Question: Read the entire Reading (scholastic journal article) completely and thoroughly. 2. Summarize the major points of the assigned reading . Here, I am looking for

Read the entire Reading (scholastic journal article) completely and thoroughly. 2. Summarize the major points of the assigned reading. Here, I am looking for a detailed executive summary in which you will convey all the important aspects of the lengthy reading. 3. If you paraphrase or directly quote from your sources, then you must insert parenthetical citations at the point at which you use materials from your resources in order to avoid plagiarism. APA uses the author/year format as in (Taylor, 2014) for paraphrased materials, or (Taylor, 2014, p. 123) for a direct quote.

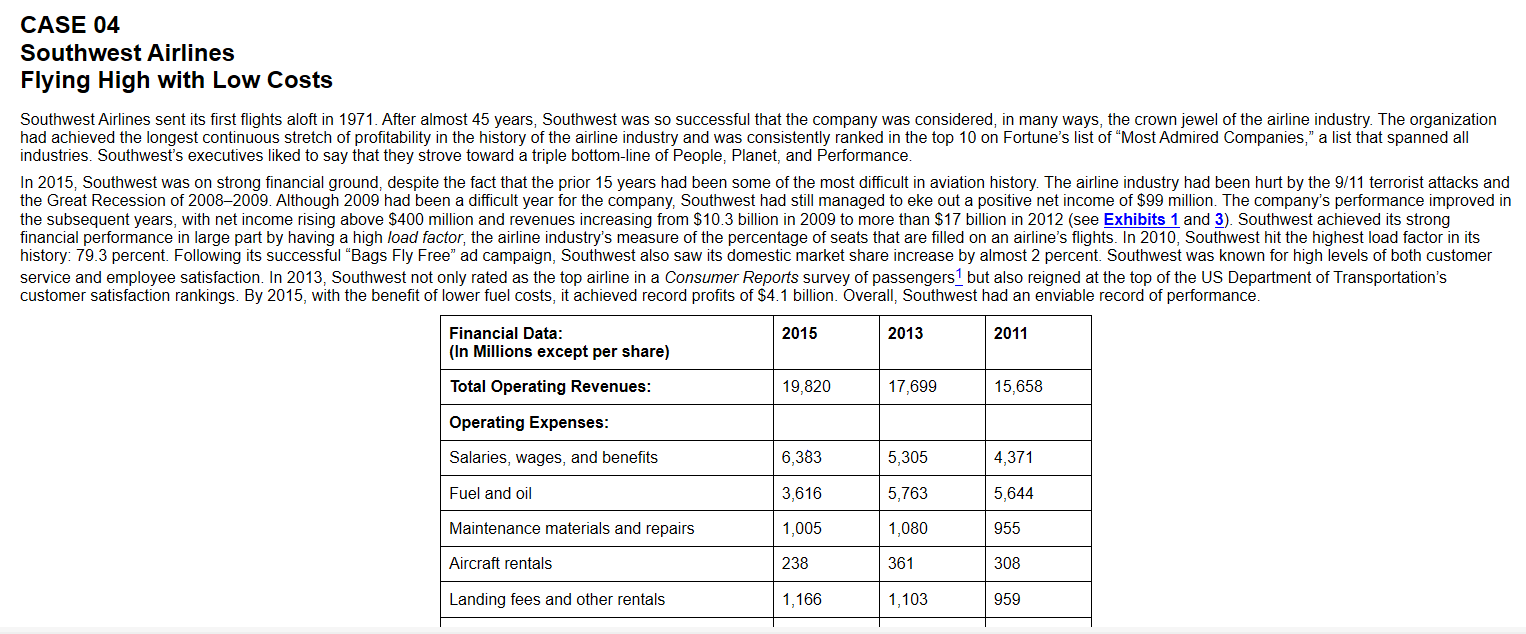

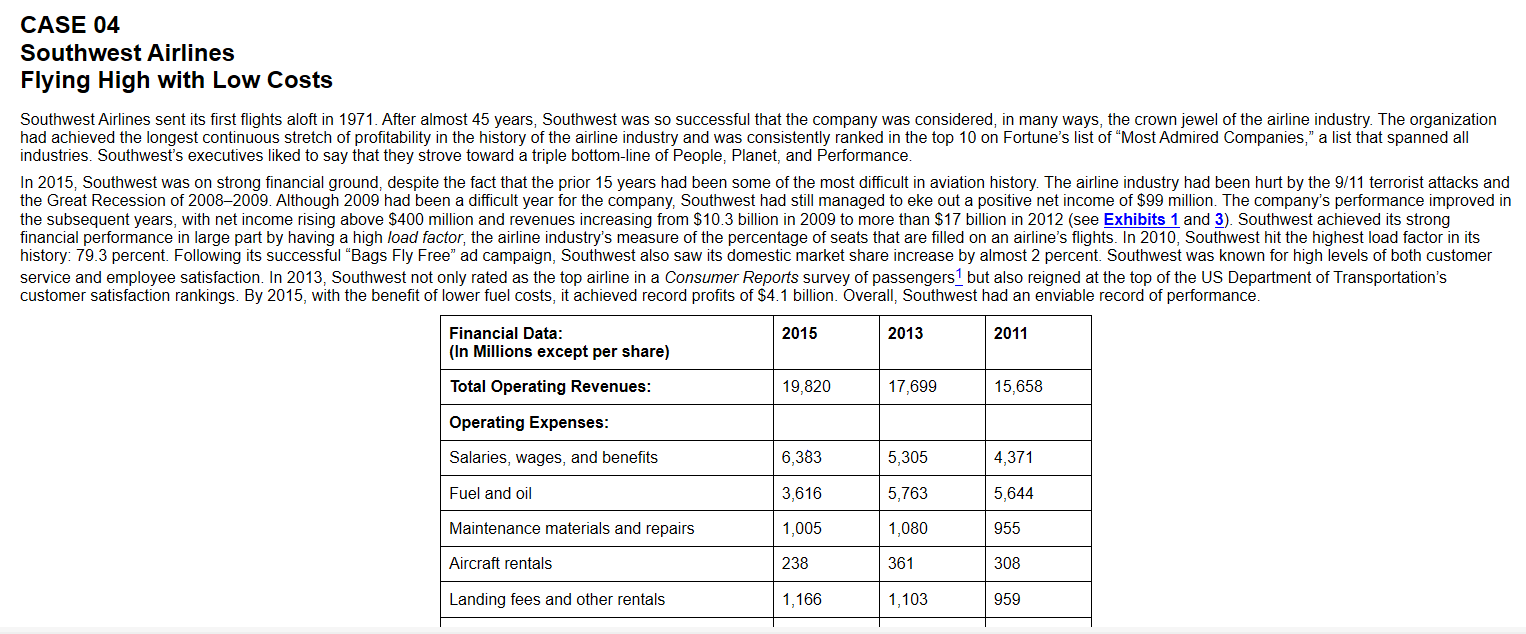

CASE 04 Southwest Airlines Flying High with Low Costs Southwest Airlines sent its first flights aloft in 1971. After almost 45 years, Southwest was so successful that the company was considered, in many ways, the crown jewel of the airline industry. The organization had achieved the longest continuous stretch of profitability in the history of the airline industry and was consistently ranked in the top 10 on Fortune's list of "Most Admired Companies," a list that spanned all industries. Southwest's executives liked to say that they strove toward a triple bottom line of People, Planet, and Performance. In 2015, Southwest was on strong financial ground, despite the fact that the prior 15 years had been some of the most difficult in aviation history. The airline industry had been hurt by the 9/11 terrorist attacks and the Great Recession of 20082009. Although 2009 had been a difficult year for the company, Southwest had still managed to eke out a positive net income of $99 million. The company's performance improved in the subsequent years, with net income rising above $400 million and revenues increasing from $10.3 billion in 2009 to more than $17 billion in 2012 (see Exhibits 1 and 3). Southwest achieved its strong financial performance in large part by having a high load factor, the airline industry's measure of the percentage of seats that are filled on an airline's flights. In 2010, Southwest hit the highest load factor in its history: 79.3 percent. Following its successful "Bags Fly Free" ad campaign, Southwest also saw its domestic market share increase by almost 2 percent. Southwest was known for high levels of both customer service and employee satisfaction. In 2013, Southwest not only rated as the top airline in a Consumer Reports survey of passengers but also reigned at the top of the US Department of Transportation's customer satisfaction rankings. By 2015, with the benefit of lower fuel costs, it achieved record profits of $4.1 billion. Overall, Southwest had an enviable record of performance. 2015 2013 2011 Financial Data: (in Millions except per share) Total Operating Revenues: 19,820 17,699 15,658 Operating Expenses: Salaries, wages, and benefits 6,383 5,305 4,371 Fuel and oil 3,616 5,763 5,644 Maintenance materials and repairs 1,005 1,080 955 Aircraft rentals 238 361 308 Landing fees and other rentals 1,166 1,103 959 Source: Bureau of Transportation Statistics, Air Carrier Financial Reports: Schedule P-1.2 The US Airline Industry The airline industry is critical to the health of the US economy. Airlines provide 11 million jobs in the United States and are responsible for five cents of every dollar of the US gross domestic product (GDP). For every 100 airline jobs that exist, 388 more jobs are supported outside of the airline industry? A key turning point in airline history was the deregulation of the industry in 1978. Before deregulation, the Civil Aeronautics Board regulated all passenger fares, which meant the price was the same for each flight between two cities. The board also regulated industry entrances and exits, mergers and acquisitions, and even airlines' rates of return. Typically, any given market had only a few airlines, and price competition was essentially nonexistent. Following deregulation, numerous new entrants moved into both established and unserved markets, and fare prices began to drop quickly. The average passenger fare in 1978 was about 8.49 cents per mile. In 2009, that price, adjusted for inflation, had decreased 56 percent. As prices declined for passengers, however, more than 150 airlines went bankrupt, and eight of the 11 major airlines went bankrupt, merged, or closed. The airline industry's profit margins are some of the lowest in the world (see Exhibits 4 and 5). Airlines paid considerable attention to reducing their operating costs, but their control over those costs was severely limited. In particular, labor costs represented the largest percentage of an airline's costs, but union agreements limited labor flexibility. The sizes of the crew and ground staff were typically proportional to the size of the aircraft they served. Other operating costs were primarily determined by the distance traveled and not by the number of passengers boarded. Most airlinesnotably Delta, American, and United-used a hub-and-spoke system to coordinate flights, which meant that they funneled the majority of their traffic through hub airports. Hub-and-spoke (HS) systems were designed to help airlines maximize their load factors, meaning they helped keep planes full going into and out of a hub airport. But they also often increased the distance that passengers had to fly to reach their final destination and the time it took for passengers to get there. The History of Southwest Airlines Legend has it that the idea for Southwest Airlines was first conceived on a napkin while Herb Kelleher was meeting with Rollin King in a San Antonio restaurant. In 1966, Kelleher was practicing law. King, one of Kelleher's clients, approached him with the idea of bringing a low-cost intrastate airline to Texas. Because federal regulations made it difficult to establish an airline that crossed state borders, the two founded Southwest Airlines in 1967 to focus on point-to-point travel among the three Texas cities of Dallas, Houston, and San Antonio In contrast to larger airlines servicing the cities through connecting interstate routes, Southwest would fly directly to each of the cities, and the flights would take roughly one hour each. When deregulation hit the airline industry in 1978, Southwest decided to compete with low fares. Demand for travel among the three cities had been rising at the time, and, with little price competition in the market, passenger fares were high. Targeting business travelers and commuters among its initial three cities, Southwest's fares were typically priced between $40 and $100 round trip in order to compete with the cost of driving Southwest was based out of Love Field in Dallas, which although a small airport, offered travelers a more convenient location because of its closer proximity to the city than the larger Dallas-Fort Worth Airport Using Love Field as inspiration, Southwest adopted a "love" theme for the airline's marketing and operations. Drinks were called "love potions," and ticket machines love machines." Later, when Southwest went public, its stock ticker would be LUV. The flight attendants were women chosen for their striking looks. They wore boots and "hot pants" (small, form-fitting shorts), which were a fashion trend. Said Kelleher, "You can have a low-cost carrier and people still don't fly it because they don't know about it. And so, the shtick kind of fits in with getting known."? Southwest also emphasized a culture of fun. Employees were known to sing announcements to passengers and deliver entertaining instructions. For example, flight attendants were known to tell passengers how nice they would look in their life vests or that they will need to deposit 25 cents for oxygen to begin flowing to their oxygen masks. It is easy to find videos on the Internet of flight attendants singing, rapping, and telling jokes to their passengers. Southwest brought the culture of fun to its employees not only through the example of its senior executives but also through its "fun" training programs. The company's advertising also tended to be a fun, even a little edgy. On one occasion, marketers brought an ad to Kelleher that targeted extra regulations and fees that other airlines stated in "fine print" marked by asterisks in their ads. Kelleher quickly approved running Southwest's ad, which read, "Some airlines should have their asterisks kicked. "8 The company's point-to-point service led to frequent departures between city-pair routes. With only three planes operating until 1974, Southwest had to focus on turning its planes around as quickly as possible. Its choice to fly into less-congested airports such as Love Field helped Southwest make those faster turnarounds. At the beginning, Southwest set the goal of turning its planes around in 15 minutes, which was 30 minutes faster than the industry average. Southwest also quickly discovered that it could segment its pricing. After starting its fares at $20 one way, Southwest raised fares for travel before 7:00 pm to $26. To target budget-minded leisure travelers, Southwest lowered fares for flights after 7:00 pm and weekend flights to as low as $13. Such decisions were key to Southwest's early success and laid the foundation for the company's successful low-cost Southwest also quickly discovered that it could segment its pricing. After starting its fares at $20 one way, Southwest raised fares for travel before 7:00 pm to $26. To target budget-minded leisure travelers, Southwest lowered fares for flights after 7:00 pm and weekend flights to as low as $13. Such decisions were key to Southwest's early success and laid the foundation for the company's successful low-cost strategy. Southwest's business model set it apart from its competitors, and the company began to grow quickly. It took the company only two years to become profitable, and it has been profitable every year since 1973 Southwest's Strategy and Operations Southwest's strategy involved offering no-frills, short-haul, high-frequency, point-to-point, low-fare service. Although Southwest's approach would later become well known and frequently studied, it started out primarily as a response to the constraints faced by the company. Federal regulations led Southwest to focus on intrastate travel among just Dallas, Houston, and San Antonio. The company's first planes were three Boeing 737s purchased because they were available at a discount because of overproduction. 10 This small fleet caused Southwest to focus on reducing the time to turn its planes around and get them back in the air. Because of its short flights, the airline did not serve meals. Eventually, Southwest would become renowned for these strategies of flying only point-to-point routes between less congested airports, adopting only one model of plane (the Boeing 737), and offering only one class of service, without meals or assigned seating. Southwest bucked the industry trend of routing planes through a hub-and-spoke (HS) model by flying its planes point-to-point (PTP) on city-pair routes. The HS modeldeveloped in the 1960s and 1970s and used by full-service carriers such as American, United, and Deltawas designed to maximize the load factors for each of an airline's individual planes by bringing customers traveling to the same location together in a central hub from all their different points of origination. The HS model was, however, generally considered to be inconvenient by passengers, and a delay in one flight on a spoke would create a domino effect of delays that would cascade throughout an airline's system of flights. Southwest determined that it would instead focus on putting as many flights as possible on its point-to-point routes by turning the planes around as quickly as possible (see Exhibits 6 and 7). Southwest was able to successfully decrease its turnaround times to close to 15 minutes for a variety of reasons. Flying PTP meant Southwest's flights weren't waiting on other flights. Since Southwest's flights were shorter, its passengers typically checked less baggage. The absence of meals on the airline's flights meant that less cleanup time was required. In addition, Southwest focused its employees on working as a team to turn planes and gave them significant latitude to work outside of formal guidelines and do whatever it took to turn a plane around quickly. Finally, Southwest stressed a high-speed boarding process. Most airlines assigned seats to their passengers, but Southwest ignored that method of boarding. Instead, each passenger got a boarding number as he or she arrived at the gate. Eliminating assigned seating meant that the airline didn't have to reconcile double-booked seats, and it motivated passengers to arrive early. Taken together, these practices combined to help Southwest turn around planes much faster than most of its competitors. By 2009, Southwest was turning planes at an average of 23 minutes, which was still roughly half of the industry average 11 In an industry facing some of the highest fixed costs in the world, Southwest's business model allowed it to keep costs low. Southwest had continued to exclusively use Boeing 737s throughout its history. By 2010, there were 548 Boeing 737s in Southwest's fleet (451 owned, 97 leased). 12 The efficiencies created by the common fleet of the 737s also meant that Southwest spent less money training its pilots, flight attendants, and mechanics and was able to staff smaller teams for its gate crews. In fact, the uniform configuration was so important to Southwest that, following its purchase of AirTran in 2011, all of Air Tran's planes were reconfigured to match Southwest's current fleet. Purchasing the same type of plane also gave Southwest some leverage negotiating prices with Boeingwhich was not insignificant, since a Boeing 737 cost between $75 million and $107 million in 2013, depending on the features included on the aircraft. Southwest also limited the commissions it paid to ticketing services and booking agents by refusing to pay fees for any third-party ticketing services except the SABRE system. These fees had historically run 5 percent to 10 percent of the price of a ticket but had moved to a lower flat fee in recent years. Instead, Southwest developed an online ticketing system of its own, and in 1995 it became the first airline to sell tickets directly from its own website. In 2010, 79 percent of Southwest's tickets were purchased online. 13 In contrast, only 35 percent of Delta's tickets were purchased online during the same period. 14 Although Southwest saved significant money on its operations, it was spending more than the average airline on marketing. In its first year of business, the airline spent 10 percent of its budget on advertising. The company had continued to emphasize marketing throughout its history, even increasing its marketing during difficult years. As Kelleher explained, "When do you need advertising the most? When times are bad."15 When Southwest achieved record profits and load factors in 2010, CEO Gary Kelly credited the company's highly successful Bags Fly Free" ad campaign for the success. 16 The campaign cost Southwest $159.5 million to produce, which was nearly the same as the combined advertising budgets of Delta, United, American, and Continental. 17 Although multiple cities were clamoring for Southwest's business, the airline made an early decision to grow slowly. Even in the best years, Southwest restricted increases in its capacity to 20 percent to 15 percent and added only two or three new cities per year. In 1996, Kelleher's reflected, "Southwest has had more opportunities for growth than it has airplanes. Yet, unlike other airlines, it has avoided the trap of growing beyond its means. "18 Following the devastating effects of the 9/11 terrorist attacks, Southwest explained in the opening statement to its 2001 annual report, "Southwest was well poised, financially, to withstand the potentially devastating hammer blow of September 11. Why? Because for several decades our leadership philosophy has been: We manage in good times so that our company and our people can be job secure and prosper through bad times." As noted, the airline recession after 9/11 as well as the US Great Recession of 2008-2009 had a strong negative impact on industry profitability (see Exhibits 8 and Exhibits 9) Southwest's Market Share in Southwest's Market Share Managing its growth in such a way kept far more cash in Southwest's pockets than was common for the industry. When fuel prices skyrocketed after 2005, Southwest was able to stay profitable because of its practice of fuel hedging, or buying options that guaranteed the price of fuel in the future. Most of the rest of the industry wasn't able to follow suit, however, because hedging required an enormous cash outlay. 19 Leadership, Culture, and Values Herb Kelleher was known for his unique style of leadership. As Kelleher reached 80 years old in 2011, he continued to display the quick wit and sense of humor that made him the face of Southwest after its founding. He was often featured in commercials and videos about the company. For one training video, he created a fully costumed rap persona called "Big Daddy O." He once dressed in a purple dress with a purple hat after losing a challenge with the maintenance crew. Kelleher was highly admired by his employees, perhaps because he was so engaged with them. For example, Kelleher was often seen helping to unload bags or serving drinks with flight crews. During one difficult period, when his pilots were willing to freeze their salaries for five years, Kelleher responded by freezing his own for the same period. As a token of their esteem for him, employees purchased Kelleher a custom Harley-Davidson motorcycle that he rode often. One of Kelleher's basic principles of business for Southwest was that the customer wasn't always right. Instead, his credo was that employees come first.20 Kelleher said, You put your employees first and if you take care of them, then they will take good care of you. Then your customers will come back, and your shareholders will like that, so it's really a unity."21 Southwest went to great lengths to maintain a culture of fun and to build a family spirit all across the airline. It even created a "Culture Committee" staffed with employees who volunteered their time after being nominated by their peers. The committee worked to create events and programs to celebrate Southwest employees at all levels from across the organization. Employees at Southwest were recruited for their positive and engaging attitudes and were given extensive training to ensure that they not only understood the airline's operations, but also embraced its culture. During hiring, Southwest conducted group interviews in which potential employees would share personal stories while interviewers observed the group for signs of empathy and interest. 22 In order to facilitate empathy among different types of employees, Southwest implemented Walk-A-Mile Day. Employees in all departments were encouraged to experience their coworkers' jobs first-hand. Walk-A-Mile Day and other practices encouraged collaboration throughout the company. When a flight did leave behind schedule, the team would meet to focus on the problem together, thus eliminating finger pointing at individuals. The results of Southwest's efforts were the highest level of employee productivity in the industry (see Exhibit 7) Southwest's employees have also benefited from its profit-sharing plan. Roughly 10 percent of Southwest's stock is held by its employees. Some think that these practices explain why, even though 82 percent of Southwest's 35,000 employees are unionized, the airline has one of the lowest rates of union complaints. It also didn't hurt that Southwest hasn't laid off or furloughed an employee since its founding in 1971. Looking back, Kelleher said during a 2011 interview that the facet of Southwest that made him most proud was having "total job security for our employees for over 40 years. I've spent my entire career staying out of their way."23 Southwest's Growth and Expansion Despite facing constant opposition to expansion from its competitors, Southwest was still able to grow steadily after its founding. Southwest moderated its growth in the face of enormous demand for what became known as the Southwest effect. In less than one year, cities newly served by Southwest would often see up to a 1,000 percent increase in air traffic, largely because of lower airfares. The Oakland- Burbank route improved from the 179th largest passenger route to the 25th largest within one year of Southwest's entry. As Exhibit 10 shows, Southwest was the dominant carrier in all of its top 100 city-pair routes Although most of Southwest's routes were short-haul flights of fewer than 1,000 miles, in the late 1990s, the airline began to look at expanding into long-haul routes. On Thanksgiving Day 1998, it commenced its first transcontinental flight from Baltimore to Oakland, a five-hour trip. Southwest was able to expand to longer routes in large part because Boeing had developed the 737-500 model aircraft. The 500 flew the longer flights at a far lower cost per mile while still maintaining the basic 737 structure and configuration that Southwest employees were used to 24 In 2007, Southwest moved to start catering more to business travelers by introducing Business Select service. Although the airline still provided only one class of seating, Business Select offered early boarding privileges, special business services at gates, and improved frequent flyer points. Initially, some observers expressed concerns about alienating core customers, but a few years later the Business Select service appeared to have increased interest from business travelers without having a noticeable effect on other travelers. In 2010, Southwest made its second acquisition (the first was Morris Air in 1993) of Air Tran for $1.4 billion. Air Tran followed a very similar strategy of offering short-haul, point-to-point, low-fare service. Air Tran's routes had little overlap with Southwest and included short international routes to the Caribbean and Mexico. The move would eventually extend Southwest's presence into Atlanta, the busiest airport in the world, and connect the airline to international markets. Full integration of the acquisition was expected to be completed by the end of 2014, by which time Southwest would begin showing Air Tran's routes on its website. In keeping with its strategy of using a single type of plane, Southwest decided to lease Air Tran's fleet of Boeing 717s to Delta so that it could use the standard Boeing 737s that it used throughout its operations 25 JetBlue: A Tough New Competitor JetBlue was founded in 1999 by former Morris Air president David Neeleman. After receiving more than $800 million in funding to establish its base of operations in JFK airport in New York, the airline grew quickly. During its first five years, JetBlue's revenues increased by more than 1100 percent, although it slowed significantly during the US recession in the latter part of the decade. In 2002, JetBlue had a successful initial public offering of stock (IPO); the airline's stock price increased by 70 percent on the first day alone. JetBlue flew both domestically and internationally, with both short- and long-haul routes. For example, JetBlue could fly long-haul flights from New York to Los Angeles, which Southwest could not do with the Boeing 737. Jet Blue's strategy and operations mimicked Southwest in many ways, including flying point to point using one type of aircraft (Airbus 320, which could fly longer routes; it later added Embraer 190 Jets for short-haul flights), not serving meals, and creating a team approach to quickly turning around flights. The airline distinguished itself from Southwest with comfortable leather seating, in-flight television offered in partnership with DirecTV, and assigned seating. JetBlue also offered its passengers simple boxed meals during flights (at an added charge) and charged for checking more than one bag. Although JetBlue's revenues were less than one-third of Southwest's, it was still a noteworthy competitor. JetBlue came in second to Southwest Airlines by only a couple points (84 to 87 out of 100) in a 2011 Consumer Reports survey of passengers 26 In 2014, Jet Blue beat out Southwest for the highest customer satisfaction rating among airlines by the American Customer Satisfaction Index (ACSI). JetBlue was also the only airline other than Southwest to show positive operating profits year after year. The airline was steadily growing its fleet of Airbus A320 and Embraer 190 jets and was consistently adding new routes JetBlue's strategy finally brought a competitor to the industry that could compete directly, and effectively, with Southwest. Looking Forward: Challenges with Growth and Competition Southwest had set the standard for the industry in multiple areas of operation, including flying more passengers per employee than any other airline, maintaining a debt-to-equity ratio far below the industry average, and by never having to stop a flight because of a union strike. Profitability at Southwest, and among all of its major competitors, was at an all-time high as a result of industry consolidation, higher capacity utilization of planes, and lower fuel costs because of the significant drop in oil prices. But despite Southwest's strong historical performance, key challenges lay ahead. Southwest had achieved steady growth following the Great Recession of 2008-2009, but some observers believed that, with record industry profitability, Southwest needed a growth plan. Southwest had gradually saturated most of the short-haul markets in the United States with little opportunity to add additional short-haul routes. Southwest had historically avoided both long-haul and international routes, but if the company was going to grow it would need to expand into those markets. CEO Gary Kelly acknowledged that long-haul markets were attractive for two reasons: first, they were the biggest, fastest-growing markets in US air travel and second, these markets had been dominated by the legacy carriers and Southwest had low market shareand thus had room to grow. But while the long-haul markets represented an opportunity, they also would not be easy to capture. For one thing, there was the question of whether Southwest could service long-haul markets with the Boeing 737, or whether Southwest would need to add a longer range aircraft, as JetBlue had done with the Airbus 320. Moreover, the traditional carriers dominated those markets and recent acquisitions (and restructurings) had strengthened their positions. Delta's acquisition of Northwest in 2008 made it the industry's largest carrier, as measured by share of revenue passenger miles (RPMs), which is the number of times that an airline carries one passenger one mile. In order to keep pace, UAL corporation, parent of United Airlines, announced in 2010 a merger with Continental Airlines. And in 2013, American Airlines acquired U.S. Airways, which made it the industry's largest carrier, surpassing Delta in share of revenue passenger miles. The consolidation of hub-and-spoke competitors in the industry reduced competition among these players and created an industry where the four largest airlines-American, Delta, UAL, and Southwest-controlled roughly 80 percent of the US air travel market. While American (with U.S. Airways), Delta (with Northwest), and United (with Continental) all had more revenue passenger miles than Southwest (because of more long-haul flights), Southwest led the domestic market in the number of passengers boarded annually. But the consolidations and restructurings) also helped the legacy carriers improve their cost position. Delta Airlines had higher profitability than Southwest from 2011-2015, and American and UAL were also realizing profits that were closer in line with what Southwest was achieving. In short, the legacy carriers were stronger and better positioned to protect their long-haul routes from encroachment by Southwest. This raised key questions about Southwest's growth prospects. Should Southwest invest heavily entering long-haul routes in the United States? Should it consider adding a longer haul aircraft to its fleet? Should it target international flights? These were questions facing CEO Kelly and Southwest as it looked for growth in an industry where growth in short-haul flightsits historical bread and butter-was limited. Roforonnor CASE 04 Southwest Airlines Flying High with Low Costs Southwest Airlines sent its first flights aloft in 1971. After almost 45 years, Southwest was so successful that the company was considered, in many ways, the crown jewel of the airline industry. The organization had achieved the longest continuous stretch of profitability in the history of the airline industry and was consistently ranked in the top 10 on Fortune's list of "Most Admired Companies," a list that spanned all industries. Southwest's executives liked to say that they strove toward a triple bottom line of People, Planet, and Performance. In 2015, Southwest was on strong financial ground, despite the fact that the prior 15 years had been some of the most difficult in aviation history. The airline industry had been hurt by the 9/11 terrorist attacks and the Great Recession of 20082009. Although 2009 had been a difficult year for the company, Southwest had still managed to eke out a positive net income of $99 million. The company's performance improved in the subsequent years, with net income rising above $400 million and revenues increasing from $10.3 billion in 2009 to more than $17 billion in 2012 (see Exhibits 1 and 3). Southwest achieved its strong financial performance in large part by having a high load factor, the airline industry's measure of the percentage of seats that are filled on an airline's flights. In 2010, Southwest hit the highest load factor in its history: 79.3 percent. Following its successful "Bags Fly Free" ad campaign, Southwest also saw its domestic market share increase by almost 2 percent. Southwest was known for high levels of both customer service and employee satisfaction. In 2013, Southwest not only rated as the top airline in a Consumer Reports survey of passengers but also reigned at the top of the US Department of Transportation's customer satisfaction rankings. By 2015, with the benefit of lower fuel costs, it achieved record profits of $4.1 billion. Overall, Southwest had an enviable record of performance. 2015 2013 2011 Financial Data: (in Millions except per share) Total Operating Revenues: 19,820 17,699 15,658 Operating Expenses: Salaries, wages, and benefits 6,383 5,305 4,371 Fuel and oil 3,616 5,763 5,644 Maintenance materials and repairs 1,005 1,080 955 Aircraft rentals 238 361 308 Landing fees and other rentals 1,166 1,103 959 Source: Bureau of Transportation Statistics, Air Carrier Financial Reports: Schedule P-1.2 The US Airline Industry The airline industry is critical to the health of the US economy. Airlines provide 11 million jobs in the United States and are responsible for five cents of every dollar of the US gross domestic product (GDP). For every 100 airline jobs that exist, 388 more jobs are supported outside of the airline industry? A key turning point in airline history was the deregulation of the industry in 1978. Before deregulation, the Civil Aeronautics Board regulated all passenger fares, which meant the price was the same for each flight between two cities. The board also regulated industry entrances and exits, mergers and acquisitions, and even airlines' rates of return. Typically, any given market had only a few airlines, and price competition was essentially nonexistent. Following deregulation, numerous new entrants moved into both established and unserved markets, and fare prices began to drop quickly. The average passenger fare in 1978 was about 8.49 cents per mile. In 2009, that price, adjusted for inflation, had decreased 56 percent. As prices declined for passengers, however, more than 150 airlines went bankrupt, and eight of the 11 major airlines went bankrupt, merged, or closed. The airline industry's profit margins are some of the lowest in the world (see Exhibits 4 and 5). Airlines paid considerable attention to reducing their operating costs, but their control over those costs was severely limited. In particular, labor costs represented the largest percentage of an airline's costs, but union agreements limited labor flexibility. The sizes of the crew and ground staff were typically proportional to the size of the aircraft they served. Other operating costs were primarily determined by the distance traveled and not by the number of passengers boarded. Most airlinesnotably Delta, American, and United-used a hub-and-spoke system to coordinate flights, which meant that they funneled the majority of their traffic through hub airports. Hub-and-spoke (HS) systems were designed to help airlines maximize their load factors, meaning they helped keep planes full going into and out of a hub airport. But they also often increased the distance that passengers had to fly to reach their final destination and the time it took for passengers to get there. The History of Southwest Airlines Legend has it that the idea for Southwest Airlines was first conceived on a napkin while Herb Kelleher was meeting with Rollin King in a San Antonio restaurant. In 1966, Kelleher was practicing law. King, one of Kelleher's clients, approached him with the idea of bringing a low-cost intrastate airline to Texas. Because federal regulations made it difficult to establish an airline that crossed state borders, the two founded Southwest Airlines in 1967 to focus on point-to-point travel among the three Texas cities of Dallas, Houston, and San Antonio In contrast to larger airlines servicing the cities through connecting interstate routes, Southwest would fly directly to each of the cities, and the flights would take roughly one hour each. When deregulation hit the airline industry in 1978, Southwest decided to compete with low fares. Demand for travel among the three cities had been rising at the time, and, with little price competition in the market, passenger fares were high. Targeting business travelers and commuters among its initial three cities, Southwest's fares were typically priced between $40 and $100 round trip in order to compete with the cost of driving Southwest was based out of Love Field in Dallas, which although a small airport, offered travelers a more convenient location because of its closer proximity to the city than the larger Dallas-Fort Worth Airport Using Love Field as inspiration, Southwest adopted a "love" theme for the airline's marketing and operations. Drinks were called "love potions," and ticket machines love machines." Later, when Southwest went public, its stock ticker would be LUV. The flight attendants were women chosen for their striking looks. They wore boots and "hot pants" (small, form-fitting shorts), which were a fashion trend. Said Kelleher, "You can have a low-cost carrier and people still don't fly it because they don't know about it. And so, the shtick kind of fits in with getting known."? Southwest also emphasized a culture of fun. Employees were known to sing announcements to passengers and deliver entertaining instructions. For example, flight attendants were known to tell passengers how nice they would look in their life vests or that they will need to deposit 25 cents for oxygen to begin flowing to their oxygen masks. It is easy to find videos on the Internet of flight attendants singing, rapping, and telling jokes to their passengers. Southwest brought the culture of fun to its employees not only through the example of its senior executives but also through its "fun" training programs. The company's advertising also tended to be a fun, even a little edgy. On one occasion, marketers brought an ad to Kelleher that targeted extra regulations and fees that other airlines stated in "fine print" marked by asterisks in their ads. Kelleher quickly approved running Southwest's ad, which read, "Some airlines should have their asterisks kicked. "8 The company's point-to-point service led to frequent departures between city-pair routes. With only three planes operating until 1974, Southwest had to focus on turning its planes around as quickly as possible. Its choice to fly into less-congested airports such as Love Field helped Southwest make those faster turnarounds. At the beginning, Southwest set the goal of turning its planes around in 15 minutes, which was 30 minutes faster than the industry average. Southwest also quickly discovered that it could segment its pricing. After starting its fares at $20 one way, Southwest raised fares for travel before 7:00 pm to $26. To target budget-minded leisure travelers, Southwest lowered fares for flights after 7:00 pm and weekend flights to as low as $13. Such decisions were key to Southwest's early success and laid the foundation for the company's successful low-cost Southwest also quickly discovered that it could segment its pricing. After starting its fares at $20 one way, Southwest raised fares for travel before 7:00 pm to $26. To target budget-minded leisure travelers, Southwest lowered fares for flights after 7:00 pm and weekend flights to as low as $13. Such decisions were key to Southwest's early success and laid the foundation for the company's successful low-cost strategy. Southwest's business model set it apart from its competitors, and the company began to grow quickly. It took the company only two years to become profitable, and it has been profitable every year since 1973 Southwest's Strategy and Operations Southwest's strategy involved offering no-frills, short-haul, high-frequency, point-to-point, low-fare service. Although Southwest's approach would later become well known and frequently studied, it started out primarily as a response to the constraints faced by the company. Federal regulations led Southwest to focus on intrastate travel among just Dallas, Houston, and San Antonio. The company's first planes were three Boeing 737s purchased because they were available at a discount because of overproduction. 10 This small fleet caused Southwest to focus on reducing the time to turn its planes around and get them back in the air. Because of its short flights, the airline did not serve meals. Eventually, Southwest would become renowned for these strategies of flying only point-to-point routes between less congested airports, adopting only one model of plane (the Boeing 737), and offering only one class of service, without meals or assigned seating. Southwest bucked the industry trend of routing planes through a hub-and-spoke (HS) model by flying its planes point-to-point (PTP) on city-pair routes. The HS modeldeveloped in the 1960s and 1970s and used by full-service carriers such as American, United, and Deltawas designed to maximize the load factors for each of an airline's individual planes by bringing customers traveling to the same location together in a central hub from all their different points of origination. The HS model was, however, generally considered to be inconvenient by passengers, and a delay in one flight on a spoke would create a domino effect of delays that would cascade throughout an airline's system of flights. Southwest determined that it would instead focus on putting as many flights as possible on its point-to-point routes by turning the planes around as quickly as possible (see Exhibits 6 and 7). Southwest was able to successfully decrease its turnaround times to close to 15 minutes for a variety of reasons. Flying PTP meant Southwest's flights weren't waiting on other flights. Since Southwest's flights were shorter, its passengers typically checked less baggage. The absence of meals on the airline's flights meant that less cleanup time was required. In addition, Southwest focused its employees on working as a team to turn planes and gave them significant latitude to work outside of formal guidelines and do whatever it took to turn a plane around quickly. Finally, Southwest stressed a high-speed boarding process. Most airlines assigned seats to their passengers, but Southwest ignored that method of boarding. Instead, each passenger got a boarding number as he or she arrived at the gate. Eliminating assigned seating meant that the airline didn't have to reconcile double-booked seats, and it motivated passengers to arrive early. Taken together, these practices combined to help Southwest turn around planes much faster than most of its competitors. By 2009, Southwest was turning planes at an average of 23 minutes, which was still roughly half of the industry average 11 In an industry facing some of the highest fixed costs in the world, Southwest's business model allowed it to keep costs low. Southwest had continued to exclusively use Boeing 737s throughout its history. By 2010, there were 548 Boeing 737s in Southwest's fleet (451 owned, 97 leased). 12 The efficiencies created by the common fleet of the 737s also meant that Southwest spent less money training its pilots, flight attendants, and mechanics and was able to staff smaller teams for its gate crews. In fact, the uniform configuration was so important to Southwest that, following its purchase of AirTran in 2011, all of Air Tran's planes were reconfigured to match Southwest's current fleet. Purchasing the same type of plane also gave Southwest some leverage negotiating prices with Boeingwhich was not insignificant, since a Boeing 737 cost between $75 million and $107 million in 2013, depending on the features included on the aircraft. Southwest also limited the commissions it paid to ticketing services and booking agents by refusing to pay fees for any third-party ticketing services except the SABRE system. These fees had historically run 5 percent to 10 percent of the price of a ticket but had moved to a lower flat fee in recent years. Instead, Southwest developed an online ticketing system of its own, and in 1995 it became the first airline to sell tickets directly from its own website. In 2010, 79 percent of Southwest's tickets were purchased online. 13 In contrast, only 35 percent of Delta's tickets were purchased online during the same period. 14 Although Southwest saved significant money on its operations, it was spending more than the average airline on marketing. In its first year of business, the airline spent 10 percent of its budget on advertising. The company had continued to emphasize marketing throughout its history, even increasing its marketing during difficult years. As Kelleher explained, "When do you need advertising the most? When times are bad."15 When Southwest achieved record profits and load factors in 2010, CEO Gary Kelly credited the company's highly successful Bags Fly Free" ad campaign for the success. 16 The campaign cost Southwest $159.5 million to produce, which was nearly the same as the combined advertising budgets of Delta, United, American, and Continental. 17 Although multiple cities were clamoring for Southwest's business, the airline made an early decision to grow slowly. Even in the best years, Southwest restricted increases in its capacity to 20 percent to 15 percent and added only two or three new cities per year. In 1996, Kelleher's reflected, "Southwest has had more opportunities for growth than it has airplanes. Yet, unlike other airlines, it has avoided the trap of growing beyond its means. "18 Following the devastating effects of the 9/11 terrorist attacks, Southwest explained in the opening statement to its 2001 annual report, "Southwest was well poised, financially, to withstand the potentially devastating hammer blow of September 11. Why? Because for several decades our leadership philosophy has been: We manage in good times so that our company and our people can be job secure and prosper through bad times." As noted, the airline recession after 9/11 as well as the US Great Recession of 2008-2009 had a strong negative impact on industry profitability (see Exhibits 8 and Exhibits 9) Southwest's Market Share in Southwest's Market Share Managing its growth in such a way kept far more cash in Southwest's pockets than was common for the industry. When fuel prices skyrocketed after 2005, Southwest was able to stay profitable because of its practice of fuel hedging, or buying options that guaranteed the price of fuel in the future. Most of the rest of the industry wasn't able to follow suit, however, because hedging required an enormous cash outlay. 19 Leadership, Culture, and Values Herb Kelleher was known for his unique style of leadership. As Kelleher reached 80 years old in 2011, he continued to display the quick wit and sense of humor that made him the face of Southwest after its founding. He was often featured in commercials and videos about the company. For one training video, he created a fully costumed rap persona called "Big Daddy O." He once dressed in a purple dress with a purple hat after losing a challenge with the maintenance crew. Kelleher was highly admired by his employees, perhaps because he was so engaged with them. For example, Kelleher was often seen helping to unload bags or serving drinks with flight crews. During one difficult period, when his pilots were willing to freeze their salaries for five years, Kelleher responded by freezing his own for the same period. As a token of their esteem for him, employees purchased Kelleher a custom Harley-Davidson motorcycle that he rode often. One of Kelleher's basic principles of business for Southwest was that the customer wasn't always right. Instead, his credo was that employees come first.20 Kelleher said, You put your employees first and if you take care of them, then they will take good care of you. Then your customers will come back, and your shareholders will like that, so it's really a unity."21 Southwest went to great lengths to maintain a culture of fun and to build a family spirit all across the airline. It even created a "Culture Committee" staffed with employees who volunteered their time after being nominated by their peers. The committee worked to create events and programs to celebrate Southwest employees at all levels from across the organization. Employees at Southwest were recruited for their positive and engaging attitudes and were given extensive training to ensure that they not only understood the airline's operations, but also embraced its culture. During hiring, Southwest conducted group interviews in which potential employees would share personal stories while interviewers observed the group for signs of empathy and interest. 22 In order to facilitate empathy among different types of employees, Southwest implemented Walk-A-Mile Day. Employees in all departments were encouraged to experience their coworkers' jobs first-hand. Walk-A-Mile Day and other practices encouraged collaboration throughout the company. When a flight did leave behind schedule, the team would meet to focus on the problem together, thus eliminating finger pointing at individuals. The results of Southwest's efforts were the highest level of employee productivity in the industry (see Exhibit 7) Southwest's employees have also benefited from its profit-sharing plan. Roughly 10 percent of Southwest's stock is held by its employees. Some think that these practices explain why, even though 82 percent of Southwest's 35,000 employees are unionized, the airline has one of the lowest rates of union complaints. It also didn't hurt that Southwest hasn't laid off or furloughed an employee since its founding in 1971. Looking back, Kelleher said during a 2011 interview that the facet of Southwest that made him most proud was having "total job security for our employees for over 40 years. I've spent my entire career staying out of their way."23 Southwest's Growth and Expansion Despite facing constant opposition to expansion from its competitors, Southwest was still able to grow steadily after its founding. Southwest moderated its growth in the face of enormous demand for what became known as the Southwest effect. In less than one year, cities newly served by Southwest would often see up to a 1,000 percent increase in air traffic, largely because of lower airfares. The Oakland- Burbank route improved from the 179th largest passenger route to the 25th largest within one year of Southwest's entry. As Exhibit 10 shows, Southwest was the dominant carrier in all of its top 100 city-pair routes Although most of Southwest's routes were short-haul flights of fewer than 1,000 miles, in the late 1990s, the airline began to look at expanding into long-haul routes. On Thanksgiving Day 1998, it commenced its first transcontinental flight from Baltimore to Oakland, a five-hour trip. Southwest was able to expand to longer routes in large part because Boeing had developed the 737-500 model aircraft. The 500 flew the longer flights at a far lower cost per mile while still maintaining the basic 737 structure and configuration that Southwest employees were used to 24 In 2007, Southwest moved to start catering more to business travelers by introducing Business Select service. Although the airline still provided only one class of seating, Business Select offered early boarding privileges, special business services at gates, and improved frequent flyer points. Initially, some observers expressed concerns about alienating core customers, but a few years later the Business Select service appeared to have increased interest from business travelers without having a noticeable effect on other travelers. In 2010, Southwest made its second acquisition (the first was Morris Air in 1993) of Air Tran for $1.4 billion. Air Tran followed a very similar strategy of offering short-haul, point-to-point, low-fare service. Air Tran's routes had little overlap with Southwest and included short international routes to the Caribbean and Mexico. The move would eventually extend Southwest's presence into Atlanta, the busiest airport in the world, and connect the airline to international markets. Full integration of the acquisition was expected to be completed by the end of 2014, by which time Southwest would begin showing Air Tran's routes on its website. In keeping with its strategy of using a single type of plane, Southwest decided to lease Air Tran's fleet of Boeing 717s to Delta so that it could use the standard Boeing 737s that it used throughout its operations 25 JetBlue: A Tough New Competitor JetBlue was founded in 1999 by former Morris Air president David Neeleman. After receiving more than $800 million in funding to establish its base of operations in JFK airport in New York, the airline grew quickly. During its first five years, JetBlue's revenues increased by more than 1100 percent, although it slowed significantly during the US recession in the latter part of the decade. In 2002, JetBlue had a successful initial public offering of stock (IPO); the airline's stock price increased by 70 percent on the first day alone. JetBlue flew both domestically and internationally, with both short- and long-haul routes. For example, JetBlue could fly long-haul flights from New York to Los Angeles, which Southwest could not do with the Boeing 737. Jet Blue's strategy and operations mimicked Southwest in many ways, including flying point to point using one type of aircraft (Airbus 320, which could fly longer routes; it later added Embraer 190 Jets for short-haul flights), not serving meals, and creating a team approach to quickly turning around flights. The airline distinguished itself from Southwest with comfortable leather seating, in-flight television offered in partnership with DirecTV, and assigned seating. JetBlue also offered its passengers simple boxed meals during flights (at an added charge) and charged for checking more than one bag. Although JetBlue's revenues were less than one-third of Southwest's, it was still a noteworthy competitor. JetBlue came in second to Southwest Airlines by only a couple points (84 to 87 out of 100) in a 2011 Consumer Reports survey of passengers 26 In 2014, Jet Blue beat out Southwest for the highest customer satisfaction rating among airlines by the American Customer Satisfaction Index (ACSI). JetBlue was also the only airline other than Southwest to show positive operating profits year after year. The airline was steadily growing its fleet of Airbus A320 and Embraer 190 jets and was consistently adding new routes JetBlue's strategy finally brought a competitor to the industry that could compete directly, and effectively, with Southwest. Looking Forward: Challenges with Growth and Competition Southwest had set the standard for the industry in multiple areas of operation, including flying more passengers per employee than any other airline, maintaining a debt-to-equity ratio far below the industry average, and by never having to stop a flight because of a union strike. Profitability at Southwest, and among all of its major competitors, was at an all-time high as a result of industry consolidation, higher capacity utilization of planes, and lower fuel costs because of the significant drop in oil prices. But despite Southwest's strong historical performance, key challenges lay ahead. Southwest had achieved steady growth following the Great Recession of 2008-2009, but some observers believed that, with record industry profitability, Southwest needed a growth plan. Southwest had gradually saturated most of the short-haul markets in the United States with little opportunity to add additional short-haul routes. Southwest had historically avoided both long-haul and international routes, but if the company was going to grow it would need to expand into those markets. CEO Gary Kelly acknowledged that long-haul markets were attractive for two reasons: first, they were the biggest, fastest-growing markets in US air travel and second, these markets had been dominated by the legacy carriers and Southwest had low market shareand thus had room to grow. But while the long-haul markets represented an opportunity, they also would not be easy to capture. For one thing, there was the question of whether Southwest could service long-haul markets with the Boeing 737, or whether Southwest would need to add a longer range aircraft, as JetBlue had done with the Airbus 320. Moreover, the traditional carriers dominated those markets and recent acquisitions (and restructurings) had strengthened their positions. Delta's acquisition of Northwest in 2008 made it the industry's largest carrier, as measured by share of revenue passenger miles (RPMs), which is the number of times that an airline carries one passenger one mile. In order to keep pace, UAL corporation, parent of United Airlines, announced in 2010 a merger with Continental Airlines. And in 2013, American Airlines acquired U.S. Airways, which made it the industry's largest carrier, surpassing Delta in share of revenue passenger miles. The consolidation of hub-and-spoke competitors in the industry reduced competition among these players and created an industry where the four largest airlines-American, Delta, UAL, and Southwest-controlled roughly 80 percent of the US air travel market. While American (with U.S. Airways), Delta (with Northwest), and United (with Continental) all had more revenue passenger miles than Southwest (because of more long-haul flights), Southwest led the domestic market in the number of passengers boarded annually. But the consolidations and restructurings) also helped the legacy carriers improve their cost position. Delta Airlines had higher profitability than Southwest from 2011-2015, and American and UAL were also realizing profits that were closer in line with what Southwest was achieving. In short, the legacy carriers were stronger and better positioned to protect their long-haul routes from encroachment by Southwest. This raised key questions about Southwest's growth prospects. Should Southwest invest heavily entering long-haul routes in the United States? Should it consider adding a longer haul aircraft to its fleet? Should it target international flights? These were questions facing CEO Kelly and Southwest as it looked for growth in an industry where growth in short-haul flightsits historical bread and butter-was limited. Roforonnor