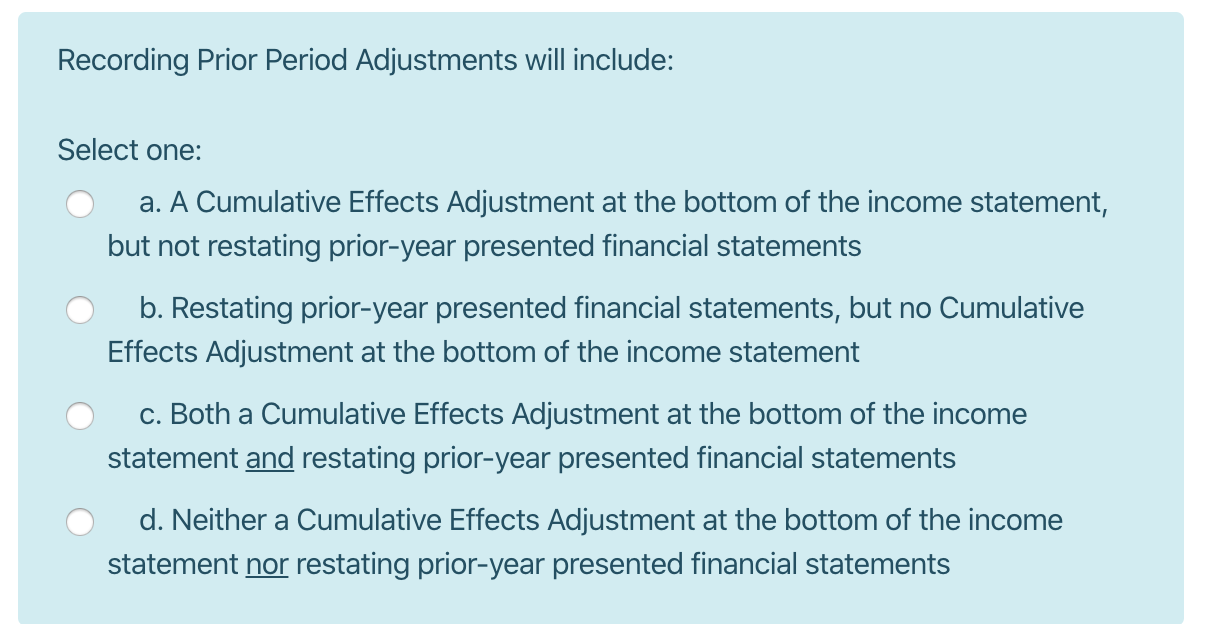

Question: Recording Prior Period Adjustments will include: Select one: o a. A Cumulative Effects Adjustment at the bottom of the income statement, but not restating prior-year

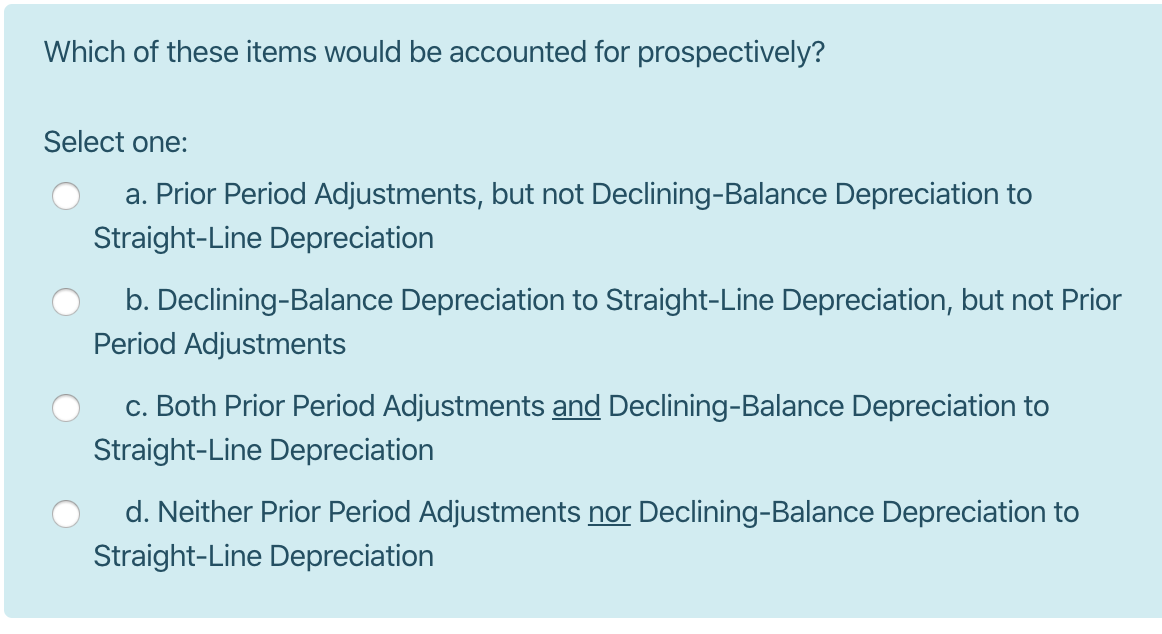

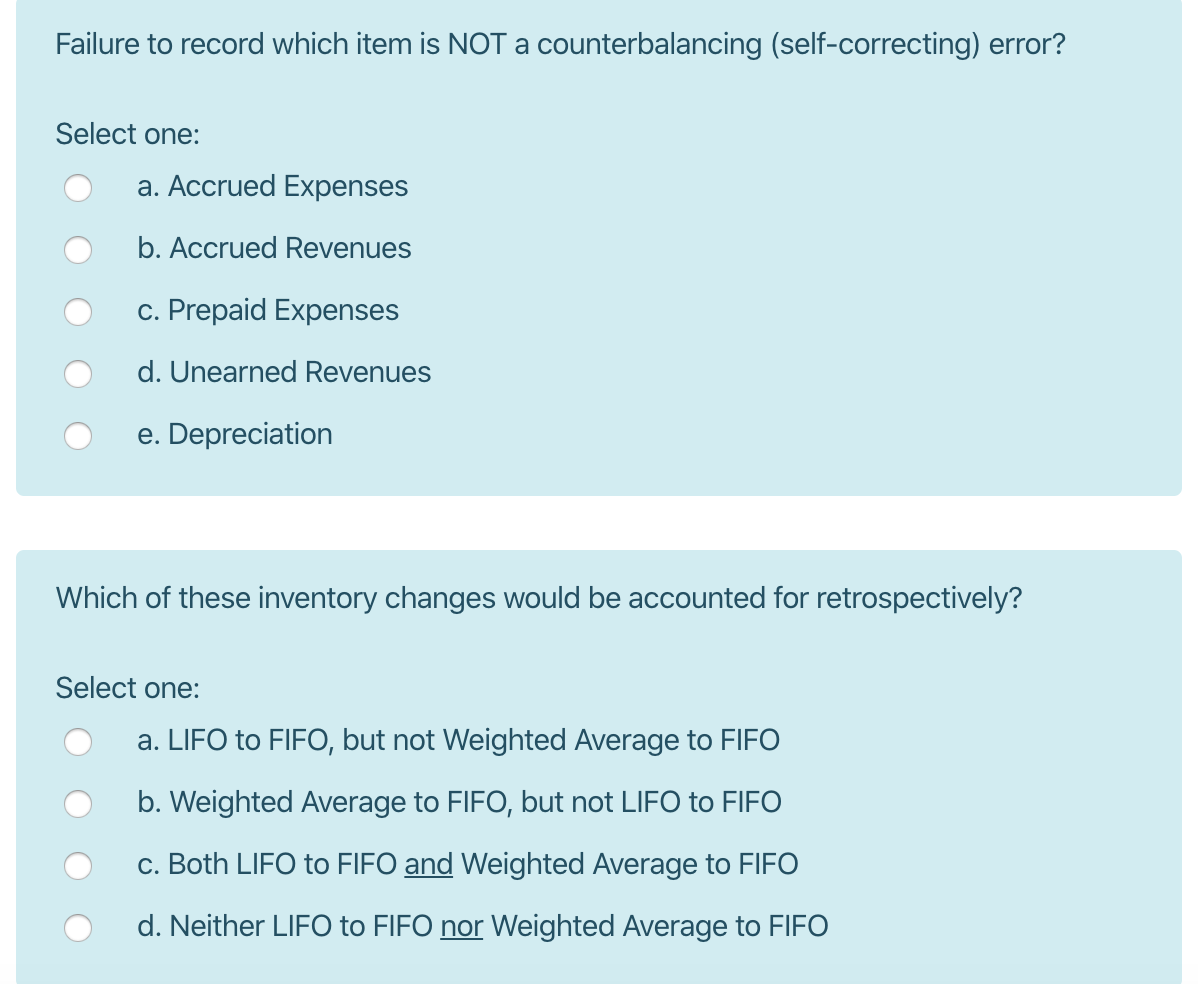

Recording Prior Period Adjustments will include: Select one: o a. A Cumulative Effects Adjustment at the bottom of the income statement, but not restating prior-year presented financial statements O b. Restating prior-year presented financial statements, but no Cumulative Effects Adjustment at the bottom of the income statement O c. Both a Cumulative Effects Adjustment at the bottom of the income statement and restating prior-year presented financial statements 0 d. Neither a Cumulative Effects Adjustment at the bottom of the income statement nor restating prior-year presented financial statements Failure to record which item is NOT a counterbalancing (self-correcting) error? Select one: o a. Accrued Expenses O b. Accrued Revenues c. Prepaid Expenses d. Unearned Revenues o e. Depreciation Which of these inventory changes would be accounted for retrospectively? Select one: o a. LIFO to FIFO, but not Weighted Average to FIFO b. Weighted Average to FIFO, but not LIFO to FIFO c. Both LIFO to FIFO and Weighted Average to FIFO d. Neither LIFO to FIFO nor Weighted Average to FIFO Recording Prior Period Adjustments will include: Select one: o a. A Cumulative Effects Adjustment at the bottom of the income statement, but not restating prior-year presented financial statements O b. Restating prior-year presented financial statements, but no Cumulative Effects Adjustment at the bottom of the income statement O c. Both a Cumulative Effects Adjustment at the bottom of the income statement and restating prior-year presented financial statements 0 d. Neither a Cumulative Effects Adjustment at the bottom of the income statement nor restating prior-year presented financial statements Failure to record which item is NOT a counterbalancing (self-correcting) error? Select one: o a. Accrued Expenses O b. Accrued Revenues c. Prepaid Expenses d. Unearned Revenues o e. Depreciation Which of these inventory changes would be accounted for retrospectively? Select one: o a. LIFO to FIFO, but not Weighted Average to FIFO b. Weighted Average to FIFO, but not LIFO to FIFO c. Both LIFO to FIFO and Weighted Average to FIFO d. Neither LIFO to FIFO nor Weighted Average to FIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts