Question: This is the full question Recording Multiple Temporary Differences Cruse Corporation started operations on January 1 of Year 1 . Taxable income from the tax

This is the full question

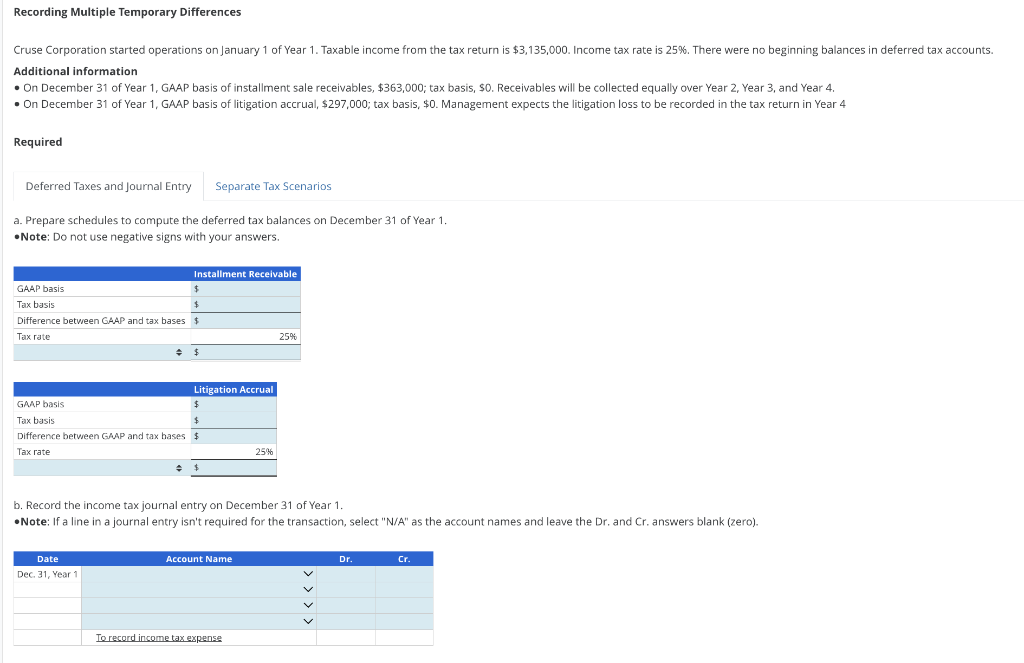

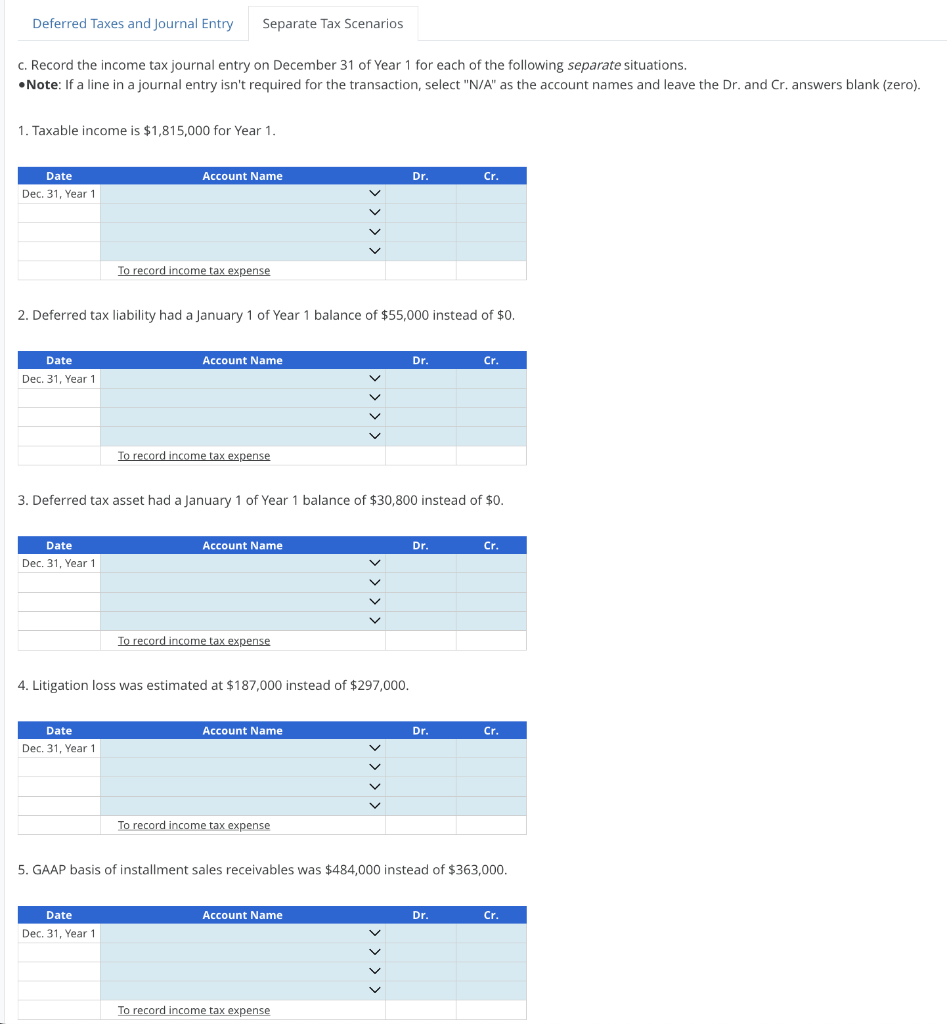

Recording Multiple Temporary Differences Cruse Corporation started operations on January 1 of Year 1 . Taxable income from the tax return is $3,135,000. Income tax rate is 25%. There were no beginning balances in deferred tax accounts. Additional information - On December 31 of Year 1, GAAP basis of installment sale receivables, $363,000; tax basis, s0. Receivables will be collected equally over Year 2 , Year 3, and Year 4. - On December 31 of Year 1, GAAP basis of litigation accrual, $297,000; tax basis, $0. Management expects the litigation loss to be recorded in the tax return in Year 4 Required a. Prepare schedules to compute the deferred tax balances on December 31 of Year 1. -Note: Do not use negative signs with your answers. b. Record the income tax journal entry on December 31 of Year 1. -Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). c. Record the income tax journal entry on December 31 of Year 1 for each of the following separate situations. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). 1. Taxable income is $1,815,000 for Year 1. 2. Deferred tax liability had a January 1 of Year 1 balance of $55,000 instead of $0. 3. Deferred tax asset had a January 1 of Year 1 balance of $30,800 instead of $0. 4. Litigation loss was estimated at $187,000 instead of $297,000. 5. GAAP basis of installment sales receivables was $484,000 instead of $363,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts