrong, it can't be that, that's just too bad, too fraudulent, surely AA & Co. wouldn't let them get away with that?"

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Yes it was wise decision because At the point when Sherron Watkins chose to compose a six page letter to Kenneth Lay she ran a great deal of dangers She hazards the wellbeing of work people and famili... View full answer

Get step-by-step solutions from verified subject matter experts