Question: Read the attached T erm Sheet Negotiations . case study and compare the two term sheets. Provide detailed answers to the following questions: What are

Read the attached Term Sheet Negotiations. case study and compare the two term sheets.

Provide detailed answers to the following questions:

- What are the main differences and similarities between the two term sheets? Be specific about the impact.

- If you were the entrepreneur and could not negotiate any of the terms in either term sheet, which one would you prefer and why?

- How would you seek to alter the terms in each term sheet during negotiations with each venture capitalist? Which terms would you seek to alter first? Be specific on what you would ask for.

- Does it make a difference to your answers whether you expect Trendsetter.com to grow fast or grow slowly?

- What aspects other than term sheets would you take into consideration when choosing among potential venture capital investors?

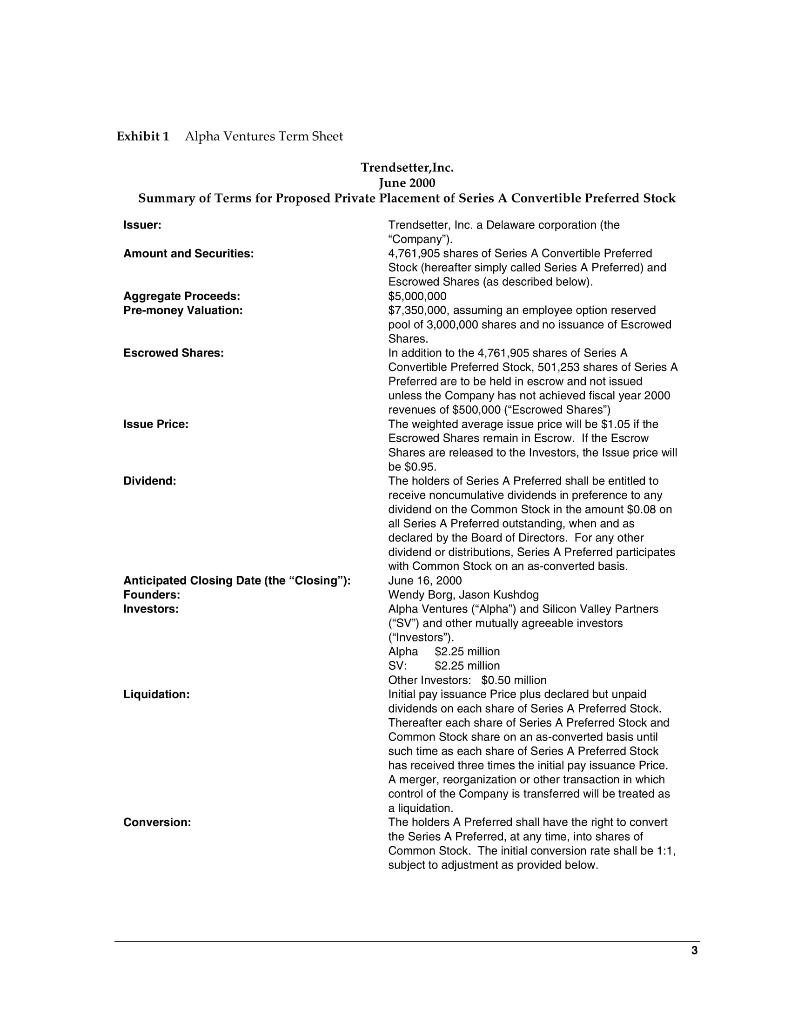

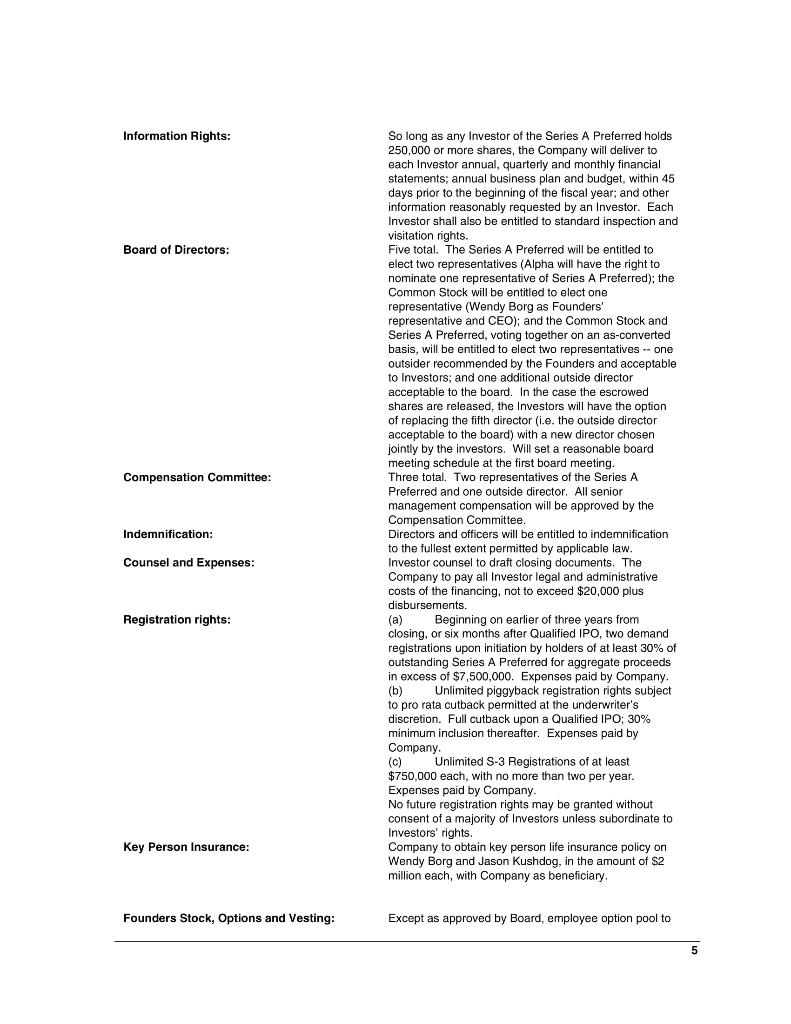

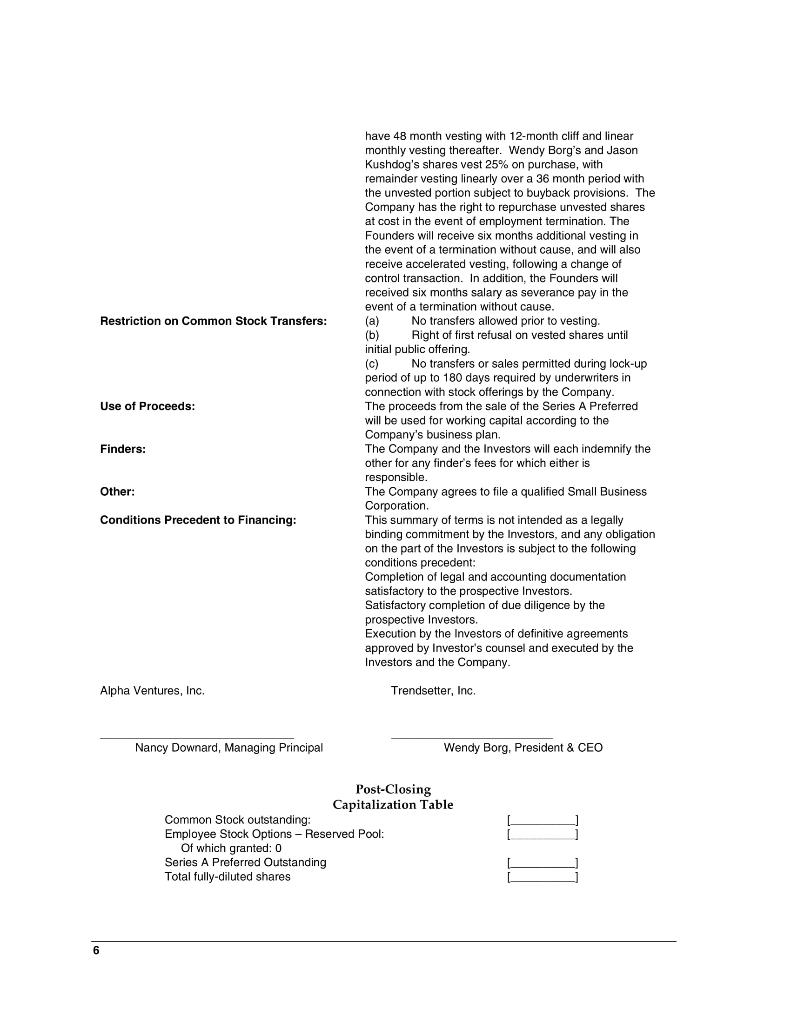

801-358 Term Sheet Negotiations for Trendsetter, Inc. At first, the two operated with their own capital but knowing very well that they would need to raise outside money. Borg explained. This type of software solution will take a lot of money to develop. Also, we needed a partner firm for the development phase. Luckily, I was able to get a former client Waldo, a major fashion retailer, to commit to work with us while we were developing the product. Although we hadn't signed any contracts yet, I had a good relationship with the CEO and I was promised that we would get a signed agreement from them once we got funding. That's why we approached the VCs. Borg and Kushdog were no fools and knew that most top-tier venture capitalists received more than 2,000 unsolicited business plans per year. In most of these venture capital firms all 2000 plans made it straight into the garbage can - without receiving any consideration. Experience had shown VCs that it was not worth their time to look for needles in a haystack. Rather, VCs focused on plans that came with recommendations and endorsements (from other VCs, entrepreneurs whom the VC had previously backed, investors in the VCs' fund and from other "friends.") Fortunately, Borg and Kushdog knew two insiders who were well-connected in the venture capital community. "Our friends got us in the door at several firms," Kushdog recalled, "Once a first meeting had been arranged we knew that the ball had been teed up for us and we needed to hit it. We knew that we were on to something when our first meeting with a VC that was originally scheduled for 30 minutes ended up lasting 2 hours-and the VC did not complain." Borg and Kushdog received a lot of interest from the VC community. They presented to seven VCs. And six of them really liked the plan and the team that was in place. The process of meetings and presentations took almost two months, however. This was longer than the entrepreneurs had expected. So it was a real relief for the two when they finally received term sheets from the VCs they wanted the most: Alpha Ventures and Mega Fund. Both funds were top tier VCs and had a lot of experience in retail and software. Plus the chemistry with both firms seemed good. Borg explained: With Mega everything went smoothly. Alpha I think really liked our idea but was pretty skeptical about our ability to get a five-star client like Waldo on board early. As a result they really liked us but wanted to invest at a lower valuation than other VCs because they did not think we could book $500,000 in revenues in the first year. After a lot of talking they came around and made a fair offer. Since Borg and Kushdog thought that both VC firms, Alpha Ventures and Mega, were an equally good fit it would come down to who gave Trendsetter a better offer. Neither of the entrepreneurs had any experience in analyzing term sheets and although the top-line valuations from both VC firms were not that different the entrepreneurs knew that they had to be very careful when comparing covenants in both term sheets. "I don't like lawyers but I think we need one, now," said Kushdog as they left the restaurant. "I agree," replied Borg, "but wouldn't it be reassuring if we could figure this out on our own first?" 2

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

What are the main differences and similarities between the two term sheets Be specific about the impact Difference The main difference between the two term sheets is that Mega Funds term sheet offers ... View full answer

Get step-by-step solutions from verified subject matter experts