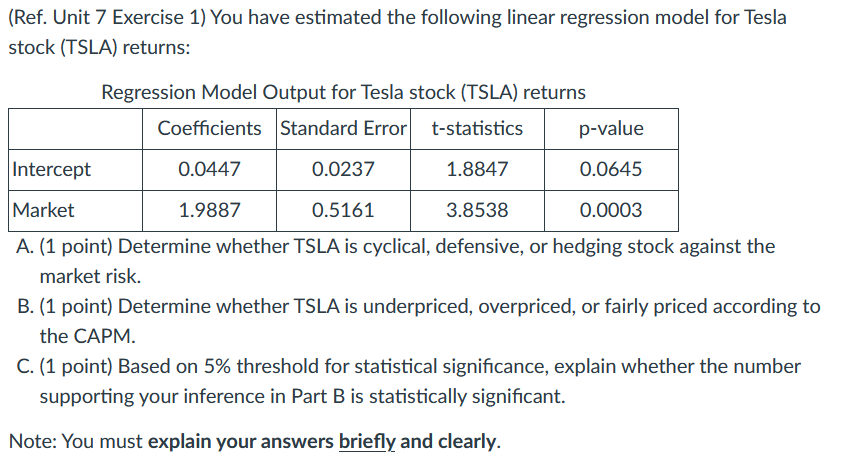

Question: (Ref. Unit 7 Exercise 1) You have estimated the following linear regression model for Tesla stock (TSLA) returns: Regression Model Output for Tesla stock (TSLA)

(Ref. Unit 7 Exercise 1) You have estimated the following linear regression model for Tesla stock (TSLA) returns: Regression Model Output for Tesla stock (TSLA) returns Coefficients Standard Error t-statistics p-value Intercept 0.0447 0.0237 1.8847 0.0645 Market 1.9887 0.5161 3.8538 0.0003 A. (1 point) Determine whether TSLA is cyclical, defensive, or hedging stock against the market risk. B. (1 point) Determine whether TSLA is underpriced, overpriced, or fairly priced according to the CAPM. C. (1 point) Based on 5% threshold for statistical significance, explain whether the number supporting your inference in Part B is statistically significant. Note: You must explain your answers briefly and clearly. (Ref. Unit 7 Exercise 1) You have estimated the following linear regression model for Tesla stock (TSLA) returns: Regression Model Output for Tesla stock (TSLA) returns Coefficients Standard Error t-statistics p-value Intercept 0.0447 0.0237 1.8847 0.0645 Market 1.9887 0.5161 3.8538 0.0003 A. (1 point) Determine whether TSLA is cyclical, defensive, or hedging stock against the market risk. B. (1 point) Determine whether TSLA is underpriced, overpriced, or fairly priced according to the CAPM. C. (1 point) Based on 5% threshold for statistical significance, explain whether the number supporting your inference in Part B is statistically significant. Note: You must explain your answers briefly and clearly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts