Question: . Recommend whether Pablo should choose Option 1 or Option 2. * Pablo's Peanuts (PP) Pablo recently emigrated from Argentina to Miami, Florida, which has

. Recommend whether Pablo should choose Option 1 or Option 2. *

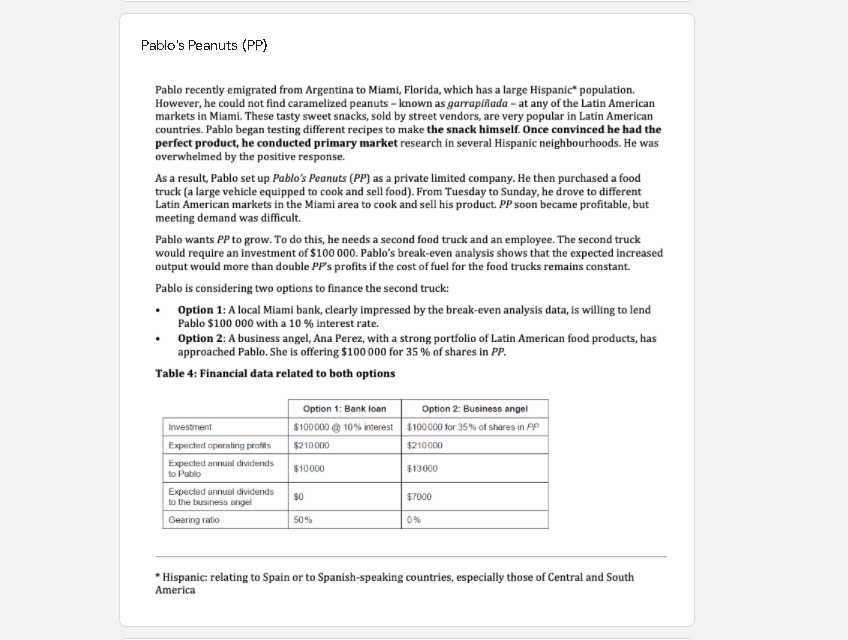

Pablo's Peanuts (PP) Pablo recently emigrated from Argentina to Miami, Florida, which has a large Hispanic* population. However, he could not find caramelized peanuts - known as garrapiada - at any of the Latin American markets in Miami. These tasty sweet snacks, sold by street vendors, are very popular in Latin American countries. Pablo began testing different recipes to make the snack himself. Once convinced he had the perfect product, he conducted primary market research in several Hispanic neighbourhoods. He was overwhelmed by the positive response. As a result, Pablo set up Pablo's Peanuts (PP) as a private limited company. He then purchased a food truck (a large vehicle equipped to cook and sell food). From Tuesday to Sunday, he drove to different Latin American markets in the Miami area to cook and sell his product. PP soon became profitable, but meeting demand was difficult Pablo wants PP to grow. To do this, he needs a second food truck and an employee. The second truck would require an investment of $100 000. Pablo's break-even analysis shows that the expected increased output would more than double PP's profits if the cost of fuel for the food trucks remains constant. Pablo is considering two options to finance the second truck: Option 1: A local Miami bank, clearly impressed by the break-even analysis data, is willing to lend Pablo $100 000 with a 10% interest rate. Option 2: A business angel, Ana Perez, with a strong portfolio of Latin American food products, has approached Pablo. She is offering $100 000 for 35 % of shares in PP. Table 4: Financial data related to both options Investment Option 1: Bank loan Option 2: Business angel $100000 @ 10% interest $100 000 for 35% of shares in PP $210000 $210000 $10000 $13000 Expected operating profits Expected annual dividends to Pablo Expected annual dividends to the business angel Gearing ratio $0 $7000 50% 0% *Hispanic: relating to Spain or to Spanish-speaking countries, especially those of Central and South America Pablo's Peanuts (PP) Pablo recently emigrated from Argentina to Miami, Florida, which has a large Hispanic* population. However, he could not find caramelized peanuts - known as garrapiada - at any of the Latin American markets in Miami. These tasty sweet snacks, sold by street vendors, are very popular in Latin American countries. Pablo began testing different recipes to make the snack himself. Once convinced he had the perfect product, he conducted primary market research in several Hispanic neighbourhoods. He was overwhelmed by the positive response. As a result, Pablo set up Pablo's Peanuts (PP) as a private limited company. He then purchased a food truck (a large vehicle equipped to cook and sell food). From Tuesday to Sunday, he drove to different Latin American markets in the Miami area to cook and sell his product. PP soon became profitable, but meeting demand was difficult Pablo wants PP to grow. To do this, he needs a second food truck and an employee. The second truck would require an investment of $100 000. Pablo's break-even analysis shows that the expected increased output would more than double PP's profits if the cost of fuel for the food trucks remains constant. Pablo is considering two options to finance the second truck: Option 1: A local Miami bank, clearly impressed by the break-even analysis data, is willing to lend Pablo $100 000 with a 10% interest rate. Option 2: A business angel, Ana Perez, with a strong portfolio of Latin American food products, has approached Pablo. She is offering $100 000 for 35 % of shares in PP. Table 4: Financial data related to both options Investment Option 1: Bank loan Option 2: Business angel $100000 @ 10% interest $100 000 for 35% of shares in PP $210000 $210000 $10000 $13000 Expected operating profits Expected annual dividends to Pablo Expected annual dividends to the business angel Gearing ratio $0 $7000 50% 0% *Hispanic: relating to Spain or to Spanish-speaking countries, especially those of Central and South America

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts