Question: Reference factors: Reference dataset: (a) Consider a 3 -factor model. Find the and for the model with the factors provided in the attached file factors.

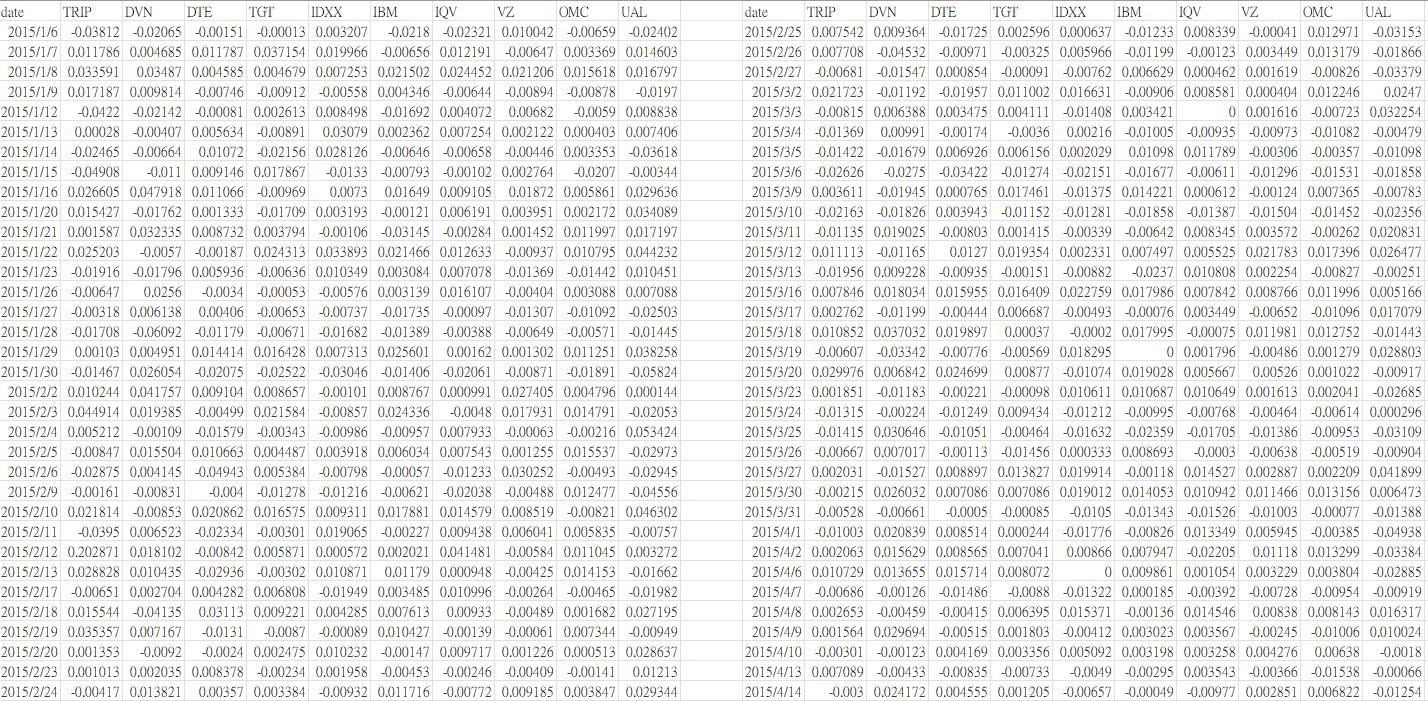

Reference factors:

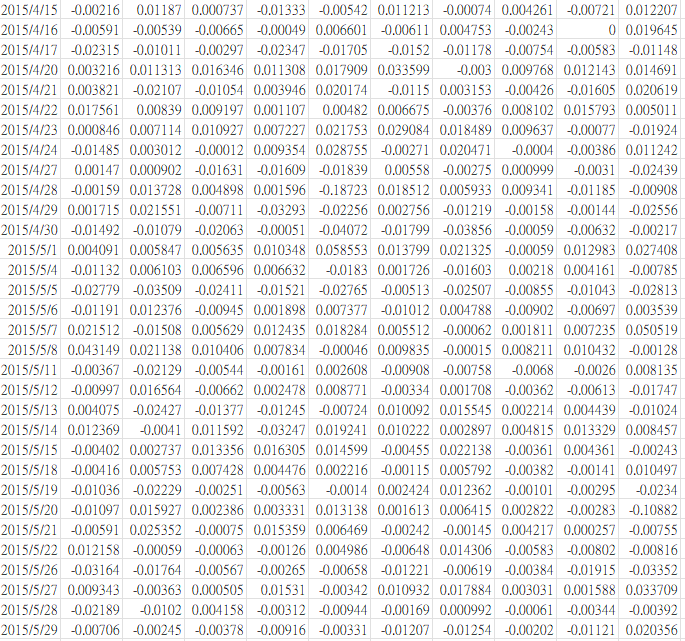

Reference dataset:

(a) Consider a 3 -factor model. Find the and for the model with the factors provided in the attached file "factors. csv". Now we have the three explicit factors in matrix F and want to fit the model X=1+BF+E where the loadings are a matrix of betas. Use all data in "dataset.csv". Print the values of and . Find the five stocks with the highest . (b) With the five stocks you find in Q3.d, we now implement walk-forward (WF) process based on rolling windows. We divide the 1000 days into 10 windows of length 100 denoted as [T0,T1,,T9] and in each Tn,n=1,,9 we will stick to a certain portfolio wn,n=1,,9, calculated based on the data only in Tn1. Apply the RPP (Q1), HRP (Q2) and GMVP portfolio. For RRP portfolio, use the budget vector [0.2,0.2,0.2,0.2,0.2] Create grouped bar charts of the allocation for each portfolio like the following figure. (c) Compute the simple return (not compounded) in this backtest. Plot the return path like the following figure. (d) Redo the Q3.c with the shrinkage estimator as follows: ^SH=(1)^+T where =0.3,^ denotes the sample covariance matrix, and the target is T=N1Tr(^)I (scaled identity). (a) Consider a 3 -factor model. Find the and for the model with the factors provided in the attached file "factors. csv". Now we have the three explicit factors in matrix F and want to fit the model X=1+BF+E where the loadings are a matrix of betas. Use all data in "dataset.csv". Print the values of and . Find the five stocks with the highest . (b) With the five stocks you find in Q3.d, we now implement walk-forward (WF) process based on rolling windows. We divide the 1000 days into 10 windows of length 100 denoted as [T0,T1,,T9] and in each Tn,n=1,,9 we will stick to a certain portfolio wn,n=1,,9, calculated based on the data only in Tn1. Apply the RPP (Q1), HRP (Q2) and GMVP portfolio. For RRP portfolio, use the budget vector [0.2,0.2,0.2,0.2,0.2] Create grouped bar charts of the allocation for each portfolio like the following figure. (c) Compute the simple return (not compounded) in this backtest. Plot the return path like the following figure. (d) Redo the Q3.c with the shrinkage estimator as follows: ^SH=(1)^+T where =0.3,^ denotes the sample covariance matrix, and the target is T=N1Tr(^)I (scaled identity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts