Question: text table 7.5, pg 176 ReDo table assuming a 5-year fixed for floating currency swap in which Barclays pays 4.5% fixed in sterling (british pounds),

text table 7.5, pg 176 ReDo table assuming a 5-year fixed for floating currency swap in which Barclays pays 4.5% fixed in sterling (british pounds), and british Petroleum pays floating $ Libor to Barclays. The initial $$ amount of the swap is $16 million. The initial excahnge rate is $1.6 per British Pound Sterling. Remember that the appropriate principal-- currency amount IS exchanged at the beginning and reversed at the end. Since British Petrol will be paying Dollar interest, British Petrol recieves/ "borrows" Dollar up front, As in table 7.5 In addition, assume that the floating $ Libor rates at the 6 dates: (2-1-16 to 2-1-21) are 4%, 3.8%, 4.2% , 4.8%, 5%, 4.6%. ReDO the table, again from the British Petrol Perspective

text table 7.5, pg 176 ReDo table assuming a 5-year fixed for floating currency swap in which Barclays pays 4.5% fixed in sterling (british pounds), and british Petroleum pays floating $ Libor to Barclays. The initial $$ amount of the swap is $16 million. The initial excahnge rate is $1.6 per British Pound Sterling. Remember that the appropriate principal-- currency amount IS exchanged at the beginning and reversed at the end. Since British Petrol will be paying Dollar interest, British Petrol recieves/ "borrows" Dollar up front, As in table 7.5 In addition, assume that the floating $ Libor rates at the 6 dates: (2-1-16 to 2-1-21) are 4%, 3.8%, 4.2% , 4.8%, 5%, 4.6%. ReDO the table, again from the British Petrol Perspective

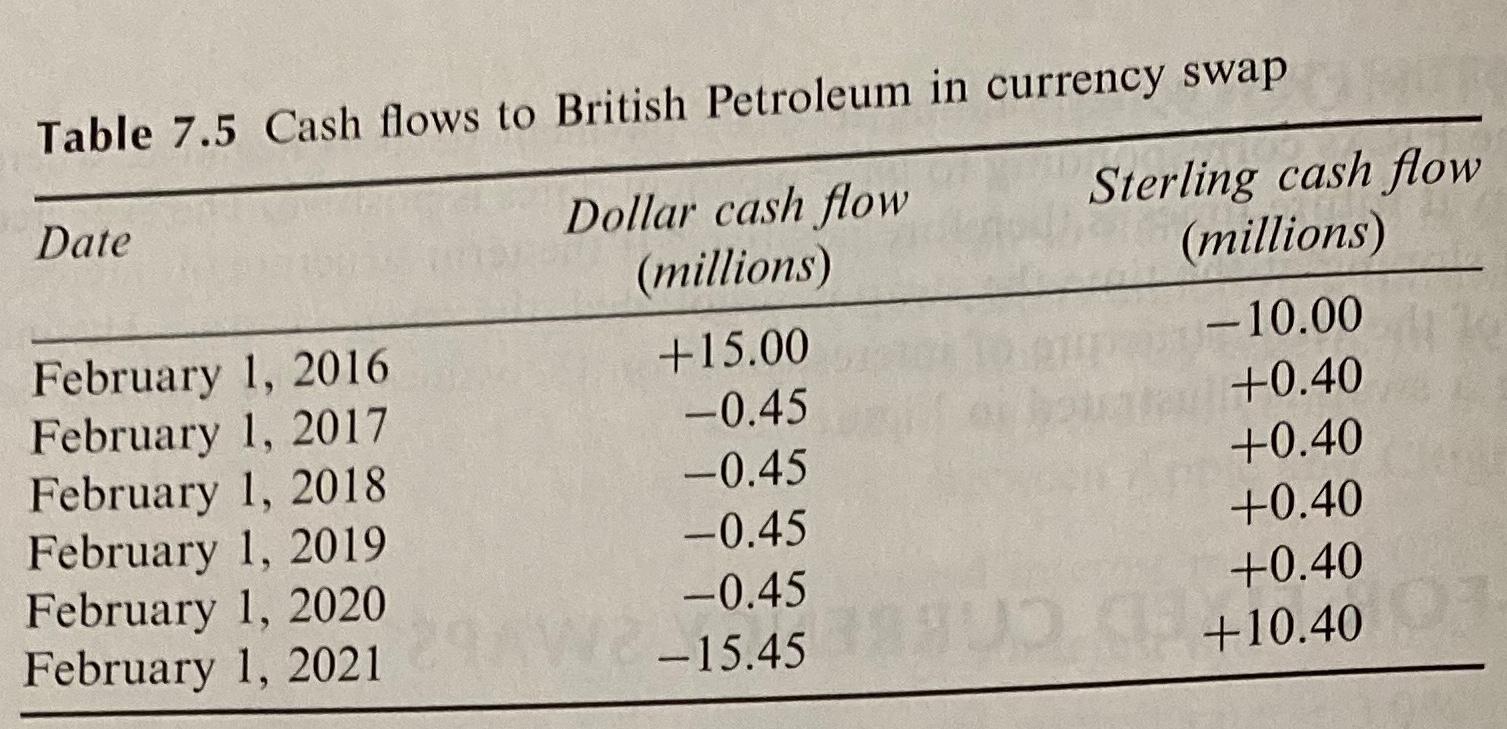

Table 7.5 Cash flows to British Petroleum in currency swap Date - February 1, 2016 February 1, 2017 February 1, 2018 February 1, 2019 February 1, 2020 February 1, 2021 Dollar cash flow (millions) +15.00 -0.45 -0.45 -0.45 -0.45 Sterling cash flow (millions) -10.00 +0.40 +0.40 +0.40 +0.40 +10.40 -15.45 0 Table 7.5 Cash flows to British Petroleum in currency swap Date - February 1, 2016 February 1, 2017 February 1, 2018 February 1, 2019 February 1, 2020 February 1, 2021 Dollar cash flow (millions) +15.00 -0.45 -0.45 -0.45 -0.45 Sterling cash flow (millions) -10.00 +0.40 +0.40 +0.40 +0.40 +10.40 -15.45 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts