Question: really need help with these problems in these 3 pages . cant figure them out A L Salary per year for Pushing Back The R15

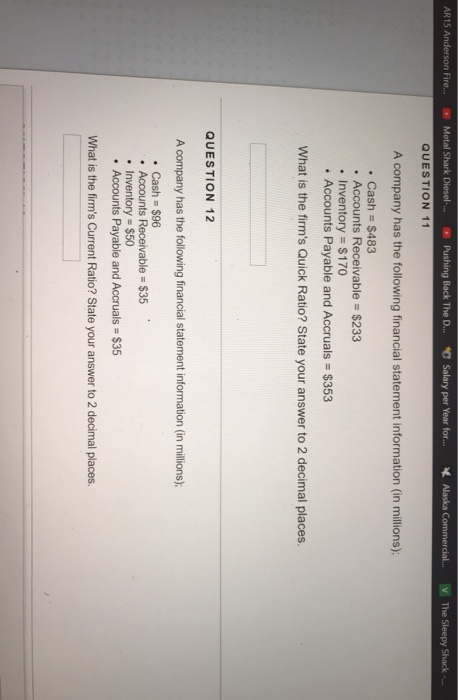

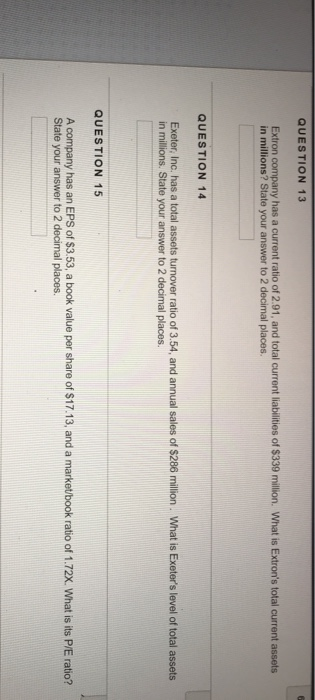

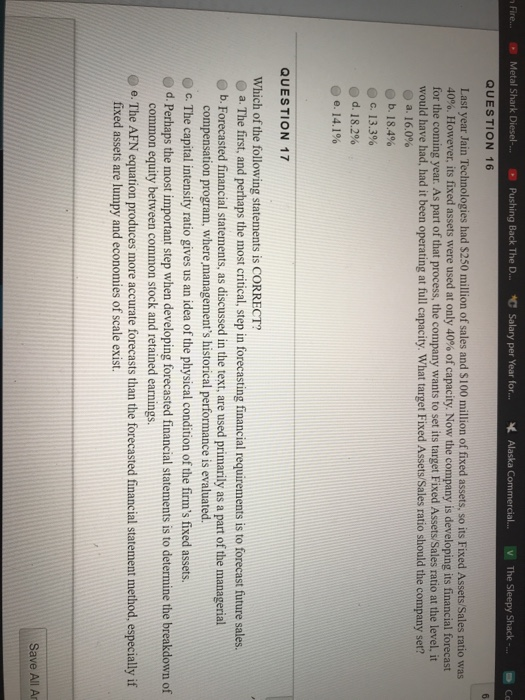

A L Salary per year for Pushing Back The R15 Anderson Fire.. Metal Shark Diesel QUESTION 11 A company has the following financial statement information (in millions): Cash = $483 Accounts Receivable = $233 Inventory = $170 Accounts Payable and Accruals = $353 What is the firm's Quick Ratio? State your answer to 2 decimal places. QUESTION 12 A company has the following financial statement information (in millions): Cash - $96 Accounts Receivable - $35 Inventory = $50 Accounts Payable and Accruals = $35 What is the firm's Current Ratio? State your answer to 2 decimal places QUESTION 13 Extron company has a current ratio of 2.91, and total current liabilities of $339 million. What is Extron's total current assets in millions? State your answer to 2 decimal places. QUESTION 14 Exeter, Inc. has a total assets turnover ratio of 3.54, and annual sales of $286 million. What is Exeter's level of total assets in millions. State your answer to 2 decimal places. QUESTION 15 A company has an EPS of $3.53, a book value per share of $17.13, and a market/book ratio of 1.72X. What is its P/E ratio? State your answer to 2 decimal places. Fire... Pushing Back The D... C Salary per year for... Alaska Commercial. V The Sleepy Shack Metal Shark Diesel... QUESTION 16 Last year Jain Technologies had $250 million of sales and S100 million of fixed assets, so its Fixed Assets/Sales ratio was 40%. However, its fixed assets were used at only 40% of capacity. Now the company is developing its financial forecast for the coming year. As part of that process, the company wants to set its target Fixed Assets/Sales ratio at the level, it would have had, had it been operating at full capacity. What target Fixed Assets/Sales ratio should the company set? a. 16.0% b. 18.4% C. 13.3% d. 18.2% e. 14.1% QUESTION 17 Which of the following statements is CORRECT? a. The first, and perhaps the most critical, step in forecasting financial requirements is to forecast future sales. b. Forecasted financial statements, as discussed in the text, are used primarily as a part of the managerial compensation program, where management's historical performance is evaluated. C. The capital intensity ratio gives us an idea of the physical condition of the firm's fixed assets. d. Perhaps the most important step when developing forecasted financial statements is to determine the breakdown of common equity between common stock and retained earnings. . The AFN equation produces more accurate forecasts than the forecasted financial statement method, especially if fixed assets are lumpy and economies of scale exist. Save All Ar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts