Question: Red Trucks Pty Ltd is a GST registered property developer. It purchased a parcel of land back in 1997 for $150,000. The land was

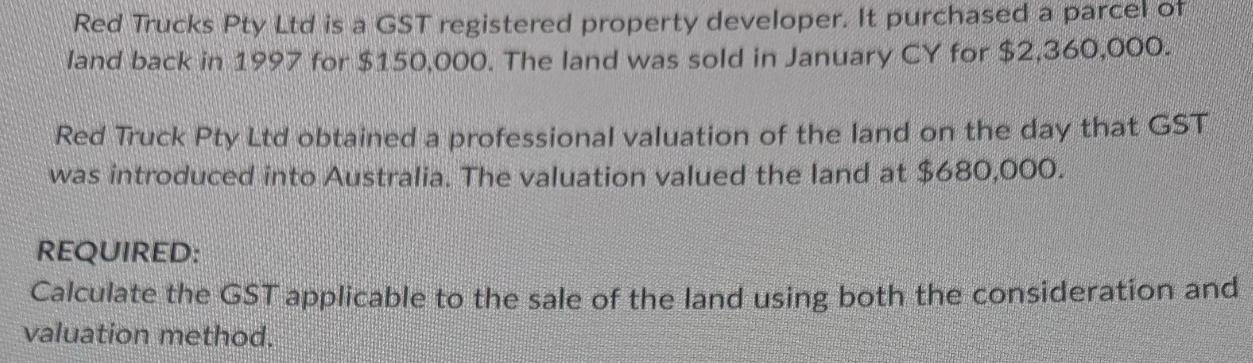

Red Trucks Pty Ltd is a GST registered property developer. It purchased a parcel of land back in 1997 for $150,000. The land was sold in January CY for $2,360,000. Red Truck Pty Ltd obtained a professional valuation of the land on the day that GST was introduced into Australia. The valuation valued the land at $680,000. REQUIRED: Calculate the GST applicable to the sale of the land using both the consideration and valuation method.

Step by Step Solution

There are 3 Steps involved in it

To calculate the GST Goods and Services Tax applicable to the sale of the land using both t... View full answer

Get step-by-step solutions from verified subject matter experts