Question: Read the case study below and answer ALL the questions that follow. [100 MARKS] Covid-19: Time to Refocus on Supply Chain Resilience It happened faster

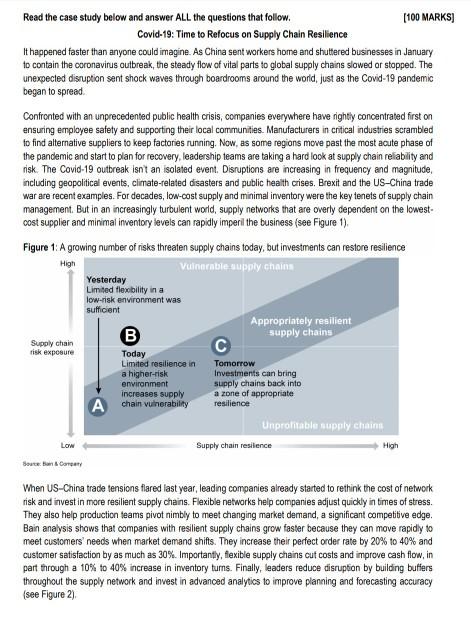

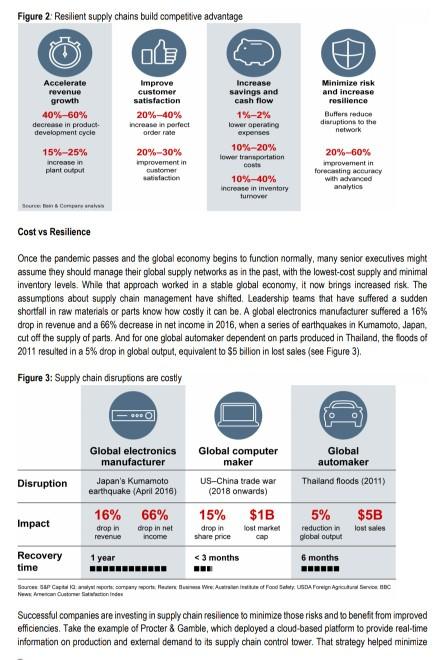

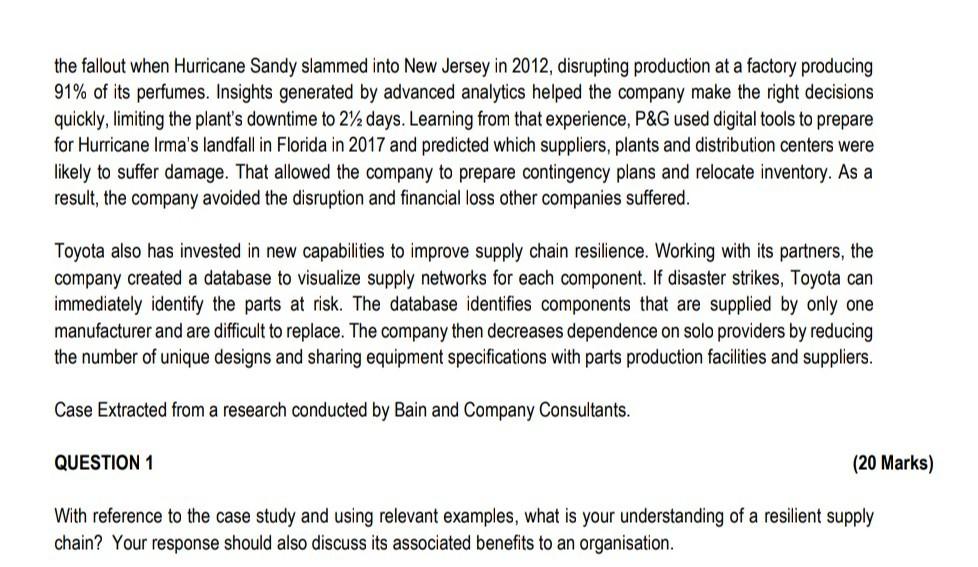

Read the case study below and answer ALL the questions that follow. [100 MARKS] Covid-19: Time to Refocus on Supply Chain Resilience It happened faster than anyone could imagine. As China sent workers home and shuttered businesses in January to contain the coronavirus outbreak, the steady flow of vital parts to global supply chains slowed or stopped. The unexpected disruption sent shock waves through boardrooms around the world, just as the Covid-19 pandemic began to spread Confronted with an unprecedented public health crisis, companies everywhere have nightly concentrated first on ensuring employee safety and supporting their local communities. Manufacturers in critical industries scrambled to find alternative suppliers to keep factories running. Now, as some regions move past the most acute phase of the pandemic and start to plan for recovery, leadership teams are taking a hard look at supply chain reliability and risk. The Covid-19 outbreak isn't an isolated event. Disruptions are increasing in frequency and magnitude, including geopolitical events, climate-related disasters and public health crises. Brexit and the US-China trade war are recent examples. For decades, low-cost supply and minimal inventory were the key tenets of supply chain management. But in an increasingly turbulent world, supply networks that are overly dependent on the lowest cost supplier and minimal inventory levels can rapidly imperil the business (see Figure 1). Figure 1: A growing number of risks threaten supply chains today, but investments can restore resilience High Vulnerable supply chains Yesterday Limited flexobility in a low-risk environment was sufficient Appropriately resilient B supply chains Supply chain C Today Limited resilience in Tomorrow a higher-risk Investments can bring supply chains back into increases supply a zone of appropriate A chain vulnerability resilience Unprofitable supply chain LOW Supply chain residence High Soute Bon Corey risk exposure environment When US-China trade tensions flared last year, leading companies already started to rethink the cost of network risk and invest in more resilient supply chains. Flexible networks help companies adjust quickly in times of stress. They also help production teams pivot nimbly to meet changing market demand, a significant competitive edge. Bain analysis shows that companies with resilient supply chains grow faster because they can move rapidly to meet customers' needs when market demand shifts. They increase their perfect order rate by 20% to 40% and customer satisfaction by as much as 30%. Importantly, flexible supply chains cut costs and improve cash flow, in part through a 10% to 40% increase in inventory turns. Finally, leaders reduce disruption by building buffers throughout the supply network and invest in advanced analytics to improve planning and forecasting accuracy see Figure 2) Figure 2 Resilient supply chains bulld competitive advantage do Accelerate revenue growth 40%-60% decrease in product development cycle 15%-25% increase in plant output Improve customer satisfaction 20%-40% increase in perfect order rate 20%-30% improvement in customer satisfaction Minimize risk and increase resilience Buffers reduce disruptions to the network Increase savings and cash flow 1%-2% lower operating expenses 10%-20% lower transportation co 10%-40% increase in inventory tumover 20%-60% improvement in forecasting accuracy with advanced analytics Surgers Cost vs Resilience Once the pandemic passes and the global economy begins to function normally, many senior executives might assume they should manage their global supply networks as in the past, with the lowest-cost supply and minimal inventory levels. While that approach worked in a stable global economy, it now brings increased risk. The assumptions about supply chain management have shifted Leadership teams that have suffered a sudden shortfall in raw materials or parts know how costly it can be. A global electronics manufacturer suffered a 16% drop in revenue and a 66% decrease in net income in 2016, when a series of earthquakes in Kumamoto, Japan, cut off the supaly of parts. And for one global automaker dependent on parts produced in Thailand, the floods of 2011 resulted in a 5% drop in global output, equivalent to $5 billion in lost sales (see Figure 3). Figure 3: Supply chain disruptions are costly A Global electronics Global computer Global manufacturer maker automaker Disruption Japan's Kumamoto US-China trade war Thailand floods (2011) earthquake (April 2016) (2018 onwards) 16% 66% 15% $1B 5% $5B Impact drop in drop in net drop in lost market reduction in lost sales revenue Income share price cap global output Recovery 1 year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock