Question: Recording and Reporting Long-Term Construction: Recognize Revenue at a Point in Time and Over Time Thrasher Construction contracted to construct a building for $1,365,000. The

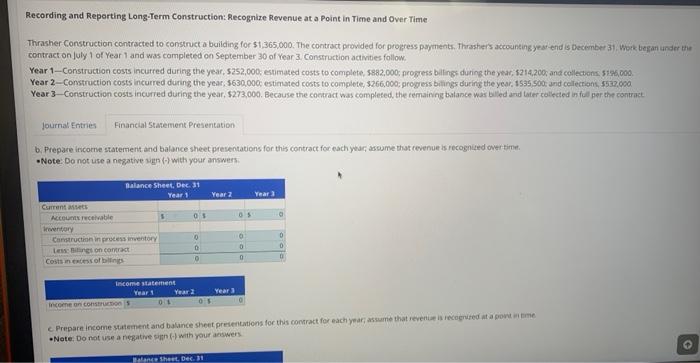

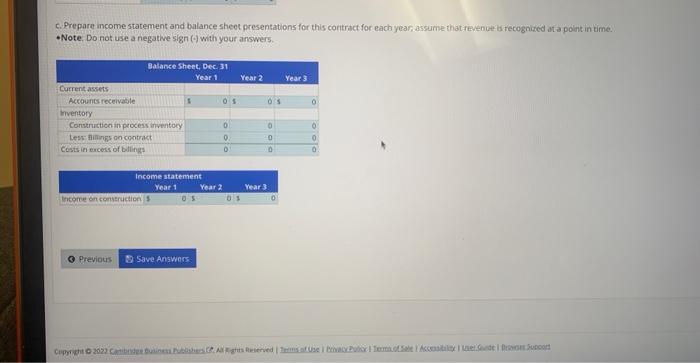

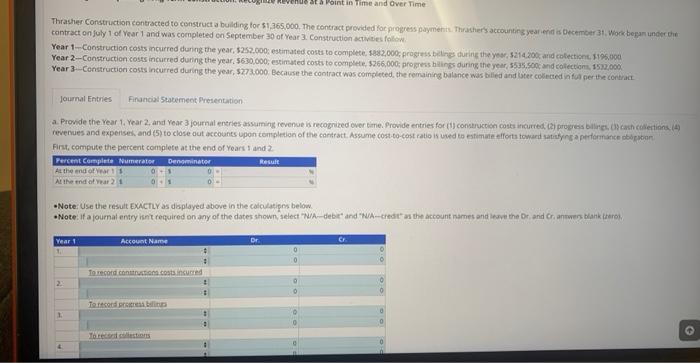

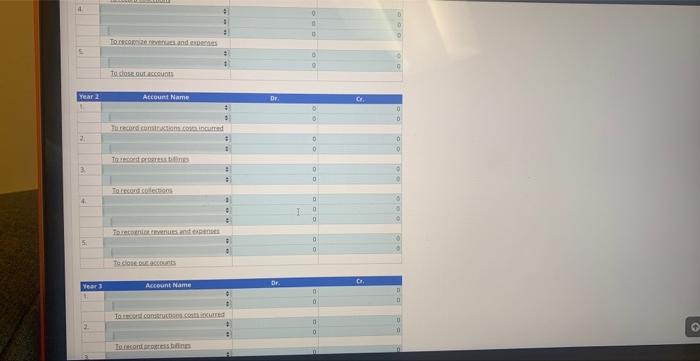

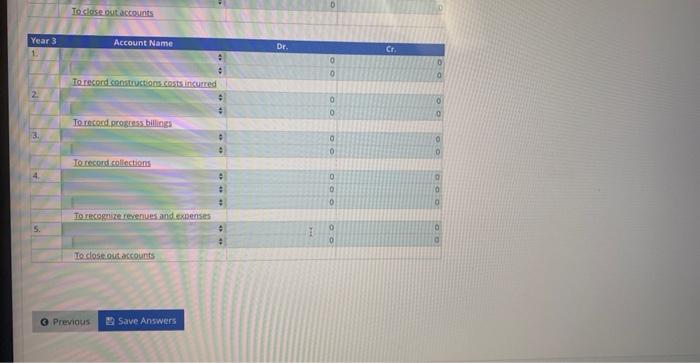

Recording and Reporting Long-Term Construction: Recognize Revenue at a Point in Time and Over Time Thrasher Construction contracted to construct a building for $1,365,000. The contract provided for progress payments. Thrasher's accounting yeat end is December 3), Wotk begat under the contract on fuly 1 of Year 1 and was campleted on September 30 of Year 3 . Construction activities follow. Year 3 - Construction costs incurred during the year, 5273,000 . Because the contract was completed, the remairing bulance was bil ed and taier collected in full per the contriat b. Prepare incorne statement and balance sheet presentations for this contract for each yesc, aswime that revenue is recognuted over tirite -Note: Do not use a negative sign (-) with your answers. -Note, Do not use a negative sinn (t) with your answers c. Prepare income statement and balance sheet presentations for this contract for each year. assume thatreventet a recognited ata poink in time. -Note. Do not use a negattive sign (t) with your answers. cantract on fuly 1 of Vear 1 and was completed en September 30 of Year 3 construction sctacties follow. Firs, compute the percent complete at the end of years I and 2 -Note: Use the resuit Exicticy as diaplayed above in the calculatipes below. Ioclose ontiaccounts c) Previous D Save Answers Recording and Reporting Long-Term Construction: Recognize Revenue at a Point in Time and Over Time Thrasher Construction contracted to construct a building for $1,365,000. The contract provided for progress payments. Thrasher's accounting yeat end is December 3), Wotk begat under the contract on fuly 1 of Year 1 and was campleted on September 30 of Year 3 . Construction activities follow. Year 3 - Construction costs incurred during the year, 5273,000 . Because the contract was completed, the remairing bulance was bil ed and taier collected in full per the contriat b. Prepare incorne statement and balance sheet presentations for this contract for each yesc, aswime that revenue is recognuted over tirite -Note: Do not use a negative sign (-) with your answers. -Note, Do not use a negative sinn (t) with your answers c. Prepare income statement and balance sheet presentations for this contract for each year. assume thatreventet a recognited ata poink in time. -Note. Do not use a negattive sign (t) with your answers. cantract on fuly 1 of Vear 1 and was completed en September 30 of Year 3 construction sctacties follow. Firs, compute the percent complete at the end of years I and 2 -Note: Use the resuit Exicticy as diaplayed above in the calculatipes below. Ioclose ontiaccounts c) Previous D Save Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts