Question: Recording Long-Term Construction: Recognize Revenue at a Point in Time and Over Time Watson Construction Company contracted to build a plant for $500,000. Construction started

Recording Long-Term Construction: Recognize Revenue at a Point in Time and Over Time

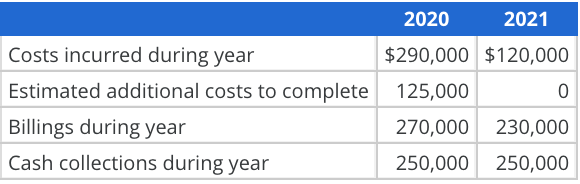

Watson Construction Company contracted to build a plant for $500,000. Construction started in January 2020 and was completed in November 2021. Watson uses the cost-to-cost method to measure the completion of its performance obligations. Data relating to the contract follow.

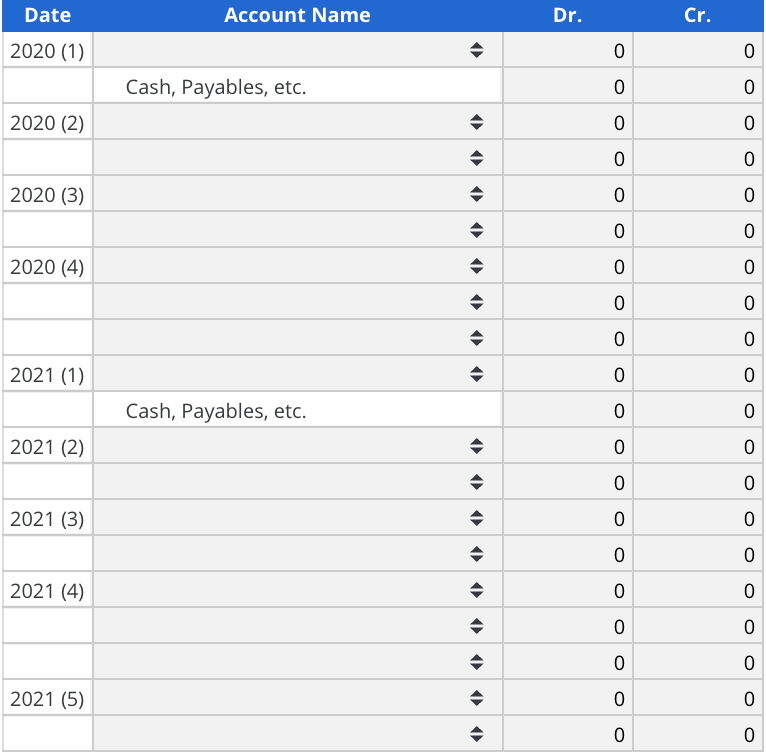

Provide the 2020 and 2021 journal entries for Watson assuming revenue is recognized over time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract.

- Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

- Note: List multiple debits or credits (when applicable) in alphabetical order according to the first letter of the account name.

- Note: Round amounts to the nearest whole dollar

2020 2021 Costs incurred during year Estimated additional costs to complete Billings during year Cash collections during year $290,000 $120,000 125,000 270,000 230,000 250,000 250,000 Date Account Name Dr. Cr. 2020 (1) Cash, Payables, etc. 2020 (2) 2020 (3) 2020 (4) 2021 (1) Cash, Payables, etc. 2021 (2) 2021 (3) 2021 (4) 2021 (5) 2020 2021 Costs incurred during year Estimated additional costs to complete Billings during year Cash collections during year $290,000 $120,000 125,000 270,000 230,000 250,000 250,000 Date Account Name Dr. Cr. 2020 (1) Cash, Payables, etc. 2020 (2) 2020 (3) 2020 (4) 2021 (1) Cash, Payables, etc. 2021 (2) 2021 (3) 2021 (4) 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts