Question: red tre 18.00 2. WO 1 C D Average wan 7. E DEC 11 WACC www- Wiche V It reconhece w PC v Frp Testimewwwwwwwwwwwwwapen

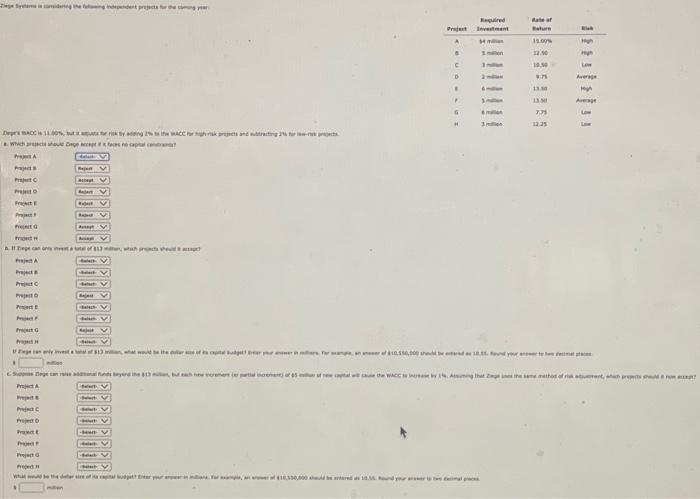

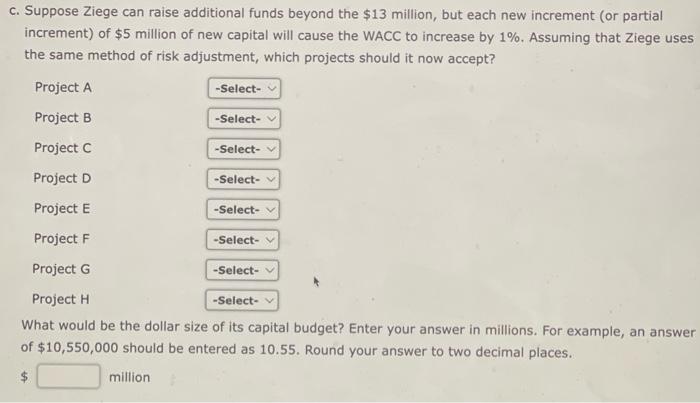

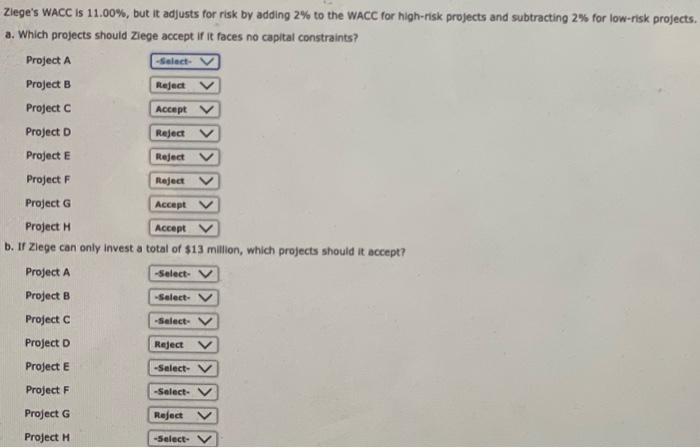

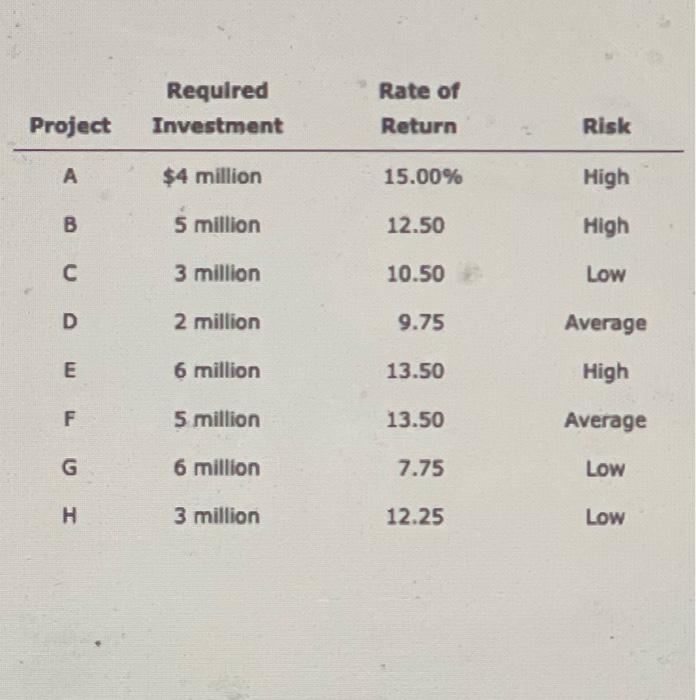

red tre 18.00 2. WO 1 C D Average wan 7. E DEC 11 WACC www- Wiche V It reconhece w PC v Frp Testimewwwwwwwwwwwwwapen www.sweet en de partout Wir hat eine rettes tam 014 A. Prett C. Suppose Ziege can raise additional funds beyond the $13 million, but each new increment (or partial increment) of $5 million of new capital will cause the WACC to increase by 1%. Assuming that Ziege uses the same method of risk adjustment, which projects should it now accept? Project A -Select- Project B -Select- -Select- Project C Project D Project E -Select- -Select- Project F -Select- Project G -Select- Project H -Select- What would be the dollar size of its capital budget? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million -Select- V Reject V Ziege's WACC IS 11.00%, but it adjusts for risk by adding 2% to the WACC for high-risk projects and subtracting 2% for low-risk projects. a. Which projects should Ziege accept if it faces no capital constraints? Project A Project B Reject V Project Accept Project D Project E Project F Reject Project G Accept V Project Accept V b. If Ziege can only Invest a total of $13 million, which projects should it accept? Project A Project B Reject -Select- -Select- -Select- Reject V Project C Project D Project E Project F Project G -Select- -Select- Rejest V Project -Select- Rate of Required Investment Project Return Risk A $4 million 15.00% High B 5 million 12.50 High 3 million 10.50 LOW 0 0 0 W D 2 million 9.75 Average E 6 million 13.50 High F 5 million 13.50 Average G 6 million 7.75 Low U I H 3 million 12.25 Low red tre 18.00 2. WO 1 C D Average wan 7. E DEC 11 WACC www- Wiche V It reconhece w PC v Frp Testimewwwwwwwwwwwwwapen www.sweet en de partout Wir hat eine rettes tam 014 A. Prett C. Suppose Ziege can raise additional funds beyond the $13 million, but each new increment (or partial increment) of $5 million of new capital will cause the WACC to increase by 1%. Assuming that Ziege uses the same method of risk adjustment, which projects should it now accept? Project A -Select- Project B -Select- -Select- Project C Project D Project E -Select- -Select- Project F -Select- Project G -Select- Project H -Select- What would be the dollar size of its capital budget? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million -Select- V Reject V Ziege's WACC IS 11.00%, but it adjusts for risk by adding 2% to the WACC for high-risk projects and subtracting 2% for low-risk projects. a. Which projects should Ziege accept if it faces no capital constraints? Project A Project B Reject V Project Accept Project D Project E Project F Reject Project G Accept V Project Accept V b. If Ziege can only Invest a total of $13 million, which projects should it accept? Project A Project B Reject -Select- -Select- -Select- Reject V Project C Project D Project E Project F Project G -Select- -Select- Rejest V Project -Select- Rate of Required Investment Project Return Risk A $4 million 15.00% High B 5 million 12.50 High 3 million 10.50 LOW 0 0 0 W D 2 million 9.75 Average E 6 million 13.50 High F 5 million 13.50 Average G 6 million 7.75 Low U I H 3 million 12.25 Low

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts