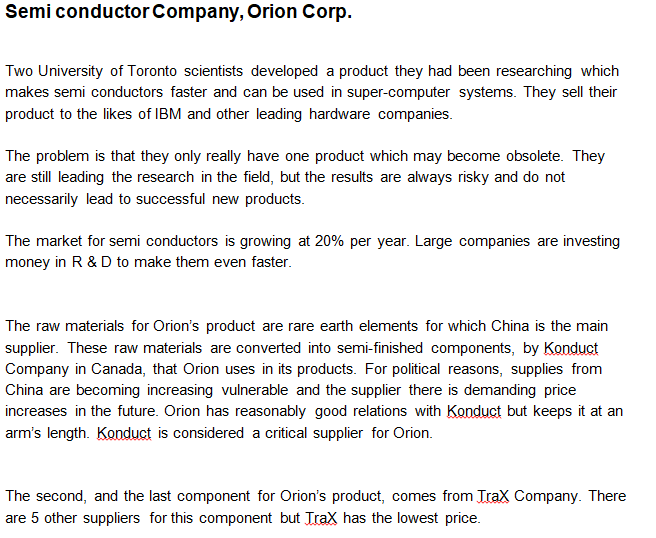

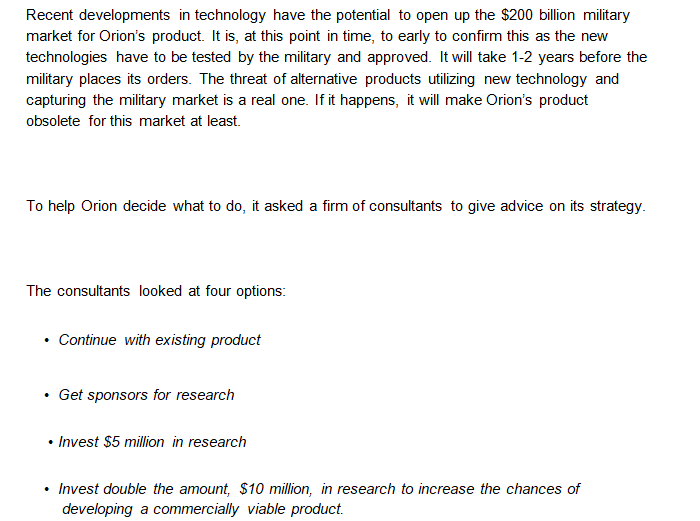

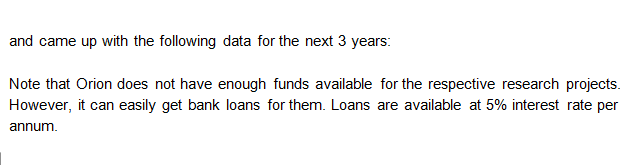

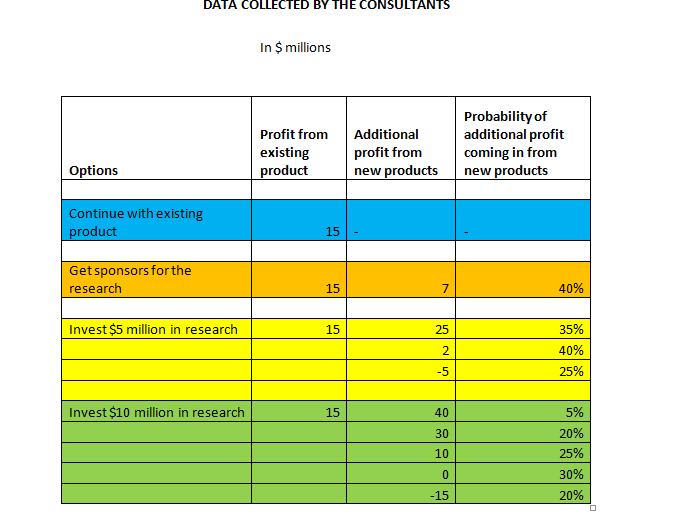

Question: Read this case study and answer the questions in detail. Semiconductor Company, Orion Corp. Two University of Toronto scientists developed a product they had been

Read this case study and answer the questions in detail.

Read this case study and answer the questions in detail.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock