Question: Recording Temporary Difference, Multiple Tax Rates In Year 1 , Adele Company accrued a legal liability of ( $ 1 0 0 ,

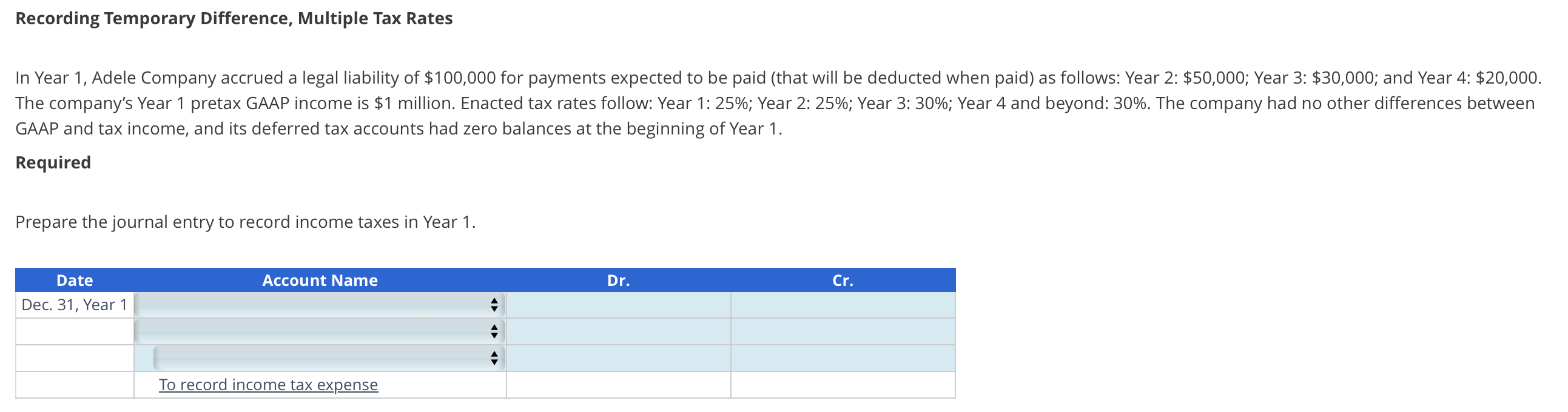

Recording Temporary Difference, Multiple Tax Rates

In Year Adele Company accrued a legal liability of $ for payments expected to be paid that will be deducted when paid as follows: Year : $ ; Year : $ ; and Year : $ The company's Year pretax GAAP income is $ million. Enacted tax rates follow: Year : ; Year : ; Year : ; Year and beyond: The company had no other differences between GAAP and tax income, and its deferred tax accounts had zero balances at the beginning of Year

Required

Prepare the journal entry to record income taxes in Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock