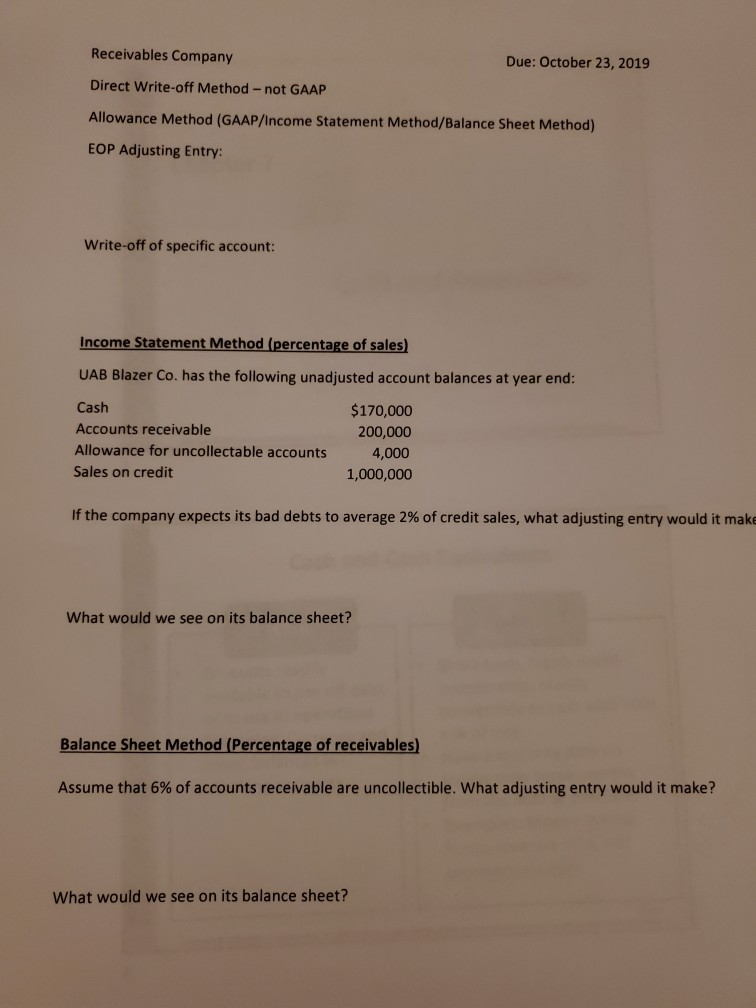

Question: Receivables Company Due: October 23, 2019 Direct Write-off Method - not GAAP Allowance Method (GAAP/Income Statement Method/Balance Sheet Method) EOP Adjusting Entry: Write-off of specific

Receivables Company Due: October 23, 2019 Direct Write-off Method - not GAAP Allowance Method (GAAP/Income Statement Method/Balance Sheet Method) EOP Adjusting Entry: Write-off of specific account: Income Statement Method (percentage of sales) UAB Blazer Co. has the following unadjusted account balances at year end: Cash $170,000 Accounts receivable 200,000 Allowance for uncollectable accounts 4,000 Sales on credit 1,000,000 If the company expects its bad debts to average 2 % of credit sales, what adjusting entry would it make What would we see on its balance sheet? Balance Sheet Method (Percentage of receivables) Assume that 6% of accounts receivable are uncollectible. What adjusting entry would it make? What would we see on its balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts