Question: Recording Multiple Temporary Differences, Multiple Tax Rates On December 3 1 , Colgait Inc. had an installment sale receivable balance of $ 1 8 0

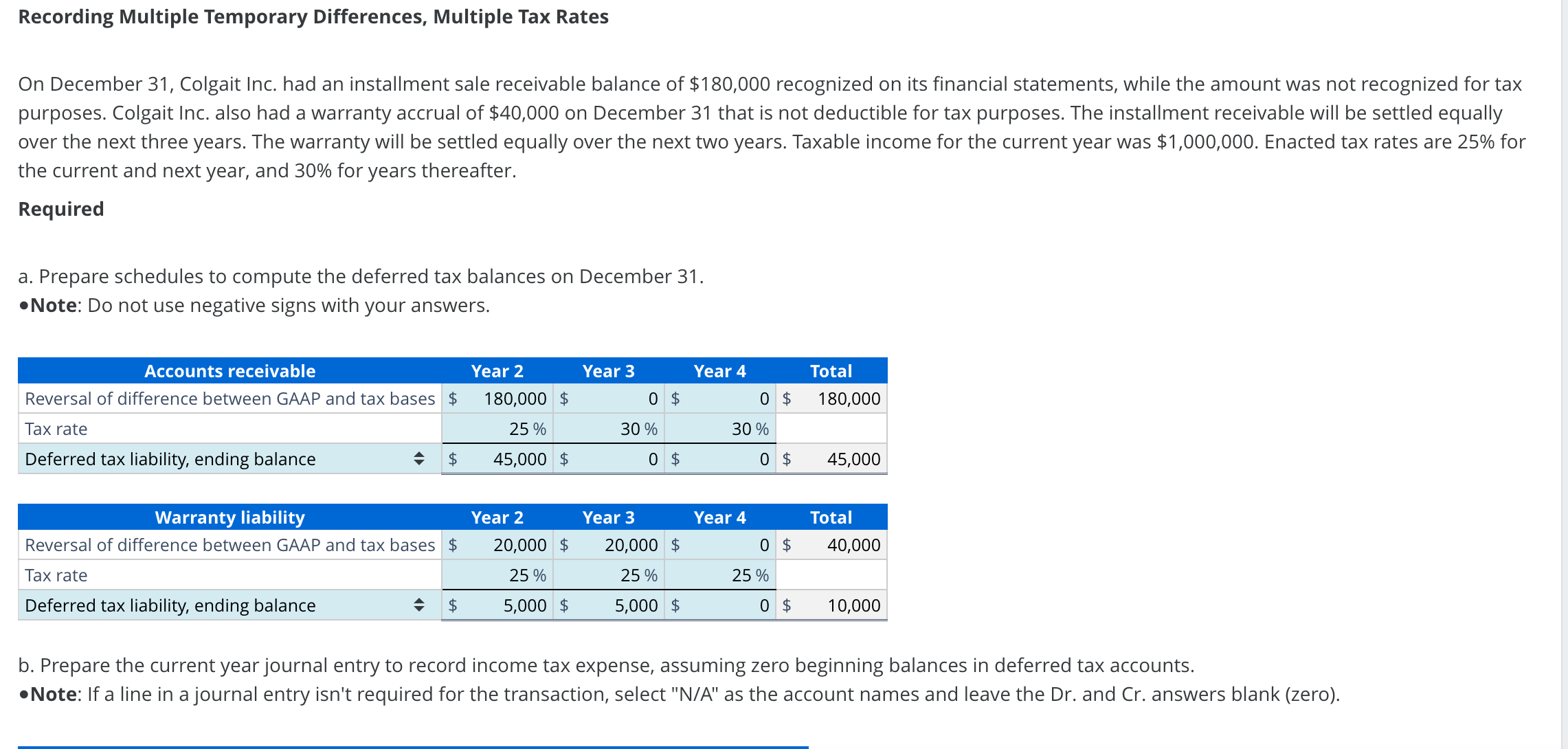

Recording Multiple Temporary Differences, Multiple Tax Rates

On December Colgait Inc. had an installment sale receivable balance of $ recognized on its financial statements, while the amount was not recognized for tax

purposes. Colgait Inc. also had a warranty accrual of $ on December that is not deductible for tax purposes. The installment receivable will be settled equally

over the next three years. The warranty will be settled equally over the next two years. Taxable income for the current year was $ Enacted tax rates are for

the current and next year, and for years thereafter.

Required

a Prepare schedules to compute the deferred tax balances on December

Note: Do not use negative signs with your answers.

b Prepare the current year journal entry to record income tax expense, assuming zero beginning balances in deferred tax accounts.

Note: If a line in a journal entry isn't required for the transaction, select NA as the account names and leave the Dr and Cr answers blank zeroRecording Multiple Temporary Differences, Multiple Tax Rates

On December Colgait Inc. had an installment sale receivable balance of $ recognized on its financial statements, while the amount was not recognized for tax purposes. Colgait Inc. also had a warranty accrual of $ on December that is not deductible for tax purposes. The installment receivable will be settled equally over the next three years. The warranty will be settled equally over the next two years. Taxable income for the current year was $ Enacted tax rates are for the current and next year, and for years thereafter.

Required

a Prepare schedules to compute the deferred tax balances on December

Note: Do not use negative signs with your answers.

Accounts receivable Year Year Year Total

Reversal of difference between GAAP and tax bases Answer

Answer

Answer

Tax rate Answer

Answer

Answer

Answer

Answer

Answer

Answer

Warranty liability Year Year Year Total

Reversal of difference between GAAP and tax bases Answer

Answer

Answer

Tax rate Answer

Answer

Answer

Answer

Answer

Answer

Answer

b Prepare the current year journal entry to record income tax expense, assuming zero beginning balances in deferred tax accounts.

Note: If a line in a journal entry isn't required for the transaction, select NA as the account names and leave the Dr and Cr answers blank zero

Date Account Name Dr Cr

Dec. Year

Answer

Answer

Answer

Answer

To record income tax expense

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock