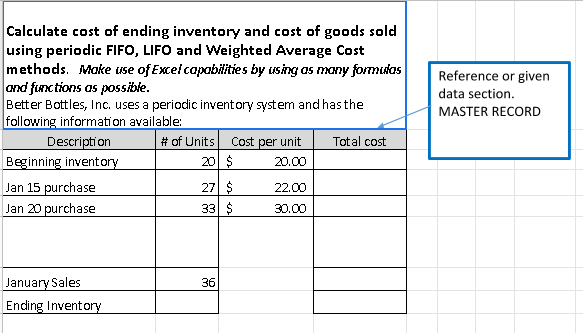

Question: Reference or given data section. MASTER RECORD Calculate cost of ending inventory and cost of goods sold using periodic FIFO, LIFO and Weighted Average Cost

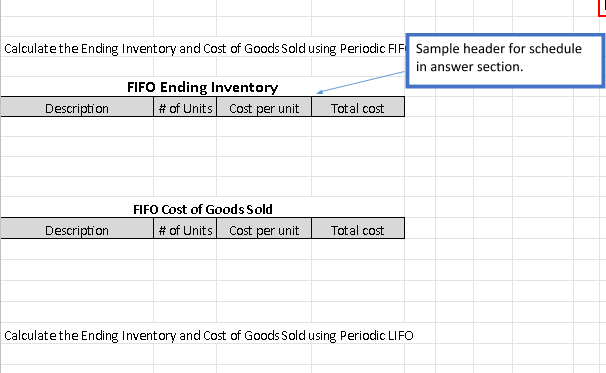

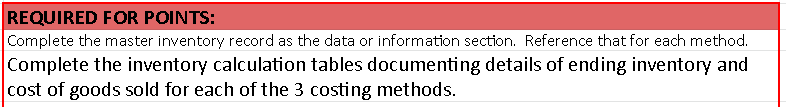

Reference or given data section. MASTER RECORD Calculate cost of ending inventory and cost of goods sold using periodic FIFO, LIFO and Weighted Average Cost methods. Make use of Excel capabilities by using as many formulas and functions as possible. Better Bottles, Inc. uses a periodic inventory system and has the following information available: Description # of Units Cost per unit Total cost Beginning inventory 201$ 20.00 Jan 15 purchase 27 $ 22.00 Jan 20 purchase 33 $ 30.00 36 January Sales Ending Inventory Calculate the Ending Inventory and Cost of Goods Sold using Periodic FIF Sample header for schedule in answer section. FIFO Ending Inventory Description # of Units Cost per unit Total cost FIFO Cost of Goods Sold # of Units Cost per unit Description Total cost Calculate the Ending Inventory and Cost of Goods Sold using Periodic LIFO Calculate the Ending Inventory and Cost of Goods Sold using Periodic Weighted Average REQUIRED FOR POINTS: Complete the master inventory record as the data or information section. Reference that for each method. Complete the inventory calculation tables documenting details of ending inventory and cost of goods sold for each of the 3 costing methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts