Question: Read the case below and answer the questions that follow. You are the head of an international firm considering the strategic options for your business.

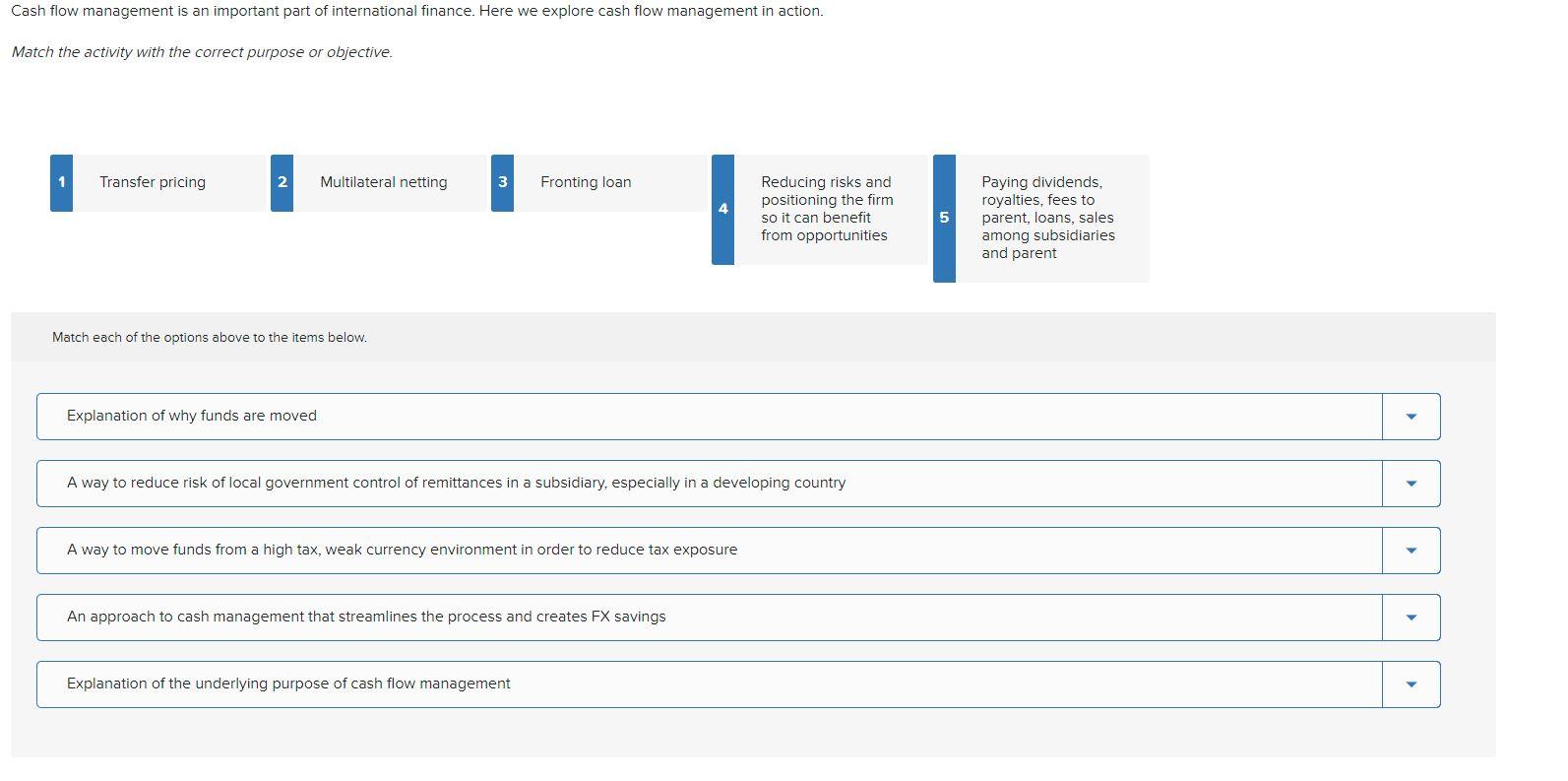

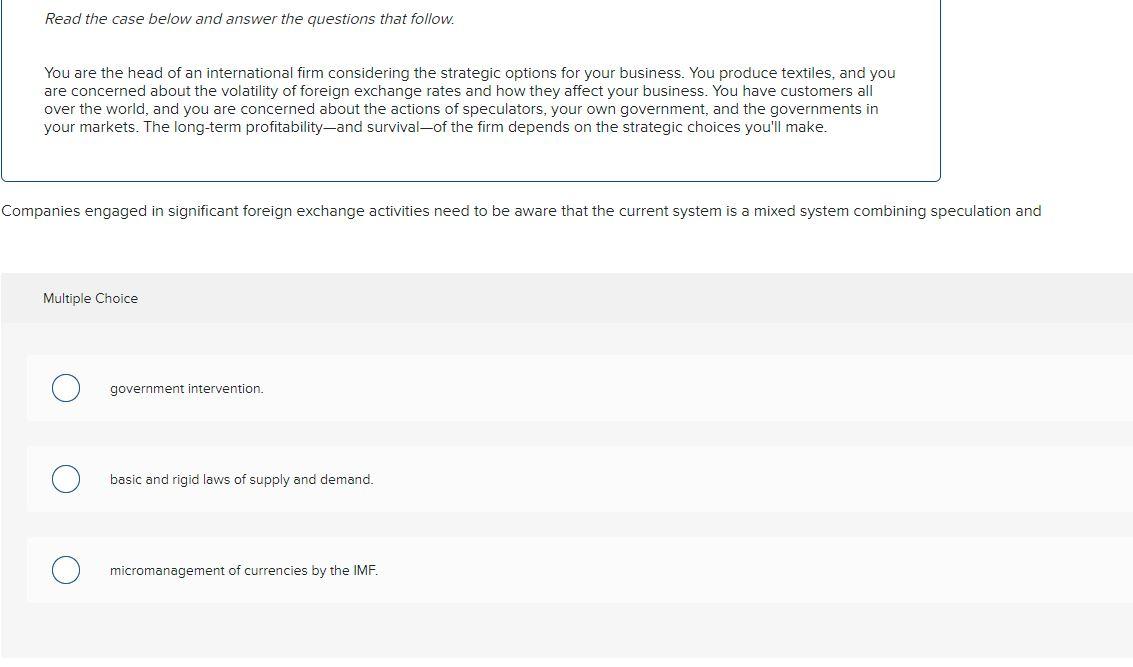

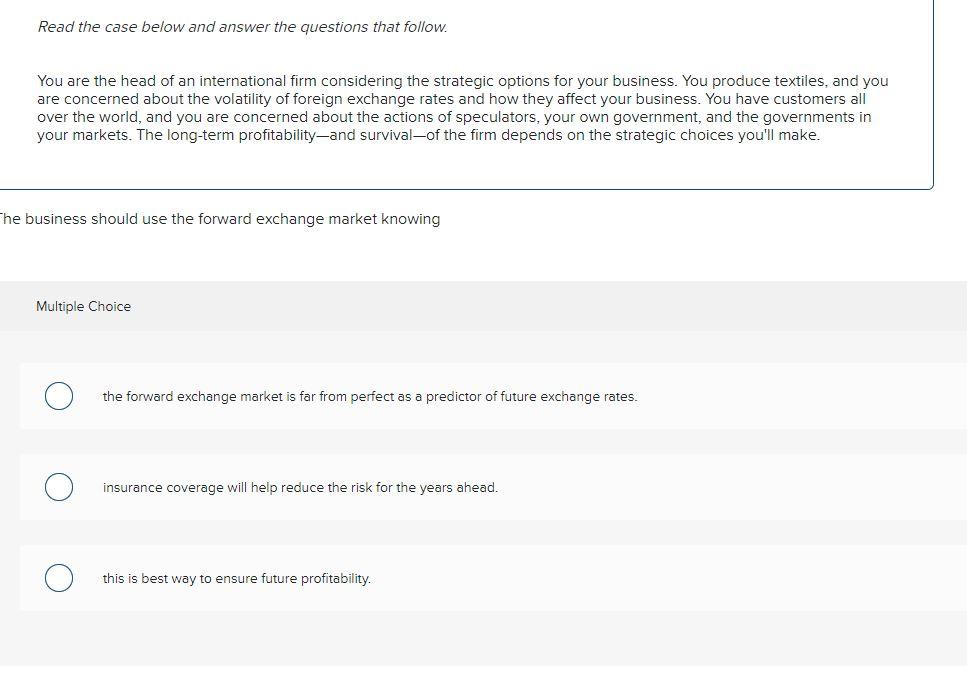

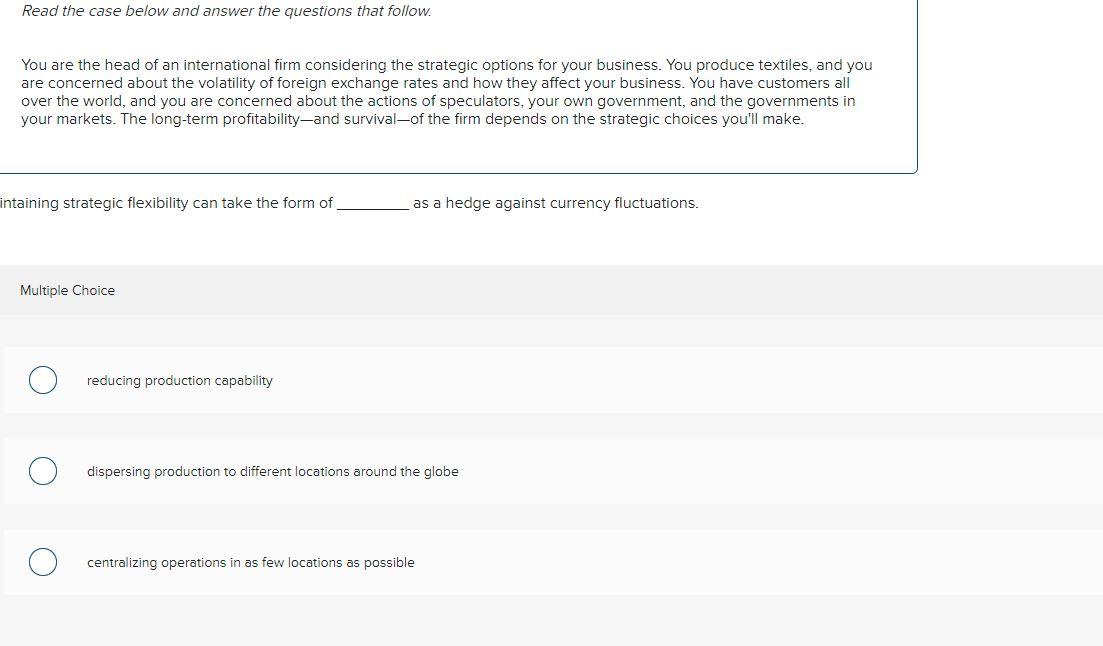

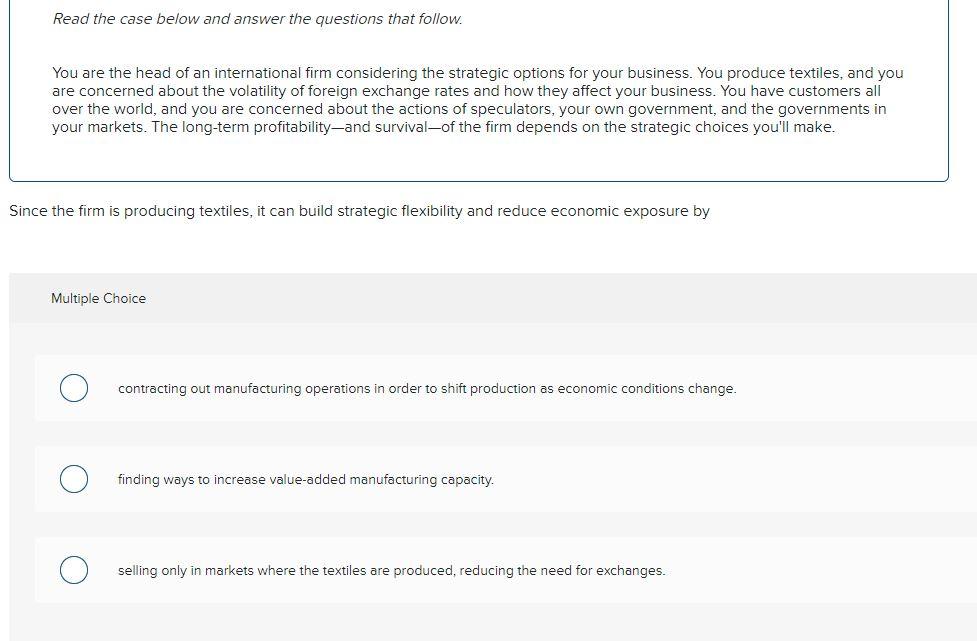

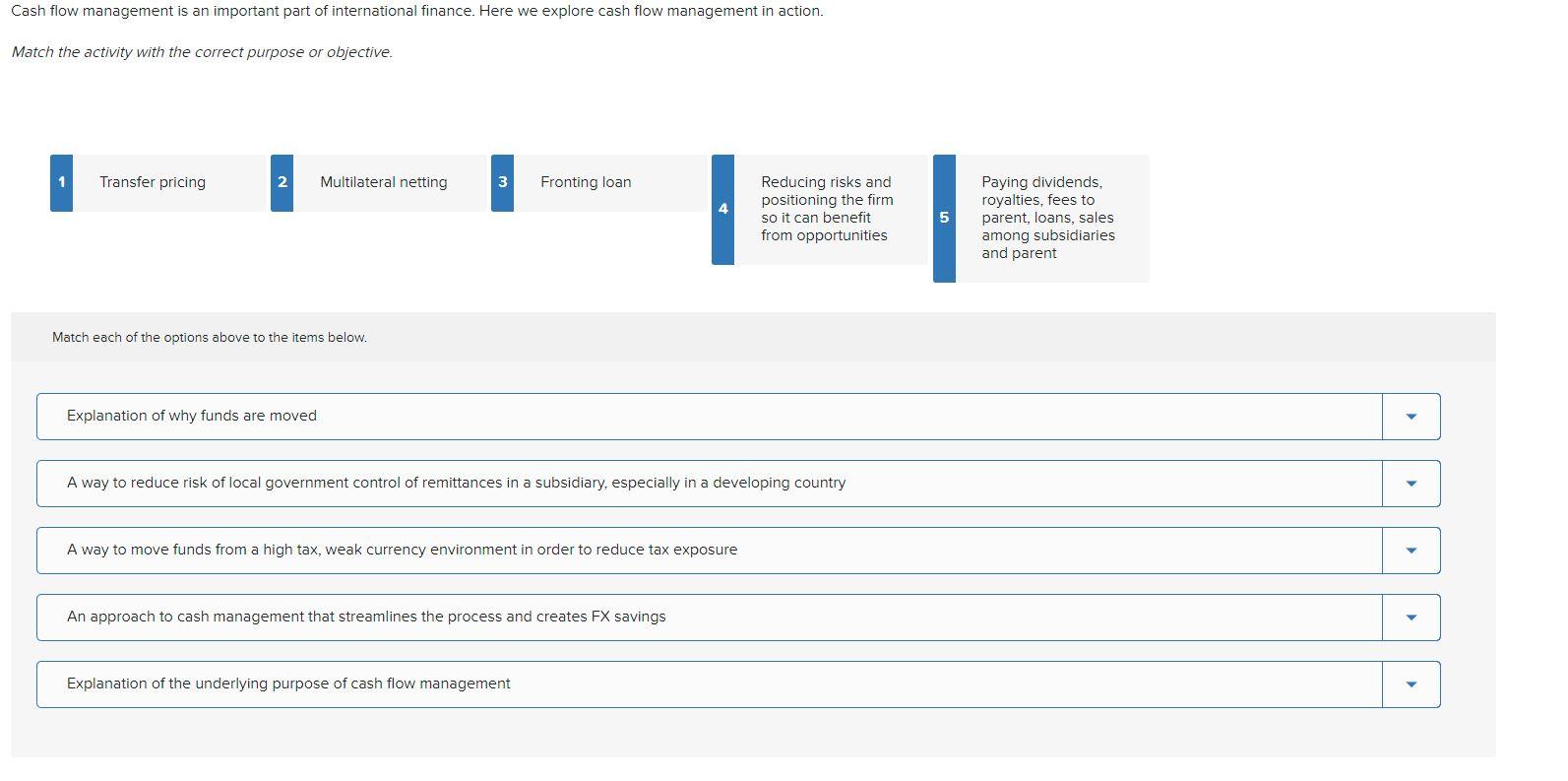

Read the case below and answer the questions that follow. You are the head of an international firm considering the strategic options for your business. You produce textiles, and you are concerned about the volatility of foreign exchange rates and how they affect your business. You have customers all over the world, and you are concerned about the actions of speculators, your own government, and the governments in your markets. The long-term profitability-and survival-of the firm depends on the strategic choices you'll make. Companies engaged in significant foreign exchange activities need to be aware that the current system is a mixed system combining speculation and Multiple Choice government intervention. basic and rigid laws of supply and demand. micromanagement of currencies by the IMF. Read the case below and answer the questions that follow. You are the head of an international firm considering the strategic options for your business. You produce textiles, and you are concerned about the volatility of foreign exchange rates and how they affect your business. You have customers all over the world, and you are concerned about the actions of speculators, your own government, and the governments in your markets. The long-term profitability-and survival-of the firm depends on the strategic choices you'll make. The business should use the forward exchange market knowing Multiple Choice the forward exchange market is far from perfect as a predictor of future exchange rates. insurance coverage will help reduce the risk for the years ahead. this is best way to ensure future profitability. Read the case below and answer the questions that follow. You are the head of an international firm considering the strategic options for your business. You produce textiles, and you are concerned about the volatility of foreign exchange rates and how they affect your business. You have customers all over the world, and you are concerned about the actions of speculators, your own government, and the governments in your markets. The long-term profitability-and survival-of the firm depends on the strategic choices you'll make. intaining strategic flexibility can take the form of as a hedge against currency fluctuations. Multiple Choice reducing production capability dispersing production to different locations around the globe centralizing operations in as few locations as possible Read the case below and answer the questions that follow. You are the head of an international firm considering the strategic options for your business. You produce textiles, and you are concerned about the volatility of foreign exchange rates and how they affect your business. You have customers all over the world, and you are concerned about the actions of speculators, your own government, and the governments in your markets. The long-term profitability-and survival of the firm depends on the strategic choices you'll make. Since the firm is producing textiles, it can build strategic flexibility and reduce economic exposure by Multiple Choice contracting out manufacturing operations in order to shift production as economic conditions change. O finding ways to increase value-added manufacturing capacity. d selling only in markets where the textiles are produced, reducing the need for exchanges. Cash flow management is an important part of international finance. Here we explore cash flow management in action. Match the activity with the correct purpose or objective. 1 Transfer pricing 2 Multilateral netting 3 Fronting loan Reducing risks and positioning the firm so it can benefit from opportunities LO Paying dividends, royalties, fees to parent, loans, sales among subsidiaries and parent Match each of the options above to the items below. Explanation of why funds are moved A way to reduce risk of local government control of remittances in a subsidiary, especially in a developing country A way to move funds from a high tax, weak currency environment in order to reduce tax exposure An approach to cash management that streamlines the process and creates FX savings Explanation of the underlying purpose of cash flow management