Question: Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. For concreteness, let return be the total retum for

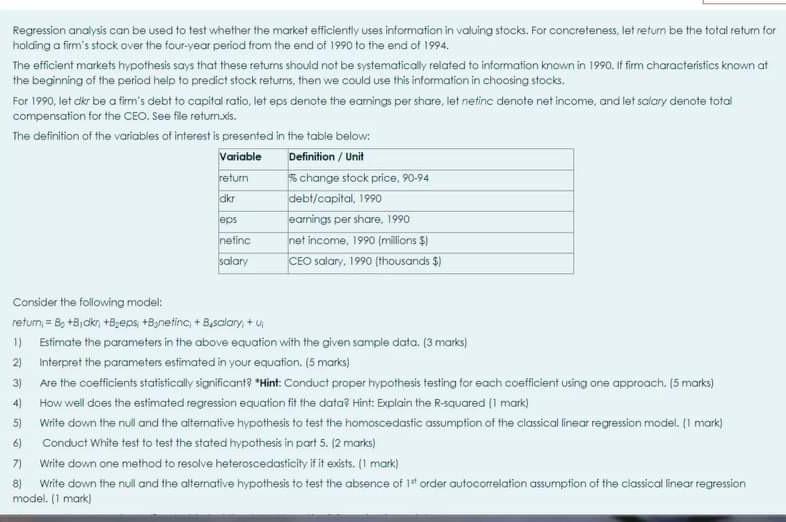

Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. For concreteness, let return be the total retum for holding a firm's stock over the four-year period from the end of 1990 to the end of 1994 The efficient markets hypothesis says that these returns should not be systematically related to information known in 1990. if firm characteristics known at the beginning of the period help to predict stock returns, then we could use this information in choosing stocks. For 1990, let dir be a firm's debt to capital ratio, let eps denote the eamings per share, let netinc denote net income, and let salory denote total compensation for the CEO. See file return.xis. The definition of the variables of interest is presented in the table below: Variable Definition / Unit return change stock price, 90-94 debt/capital, 1990 warnings per share. 1990 netinc net income, 1990 (millions $) salary CEO salary, 1990 (thousands $) dki eps Consider the following model: retum; = 8 +8,0kn +3,eps +Binetina + Besclary+u Estimate the parameters in the above equation with the given sample data. (3 marks) 21 Interpret the parameters estimated in your equation (5 marks) 3) Are the coefficients statistically significant? 'Hint: Conduct proper hypothesis testing for each coefficient using one approach. 15 marks) How well does the estimated regression equation fit the data? Hint: Explain the R-squared (1 mark) Write down the null and the alternative hypothesis to test the homoscedastic assumption of the classical linear regression model. (1 mark) Conduct White test to test the stated hypothesis in part 5. [2 marks) 7 Write down one method to resolve heteroscedasticity if it exists. (1 mark) Write down the null and the alternative hypothesis to test the absence of 1* order autocorrelation assumption of the classical linear regression model. (1 mark) 5) 6) 81 Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. For concreteness, let return be the total retum for holding a firm's stock over the four-year period from the end of 1990 to the end of 1994 The efficient markets hypothesis says that these returns should not be systematically related to information known in 1990. if firm characteristics known at the beginning of the period help to predict stock returns, then we could use this information in choosing stocks. For 1990, let dir be a firm's debt to capital ratio, let eps denote the eamings per share, let netinc denote net income, and let salory denote total compensation for the CEO. See file return.xis. The definition of the variables of interest is presented in the table below: Variable Definition / Unit return change stock price, 90-94 debt/capital, 1990 warnings per share. 1990 netinc net income, 1990 (millions $) salary CEO salary, 1990 (thousands $) dki eps Consider the following model: retum; = 8 +8,0kn +3,eps +Binetina + Besclary+u Estimate the parameters in the above equation with the given sample data. (3 marks) 21 Interpret the parameters estimated in your equation (5 marks) 3) Are the coefficients statistically significant? 'Hint: Conduct proper hypothesis testing for each coefficient using one approach. 15 marks) How well does the estimated regression equation fit the data? Hint: Explain the R-squared (1 mark) Write down the null and the alternative hypothesis to test the homoscedastic assumption of the classical linear regression model. (1 mark) Conduct White test to test the stated hypothesis in part 5. [2 marks) 7 Write down one method to resolve heteroscedasticity if it exists. (1 mark) Write down the null and the alternative hypothesis to test the absence of 1* order autocorrelation assumption of the classical linear regression model. (1 mark) 5) 6) 81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts