Question: Recording Entries for Short-term Notes Payable Masy's Store supported its operations for the year through short-term note financing as follows: Sep. 30: The company borrowed

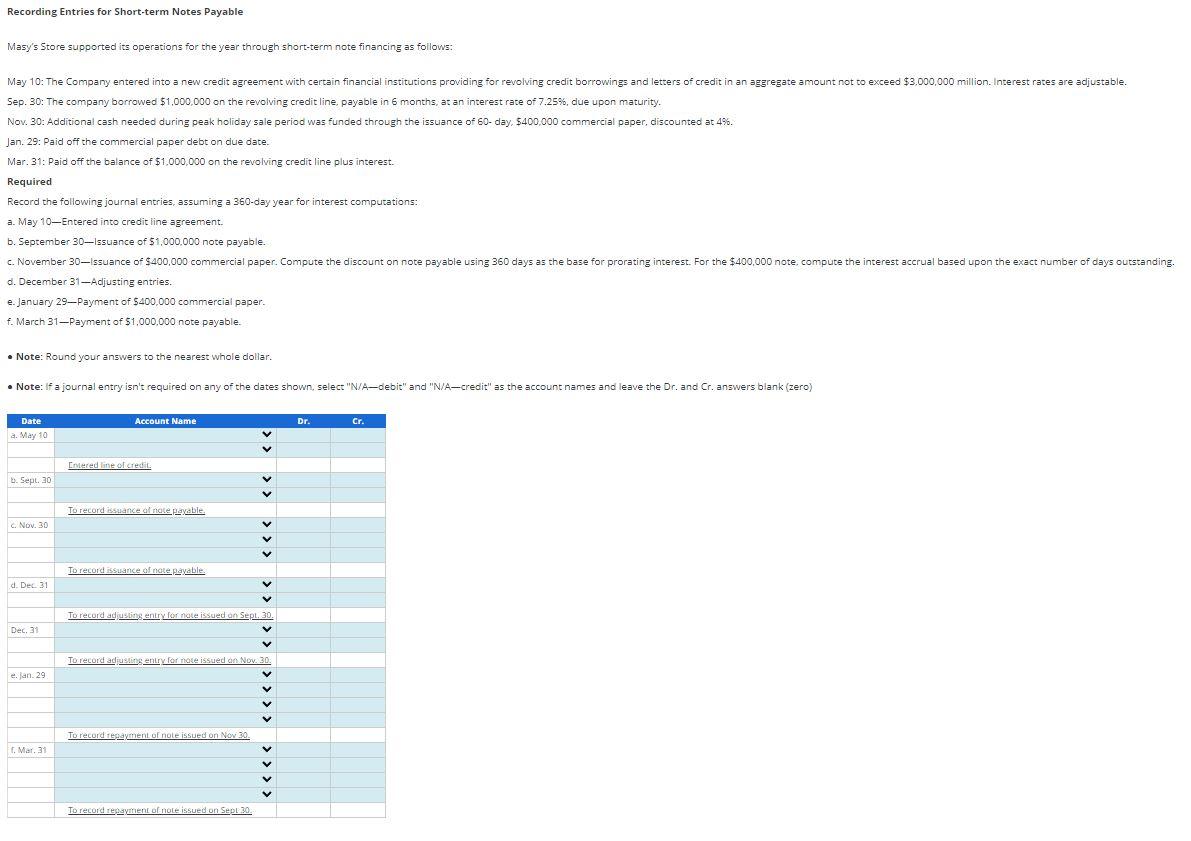

Recording Entries for Short-term Notes Payable Masy's Store supported its operations for the year through short-term note financing as follows: Sep. 30: The company borrowed $1,000,000 on the revolving credit line, payable in 6 months, at an interest rate of 7.25%, due upon maturity. Nov. 30: Additional cash needed during peak holiday sale period was funded through the issuance of 60 -day, $400,000 commercial paper, discounted at 4%. Jan. 29: Paid off the commercial paper debt on due date. Mar. 31: Paid off the balance of $1,000,000 on the revolving credit line plus interest. Required Record the following journal entries, assuming a 360-day year for interest computations: a. May 10-Entered into credit line agreement. b. September 30-lssuance of $1,000,000 note payable. d. December 31 -Adjusting entries. e. January 29-Payment of $400,000 commercial paper. f. March 31 Payment of $1,000,000 note payable. - Note: Round your answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts