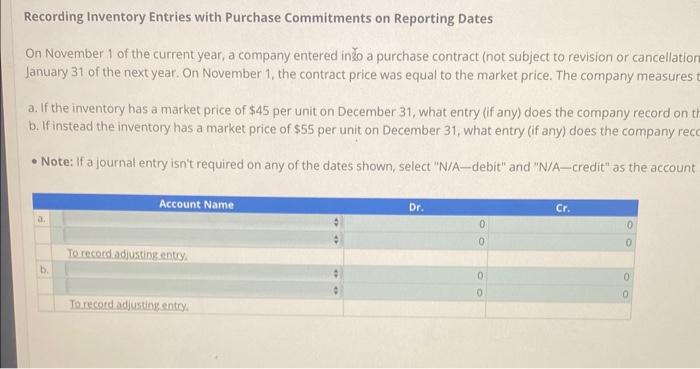

Question: Recording Inventory Entries with Purchase Commitments on Reporting Dates On November 1 of the current year, a company entered into a purchase contract (not subject

On November 1 of the current year, a company entered into a purchase contract (not subject to revision or cancellation) to purchase 700 units of inventory for $50 per unit before January 31 of the next year. On November 1, the contract price was equal to the market price. The company measures the cost of inventory using the LIFO inventory method.

a. If the inventory has a market price of $45 per unit on December 31, what entry (if any) does the company record on that date when preparing nancial statements?

b. If instead the inventory has a market price of $55 per unit on December 31, what entry (if any) does the company record on that date when preparing nancial statements?

Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero).

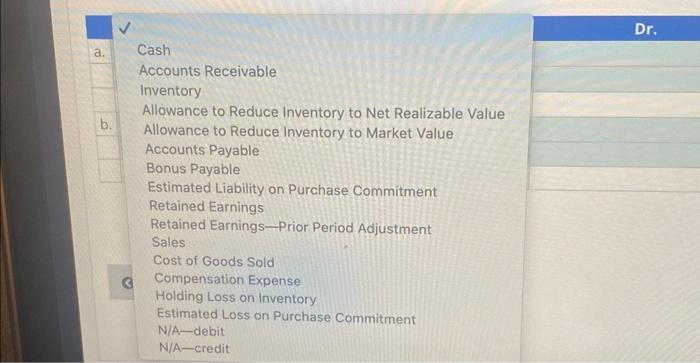

Recording Inventory Entries with Purchase Commitments on Reporting Dates On November 1 of the current year, a company entered ino a purchase contract (not subject to revision or cancellatio) January 31 of the next year. On November 1 , the contract price was equal to the market price. The company measures a. If the inventory has a market price of $45 per unit on December 31 , what entry (if any) does the company record on t b. If instead the inventory has a market price of $55 per unit on December 31 , what entry (if any) does the company rec - Note: If a journal entry isn't required on any of the dates shown, select "N/A-debit" and "N/A-credit" as the account a. Cash Accounts Receivable Inventory Allowance to Reduce Inventory to Net Realizable Value b. Allowance to Reduce Inventory to Market Value Accounts Payable Bonus Payable Estimated Liability on Purchase Commitment Retained Earnings Retained Earnings-Prior Period Adjustment Sales Cost of Goods Sold Compensation Expense Holding Loss on Inventory Estimated Loss on Purchase Commitment N/A-debit N/A-credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts