Question: Recall that a straddle position is a long call option plus a long put option with the same strike price and same expiration date. For

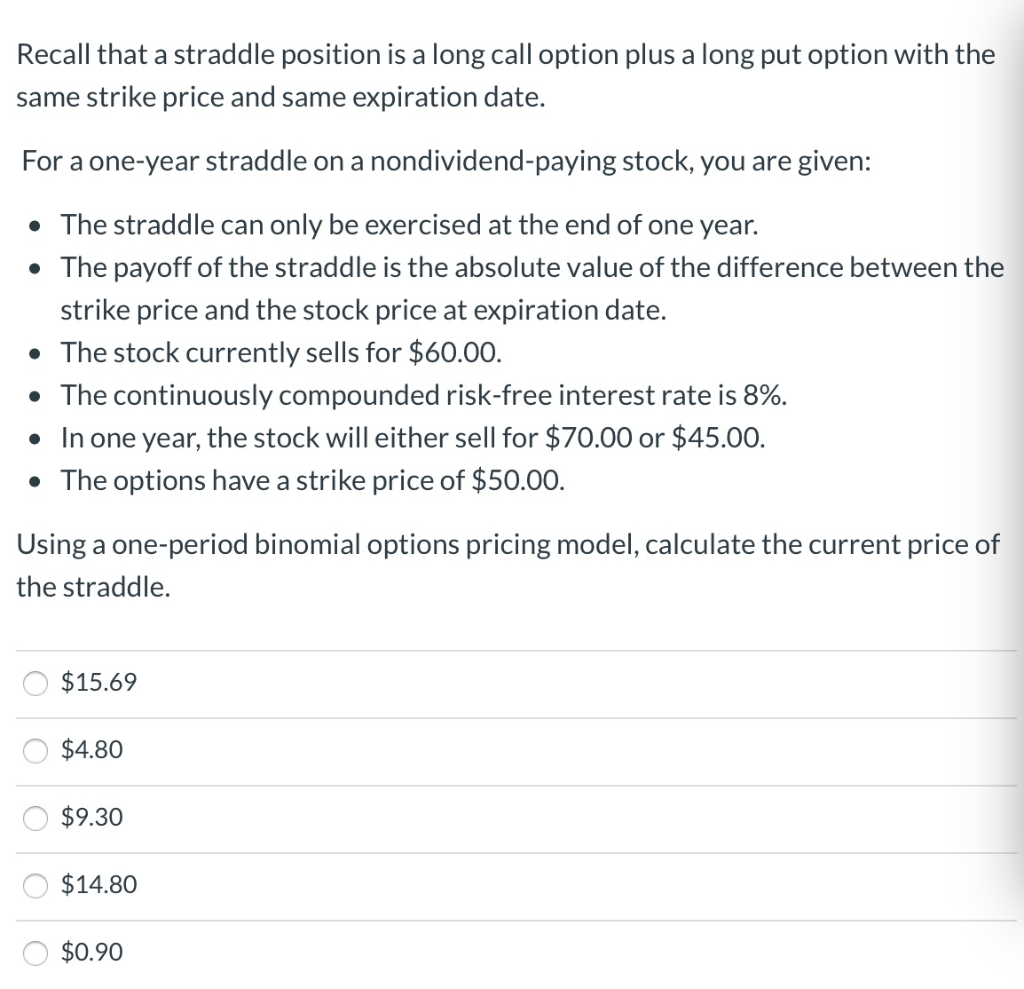

Recall that a straddle position is a long call option plus a long put option with the same strike price and same expiration date. For a one-year straddle on a nondividend-paying stock, you are given: The straddle can only be exercised at the end of one year. The payoff of the straddle is the absolute value of the difference between the strike price and the stock price at expiration date. The stock currently sells for $60.00. The continuously compounded risk-free interest rate is 8%. In one year, the stock will either sell for $70.00 or $45.00. The options have a strike price of $50.00. Using a one-period binomial options pricing model, calculate the current price of the straddle. O $15.69 O $4.80 0 $9.30 $14.80 $0.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts