Question: Recording Multiple Temporary Differences Additional information On December 3 1 of Year 1 , GAAP basis of installment sale receivables, $ 8 2 , 5

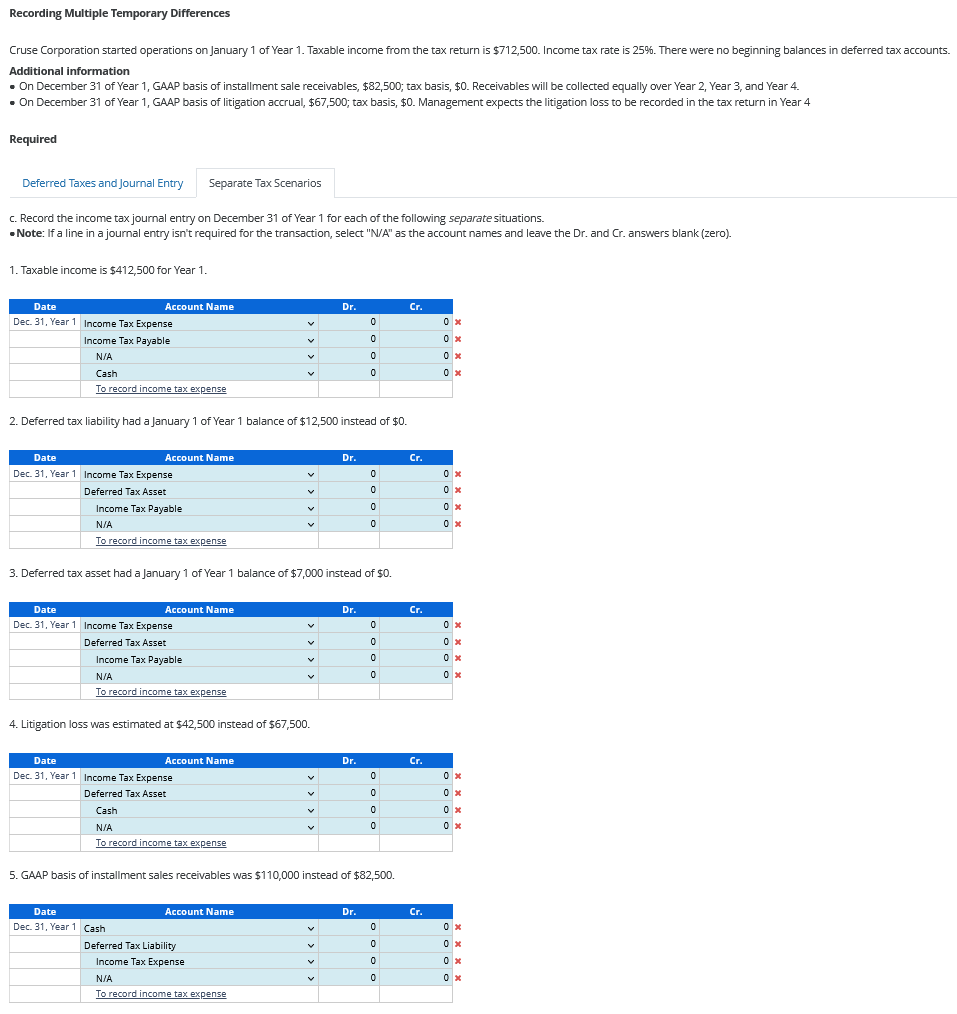

Recording Multiple Temporary Differences

Additional information

On December of Year GAAP basis of installment sale receivables, $; tax basis, $ Receivables will be collected equally over Year Year and Year

On December of Year GAAP basis of litigation accrual, $; tax basis, $ Management expects the litigation loss to be recorded in the tax return in Year

Required

Deferred Taxes and Journal Entry

c Record the income tax journal entry on December of Year for each of the following separate situations.

Note: If a line in a journal entry isn't required for the transaction, select NA as the account names and leave the Dr and Cr answers blank zero

Taxable income is $ for Year

Deferred tax liability had a January of Year balance of $ instead of $

Deferred tax asset had a January of Year balance of $ instead of $

Litigation loss was estimated at $ instead of $

GAAP basis of installment sales receivables was $ instead of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock