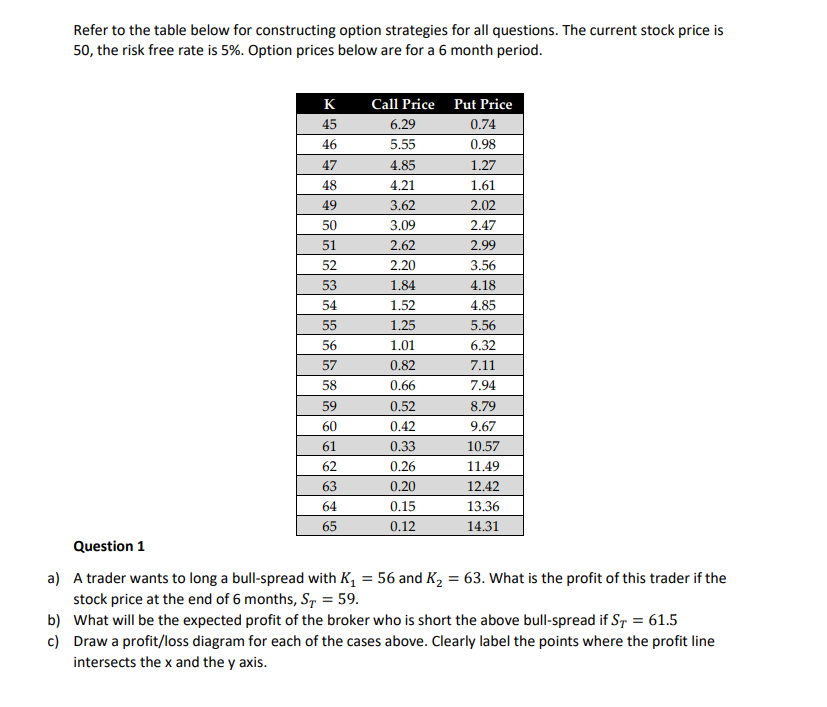

Question: Refer to the table below for constructing option strategies for all questions. The current stock price is 50, the risk free rate is 5%. Option

Refer to the table below for constructing option strategies for all questions. The current stock price is 50, the risk free rate is 5%. Option prices below are for a 6 month period. K Call Price Put Price 45 6.29 0.74 46 5.55 0.98 47 4.85 1.27 48 4.21 1.61 49 3.62 2.02 50 3.09 2.47 51 2.62 2.99 52 2.20 3.56 53 1.84 4.18 54 1.52 4.85 55 1.25 5.56 56 1.01 6.32 57 0.82 7.11 58 0.66 7.94 59 0.52 8.79 60 0.42 9.67 61 0.33 10.57 62 0.26 11.49 63 0.20 12.42 0.15 13.36 65 0.12 14.31 Question 1 a) A trader wants to long a bull-spread with K. = 56 and K, = 63. What is the profit of this trader if the stock price at the end of 6 months, Sy = 59. b) What will be the expected profit of the broker who is short the above bull-spread if S = 61.5 c) Draw a profit/loss diagram for each of the cases above. Clearly label the points where the profit line intersects the x and the y axis. 64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts