Question: REAL un contexternal_browser.&launchUd=http%253A%252F%252Fimmheducation.com 252Fmgmiddleware HW Assignment 6 (Ch 9-13) 6 Saved Help Save & Exit Check 25 If we consider the effect of taxes, then

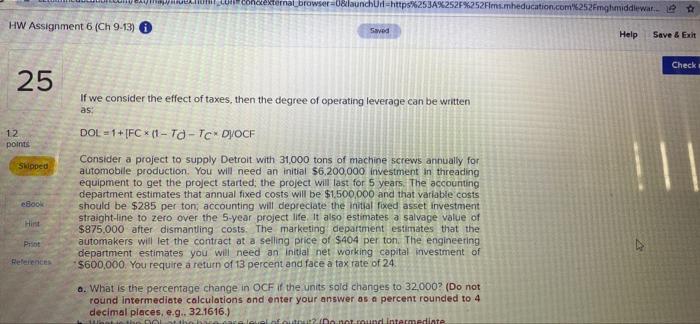

REAL un contexternal_browser.&launchUd=http%253A%252F%252Fimmheducation.com 252Fmgmiddleware HW Assignment 6 (Ch 9-13) 6 Saved Help Save & Exit Check 25 If we consider the effect of taxes, then the degree of operating leverage can be written as, 12 points DOL = 1 + [FC*11 - TO - TcDOCF Skloped 800 Hint Consider a project to supply Detroit with 31,000 tons of machine screws annually for automobile production. You will need an initial $6,200,000 investment in threading equipment to get the project started, the project will last for 5 years. The accounting department estimates that annual fixed costs will be $1,500,000 and that variable costs should be $285 per ton, accounting will depreciate the initial fixed asset investment straight-line to zero over the 5-year project life. It also estimates a salvage value of $875.000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $404 per ton. The engineering department estimates you will need an initial networking capital investment of $600,000. You require a return of 13 percent and face a tax rate of 24 o. What is the percentage change in OCF if the units sold changes to 32,000? (Do not round Intermediate calculations and enter your answer as a percent rounded to 4 decimal places, e.g. 32.1616.) SOL Do not und Intermediate Prot References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts