Question: Read the below article and summarize it with your own words? Read the below article and summarize it with your own words? Why Unly Five

Read the below article and summarize it with your own words?

Read the below article and summarize it with your own words?

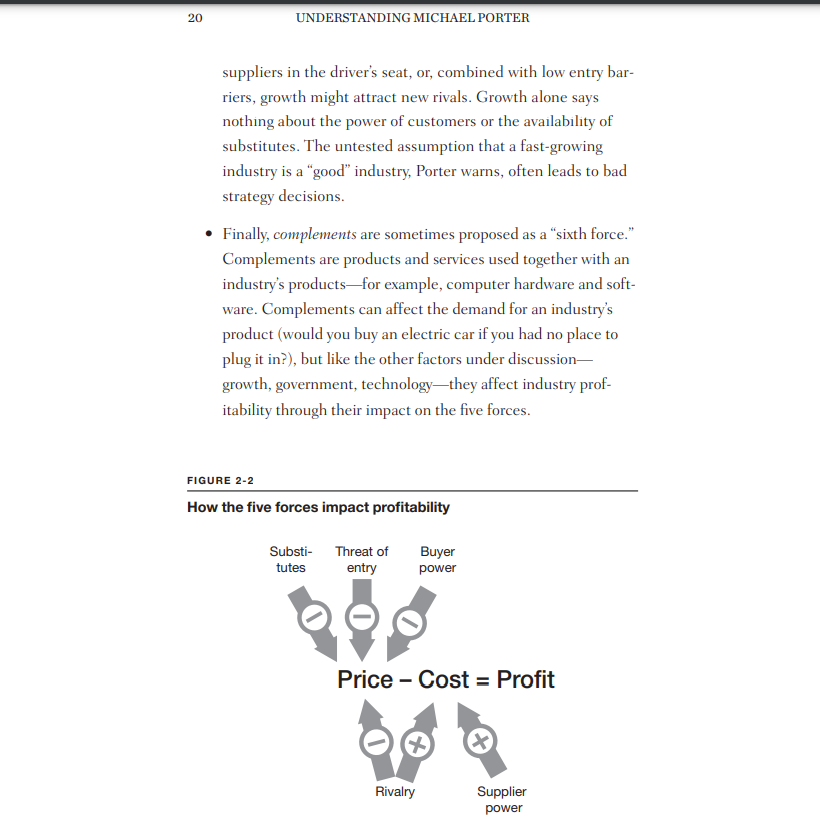

Why Unly Five Forces? The five forces framework applies in all industries for the simple reason that it encompasses relationships fundamental to all commerce: those between buyers and sellers, between sellers and suppliers, between rival sellers, and between supply and demand. Think about it. This covers all of the bases. The five forces are universal and fundamental. When I lead strategy discussions among managers, I usually ask them if they know Porter's five forces framework. Most do. But then something interesting happens. The conversation quickly degenerates into a competition to see who can name all five. Typically, people are only able to remember three or four. Also typically, they will throw in a candidate that isn't one of the five forces, but they're absolutely certain it must be for the simple reason that in their industry, this particular phenomenon is highly relevant to their success. So let me underline the big idea here. Memorizing the five forces won't make you a better business thinker; it will only help you to sound like one. It matters that you grasp the deeper point: there are a limited number of structural forces at work in every industry that systematically impact profitability in a predictable direction. Supply and Demand Everyone has learned at some point in their training about the importance of supply and demand in determining prices. In perfect markets, the adjustment is very sensitive: when supply rises, prices immediately drop to the new equilibrium. In perfect competition there are no profits because price is always driven down to the marginal cost of production. But in practice, very few markets are "perfect." Porter's five forces framework offers a way to think systematically about imperfect markets. If there are barriers to entry, for example, new supply can't simply rush into the market to meet demand. The power of suppliers and buyers, for example, will have direct consequences for prices. And so on. Other factors may be important, but they are not structural. Consider four that get the most attention: - Government regulation will be relevant to competition if it changes the industry's structure through its impact on one or more of the five forces. - The same goes for technology. If the Internet, for example, makes it easier for customers in an industry to shop around for the best price, then industry profitability will drop because, in this instance, the Internet has changed the industry's structure by increasing the power of buyers. - Managers often mistakenly assume that a high-growth industry will be an attractive one. But growth is no guarantee that the industry will be profitable. For example, growth might put suppliers in the driver's seat, or, combined with low entry barriers, growth might attract new rivals. Growth alone says nothing about the power of customers or the avallability of substitutes. The untested assumption that a fast-growing industry is a "good" industry, Porter warns, often leads to bad strategy decisions. - Finally, complements are sometimes proposed as a "sixth force." Complements are products and services used together with an industry's products - for example, computer hardware and software. Complements can affect the demand for an industry's product (would you buy an electric car if you had no place to plug it in?), but like the other factors under discussiongrowth, government, technology-they affect industry profitability through their impact on the five forces. FIGURE 2-2 How the five forces impact profitability Depending on your industry, then, understanding and managing these factors can be important to your success. But the impact on industry profitability of "more" of any of these factors, unlike "more buyer power," will be neither systematic nor predictable. Some technologies might raise costs and lower prices, therefore lowering profitability. Others might have the opposite effect. Still others will have no impact at all. The same goes for growth, for government, and for complements. If a force is structural, you can always predict that "more" will affect prices or costs in a known direction. More buyer power always drives prices down, not up. More supplier power always pushes costs higher, not lower. Figure 2-2 summarizes the dominant impact on profitability of each of the five forcesStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts