Question: ReDO Table assuming a 5-year fixed for floating currency swap in which BARCLAYS pays 4.5 % fixed in Sterling (British Pounds), and British Petroleum pays

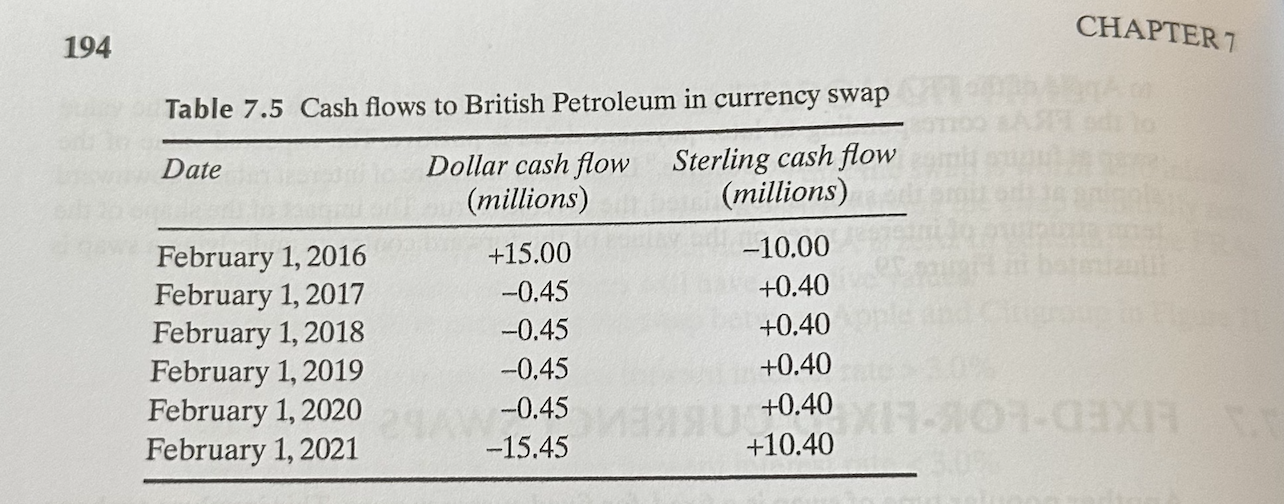

ReDO Table assuming a 5-year fixed for floating currency swap in which BARCLAYS pays 4.5 % fixed in Sterling (British Pounds), and British Petroleum pays floating $ Libor to BARCLAYS. The initial $$ amount of the swap is $16 million. The initial exchange rate is $1.6 per British Pound Sterling. Remember that the appropriate principal-currency amount IS exchanged at the beginning and reversed at the end. Since British Petrol will be paying DOLLAR interest, British Petrol receives / borrows DOLLAR up front, AS IN TABLE 7.5. In addition, assume that the floating $ Libor rates at the 6 dates: (2-1-16 to 2-1-21) are 4 %, 3.8 %, 4.2 % , 4.8 %, 5 %, 4.6 % . REDO THE TABLE, again from the British Petrol perspective.

Table 7.5 Cash flows to British Petroleum in currency swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts