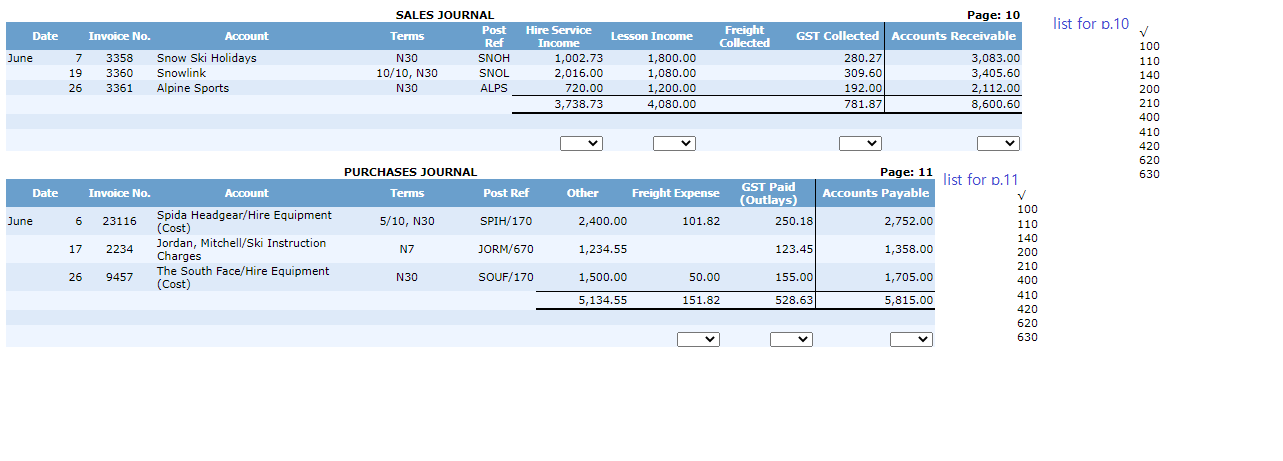

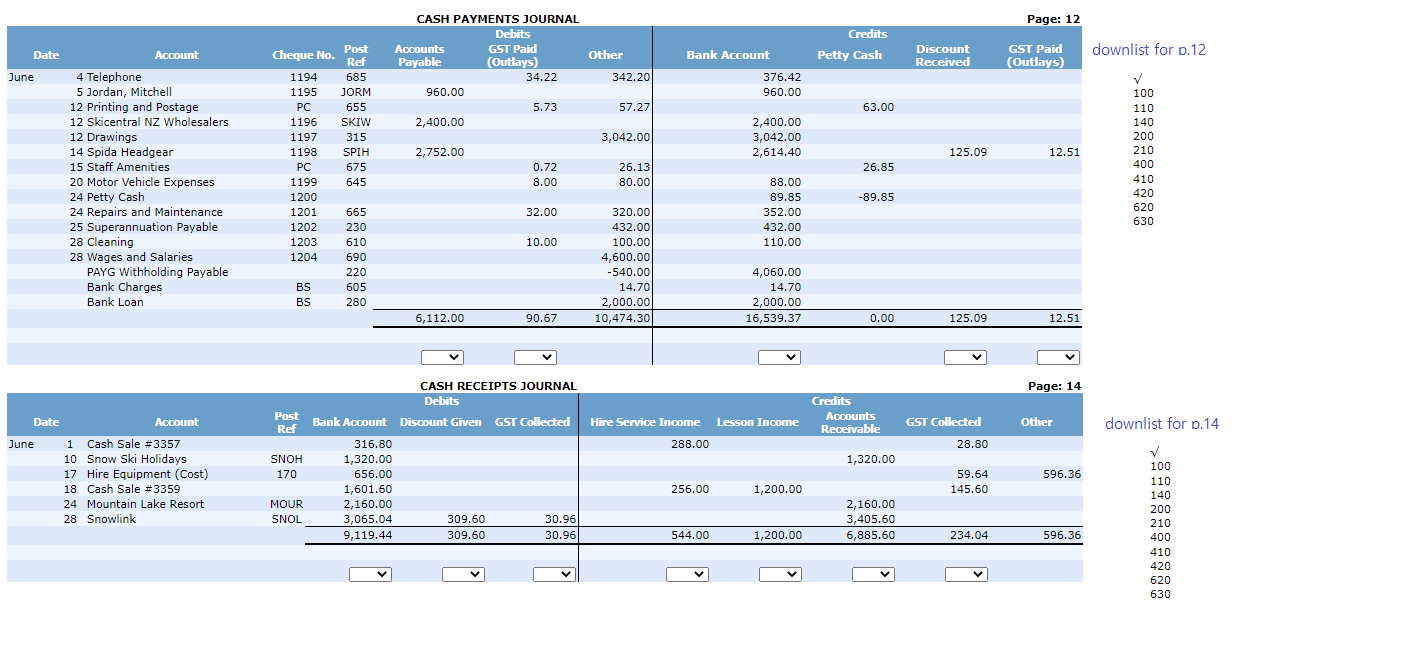

Question: Record the chart of account reference number underneath each column to be posted to the general ledger then post the journal totals to the general

Record the chart of account reference number underneath each column to be posted to the general ledger then post the journal totals to the general ledger. Please note predictive text is available for the general ledger details fields. When posting totals to the Bank Account general ledger account from the Cash Payments Journal and the Cash Receipts Journal use the generic terms 'Payments' and 'Receipts' in the details field. When posting from the sales, purchases, cash payments and cash receipts journals, you must enter in the details the opposing debit/credits as per the column headings in the respective journals (e.g. When posting to Accounts Payable 200 from the Cash Payments Journal, the details field will be Bank Account/Discount Received/GST Paid (Outlays)).

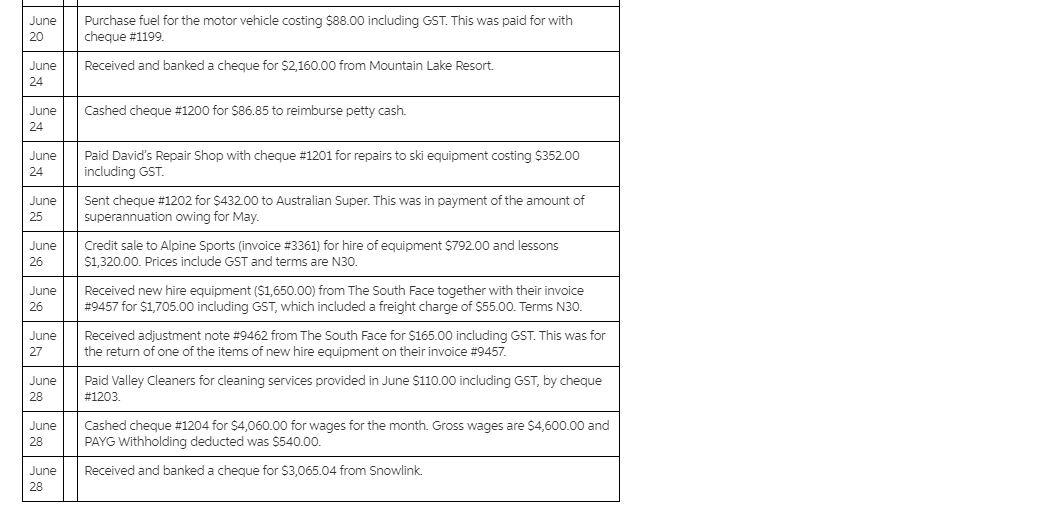

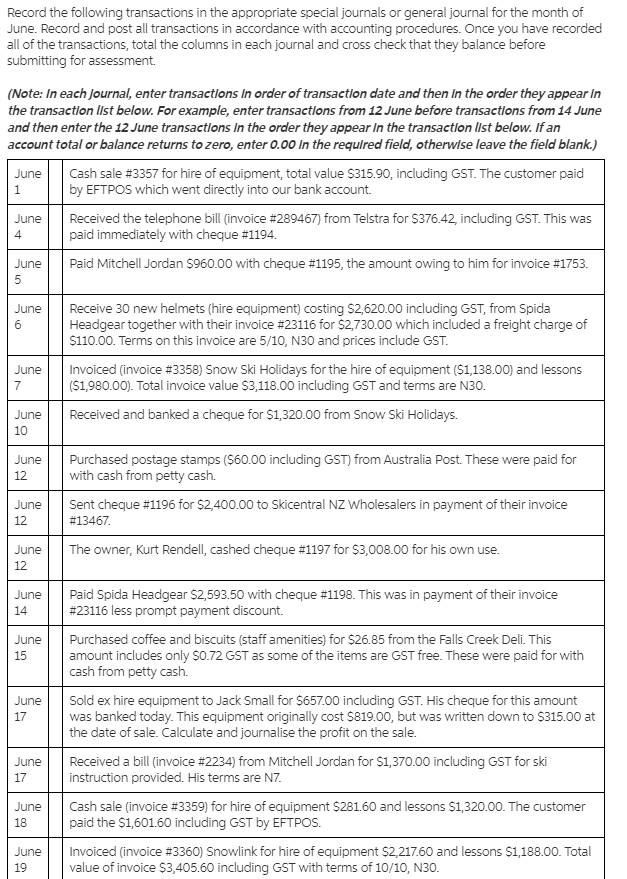

June 20 June 24 June 24 June 24 June 25 June 26 June 26 June 27 June 28 June 28 Purchase fuel for the motor vehicle costing $88.00 including GST. This was paid for with cheque #1199. Received and banked a cheque for $2,160.00 from Mountain Lake Resort. Cashed cheque #1200 for $86.85 to reimburse petty cash. Paid David's Repair Shop with cheque #1201 for repairs to ski equipment costing $352.00 including GST. Sent cheque #1202 for $432.00 to Australian Super. This was in payment of the amount of superannuation owing for May. Credit sale to Alpine Sports (invoice #3361) for hire of equipment $792.00 and lessons $1,320.00. Prices include GST and terms are N30. Received new hire equipment ($1,650.00) from The South Face together with their invoice #9457 for $1,705.00 including GST, which included a freight charge of $55.00. Terms N30. Received adjustment note #9462 from The South Face for $165.00 including GST. This was for the return of one of the items of new hire equipment on their invoice #9457. Paid Valley Cleaners for cleaning services provided in June $110.00 including GST, by cheque #1203. Cashed cheque #1204 for $4,060.00 for wages for the month. Gross wages are $4,600.00 and PAYG Withholding deducted was $540.00. June 28 Received and banked a cheque for $3,065.04 from Snowlink.

Step by Step Solution

There are 3 Steps involved in it

1 June Purchase fuel for the motor vehicle costing 8800 including GST This was paid for with 20 cheques 1199 Debit Fuel Expense including GST Credit B... View full answer

Get step-by-step solutions from verified subject matter experts