Question: Read the Hecht v . And ver Assoc. Mgmt . Co . case in Ch . 4 0 . In that case, the Andover LLC

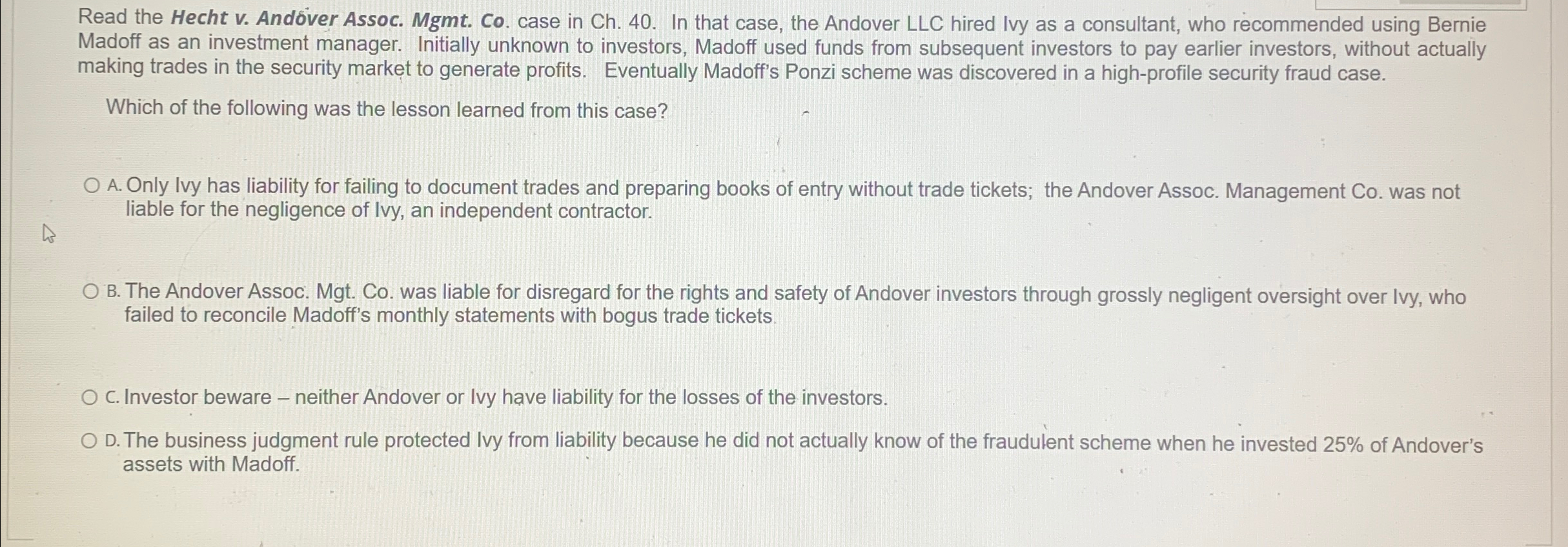

Read the Hecht v Andver Assoc. Mgmt Co case in Ch In that case, the Andover LLC hired Ivy as a consultant, who recommended using Bernie Madoff as an investment manager. Initially unknown to investors, Madoff used funds from subsequent investors to pay earlier investors, without actually making trades in the security market to generate profits. Eventually Madoff's Ponzi scheme was discovered in a highprofile security fraud case.

Which of the following was the lesson learned from this case?

A Only Ivy has liability for failing to document trades and preparing books of entry without trade tickets; the Andover Assoc. Management Co was not liable for the negligence of Ivy, an independent contractor.

B The Andover Assoc. Mgt Co was liable for disregard for the rights and safety of Andover investors through grossly negligent oversight over Ivy, who failed to reconcile Madoff's monthly statements with bogus trade tickets.

C Investor beware neither Andover or Ivy have liability for the losses of the investors.

D The business judgment rule protected Ivy from liability because he did not actually know of the fraudulent scheme when he invested of Andover's assets with Madoff.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock