Question: Refer to the stock options on Microsoft in the Eigure 2.10. Suppose you buy a November expiration call option on 200 shares with the

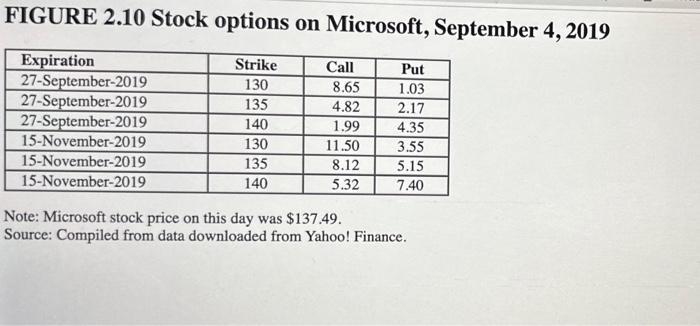

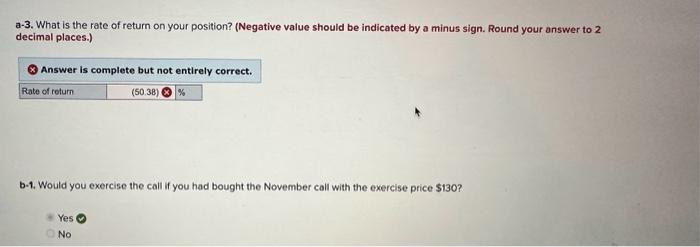

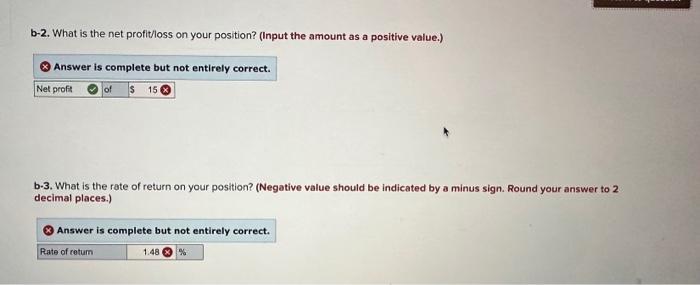

Refer to the stock options on Microsoft in the Eigure 2.10. Suppose you buy a November expiration call option on 200 shares with the excise price of $135. Required: a-1. If the stock price at option expiration is $143, will you exercise your call? Yes No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Answer is complete but not entirely correct. Not loss of $268 FIGURE 2.10 Stock options on Microsoft, September 4, 2019 Expiration 27-September-2019 27-September-2019 27-September-2019 15-November-2019 15-November-2019 15-November-2019 Strike 130 135 140 130 135 140 Call 8.65 4.82 1.99 11.50 8.12 5.32 Put 1.03 2.17 4.35 3.55 5.15 7.40 Note: Microsoft stock price on this day was $137.49. Source: Compiled from data downloaded from Yahoo! Finance. a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Rate of return (50.38) % b-1. Would you exercise the call if you had bought the November call with the exercise price $130? Yes No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Answer is complete but not entirely correct. Net profit of $150 b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Rate of return 1.48%

Step by Step Solution

3.32 Rating (167 Votes )

There are 3 Steps involved in it

a1 Price of 135 Strike price call 482 Contract size 200 shares Total cost Contract sizePrice of 135 Strike price call 200482 964 Under call option it ... View full answer

Get step-by-step solutions from verified subject matter experts