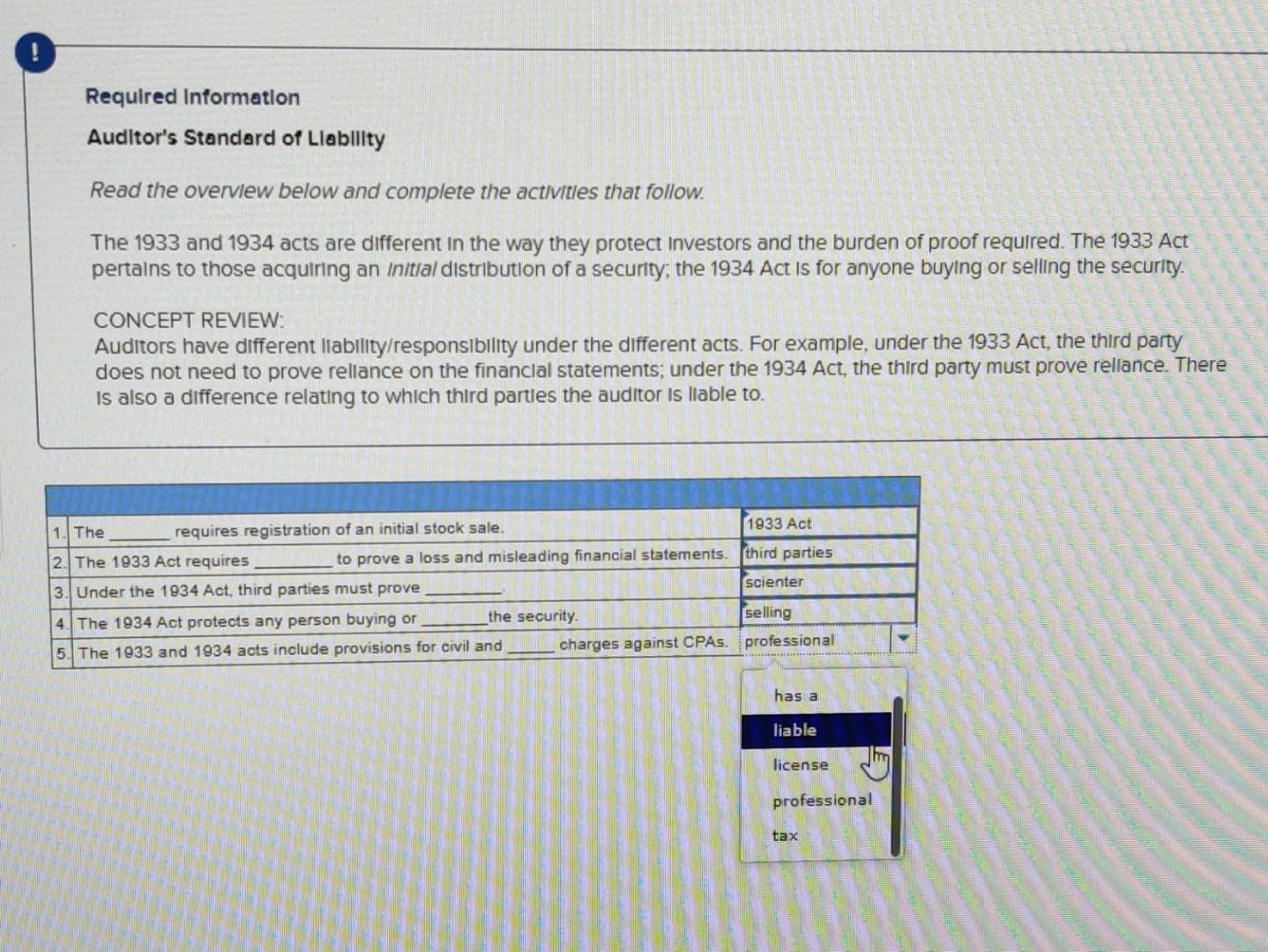

Question: Read the overview below and complete the activities that follow. The 1933 and 1934 acts are different in the way they protect investors and the

the #4 and 5 were wrong and I don't understand why. You can see the options that I have for #5. In #4 beside selling that was wrong the other options are auditing, registering, reporting and research.

Thank you for your help.

Required Information Auditor's Standard of Llability Read the overvlew below and complete the activitles that follow. The 1933 and 1934 acts are different In the way they protect Investors and the burden of proof required. The 1933 Act pertains to those acquiring an Initial distribution of a security; the 1934 Act is for anyone buylng or selling the security. CONCEPT REVIEW: Auditors have different Ilability/responsibility under the different acts. For example, under the 1933 Act, the third party does not need to prove rellance on the financlal statements; under the 1934Act, the third party must prove rellance. There Is also a difference relating to which third partles the auditor is llable to. Required Information Auditor's Standard of Llability Read the overvlew below and complete the activitles that follow. The 1933 and 1934 acts are different In the way they protect Investors and the burden of proof required. The 1933 Act pertains to those acquiring an Initial distribution of a security; the 1934 Act is for anyone buylng or selling the security. CONCEPT REVIEW: Auditors have different Ilability/responsibility under the different acts. For example, under the 1933 Act, the third party does not need to prove rellance on the financlal statements; under the 1934Act, the third party must prove rellance. There Is also a difference relating to which third partles the auditor is llable to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts