Question: Read the case study below and answer the questions that follow. You recently met with a long-standing client, Amy Rodgers, to review her financial planning

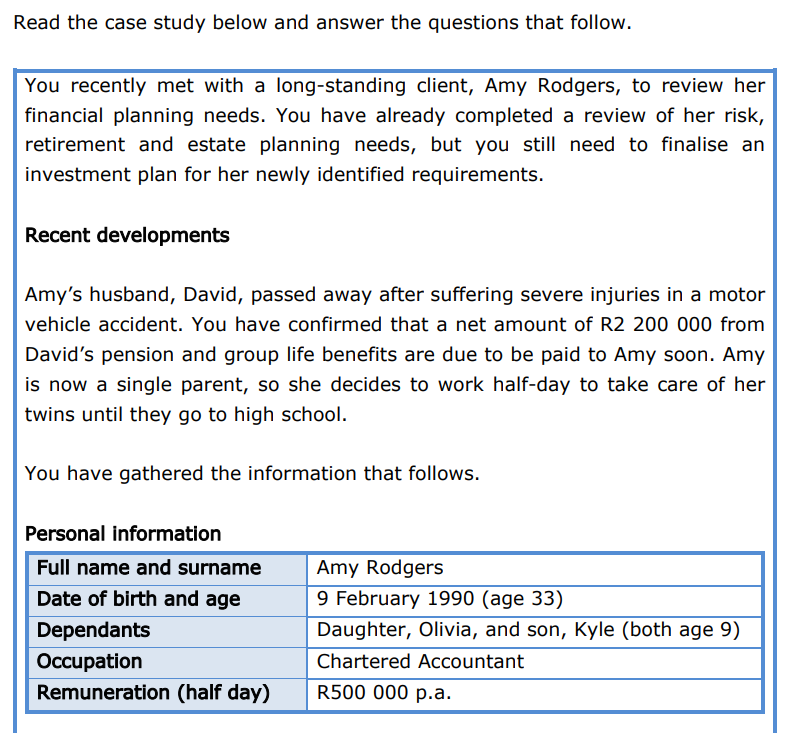

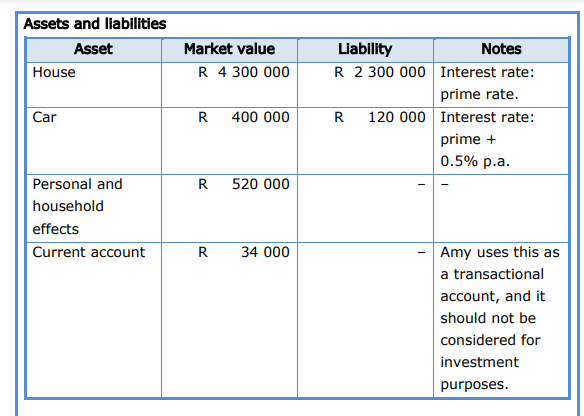

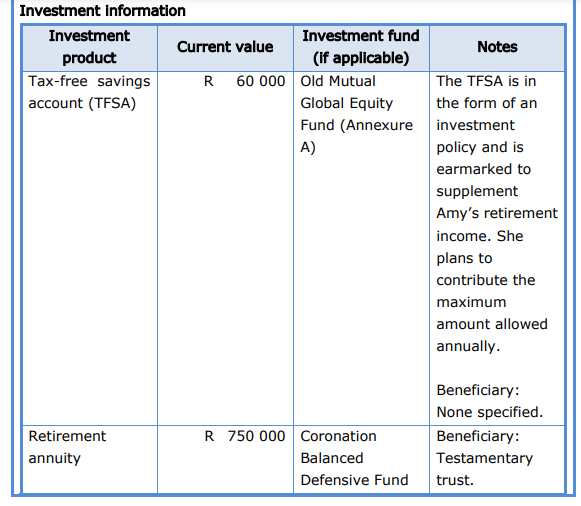

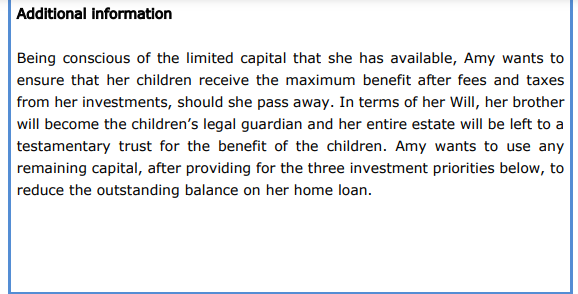

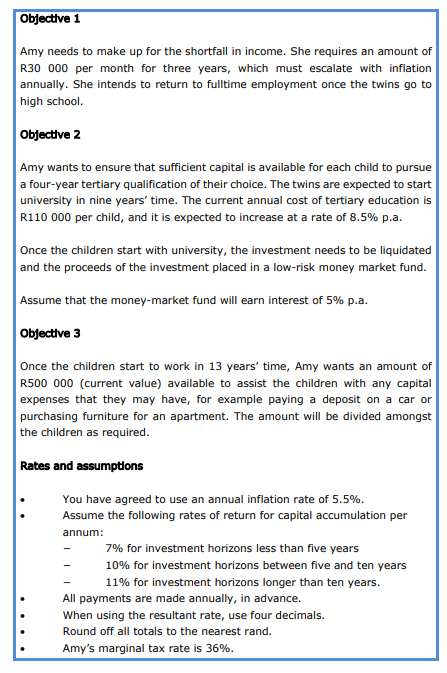

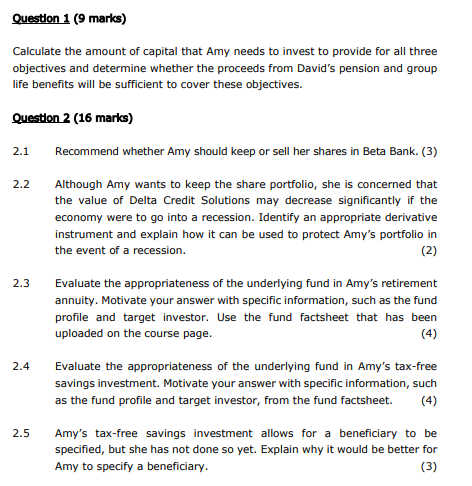

Read the case study below and answer the questions that follow. You recently met with a long-standing client, Amy Rodgers, to review her financial planning needs. You have already completed a review of her risk, retirement and estate planning needs, but you still need to finalise an investment plan for her newly identified requirements. Recent developments Amy's husband, David, passed away after suffering severe injuries in a motor vehicle accident. You have confirmed that a net amount of R2 200000 from David's pension and group life benefits are due to be paid to Amy soon. Amy is now a single parent, so she decides to work half-day to take care of her twins until they go to high school. You have gathered the information that follows. Personal information Assets and liabilities Tnvestment information Selected information regarding share portfolio The average dividend yield for financial companies is 4.2%, and the average P/E ratio for financial companies is 19.8 . Additional information Being conscious of the limited capital that she has available, Amy wants to ensure that her children receive the maximum benefit after fees and taxes from her investments, should she pass away. In terms of her Will, her brother will become the children's legal guardian and her entire estate will be left to a testamentary trust for the benefit of the children. Amy wants to use any remaining capital, after providing for the three investment priorities below, to reduce the outstanding balance on her home loan. Amy needs to make up for the shortfall in income. She requires an amount of R30 000 per month for three years, which must escalate with inflation annually. She intends to return to fulltime employment once the twins go to high school. Objective 2 Amy wants to ensure that sufficient capital is available for each child to pursue a four-year tertiary qualification of their choice. The twins are expected to start university in nine years' time. The current annual cost of tertiary education is R110 000 per child, and it is expected to increase at a rate of 8.5% p.a. Once the children start with university, the investment needs to be liquidated and the proceeds of the investment placed in a low-risk money market fund. Assume that the money-market fund will earn interest of 5% p.a. Objective 3 Once the children start to work in 13 years' time, Amy wants an amount of R500 000 (current value) available to assist the children with any capital expenses that they may have, for example paying a deposit on a car or purchasing furniture for an apartment. The amount will be divided amongst the children as required. Rates and assumptions - You have agreed to use an annual inflation rate of 5.5\%. - Assume the following rates of return for capital accumulation per annum: - 7% for investment horizons less than five years - 10% for investment horizons between five and ten years - 11% for investment horizons longer than ten years. All payments are made annually, in advance. When using the resultant rate, use four decimals. Round off all totals to the nearest rand. Amy's marginal tax rate is 36%. Calculate the amount of capital that Amy needs to invest to provide for all three objectives and determine whether the proceeds from David's pension and group life benefits will be sufficient to cover these objectives. Queston 2 (16 marks) 2.1 Recommend whether Amy should keep or sell her shares in Beta Bank. (3) 2.2 Although Amy wants to keep the share portfolio, she is concerned that the value of Delta Credit Solutions may decrease significantly if the economy were to go into a recession. Identify an appropriate derivative instrument and explain how it can be used to protect Amy's portfolio in the event of a recession. 2.3 Evaluate the appropriateness of the underlying fund in Amy's retirement annuity. Motivate your answer with specific information, such as the fund profile and target investor. Use the fund factsheet that has been uploaded on the course page. 2.4 Evaluate the appropriateness of the underlying fund in Amy's tax-free savings investment. Motivate your answer with specific information, such as the fund profile and target investor, from the fund factsheet. 2.5 Amy's tax-free savings investment allows for a beneficiary to be specified, but she has not done so yet. Explain why it would be better for Amy to specify a beneficiary. Read the case study below and answer the questions that follow. You recently met with a long-standing client, Amy Rodgers, to review her financial planning needs. You have already completed a review of her risk, retirement and estate planning needs, but you still need to finalise an investment plan for her newly identified requirements. Recent developments Amy's husband, David, passed away after suffering severe injuries in a motor vehicle accident. You have confirmed that a net amount of R2 200000 from David's pension and group life benefits are due to be paid to Amy soon. Amy is now a single parent, so she decides to work half-day to take care of her twins until they go to high school. You have gathered the information that follows. Personal information Assets and liabilities Tnvestment information Selected information regarding share portfolio The average dividend yield for financial companies is 4.2%, and the average P/E ratio for financial companies is 19.8 . Additional information Being conscious of the limited capital that she has available, Amy wants to ensure that her children receive the maximum benefit after fees and taxes from her investments, should she pass away. In terms of her Will, her brother will become the children's legal guardian and her entire estate will be left to a testamentary trust for the benefit of the children. Amy wants to use any remaining capital, after providing for the three investment priorities below, to reduce the outstanding balance on her home loan. Amy needs to make up for the shortfall in income. She requires an amount of R30 000 per month for three years, which must escalate with inflation annually. She intends to return to fulltime employment once the twins go to high school. Objective 2 Amy wants to ensure that sufficient capital is available for each child to pursue a four-year tertiary qualification of their choice. The twins are expected to start university in nine years' time. The current annual cost of tertiary education is R110 000 per child, and it is expected to increase at a rate of 8.5% p.a. Once the children start with university, the investment needs to be liquidated and the proceeds of the investment placed in a low-risk money market fund. Assume that the money-market fund will earn interest of 5% p.a. Objective 3 Once the children start to work in 13 years' time, Amy wants an amount of R500 000 (current value) available to assist the children with any capital expenses that they may have, for example paying a deposit on a car or purchasing furniture for an apartment. The amount will be divided amongst the children as required. Rates and assumptions - You have agreed to use an annual inflation rate of 5.5\%. - Assume the following rates of return for capital accumulation per annum: - 7% for investment horizons less than five years - 10% for investment horizons between five and ten years - 11% for investment horizons longer than ten years. All payments are made annually, in advance. When using the resultant rate, use four decimals. Round off all totals to the nearest rand. Amy's marginal tax rate is 36%. Calculate the amount of capital that Amy needs to invest to provide for all three objectives and determine whether the proceeds from David's pension and group life benefits will be sufficient to cover these objectives. Queston 2 (16 marks) 2.1 Recommend whether Amy should keep or sell her shares in Beta Bank. (3) 2.2 Although Amy wants to keep the share portfolio, she is concerned that the value of Delta Credit Solutions may decrease significantly if the economy were to go into a recession. Identify an appropriate derivative instrument and explain how it can be used to protect Amy's portfolio in the event of a recession. 2.3 Evaluate the appropriateness of the underlying fund in Amy's retirement annuity. Motivate your answer with specific information, such as the fund profile and target investor. Use the fund factsheet that has been uploaded on the course page. 2.4 Evaluate the appropriateness of the underlying fund in Amy's tax-free savings investment. Motivate your answer with specific information, such as the fund profile and target investor, from the fund factsheet. 2.5 Amy's tax-free savings investment allows for a beneficiary to be specified, but she has not done so yet. Explain why it would be better for Amy to specify a beneficiary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts