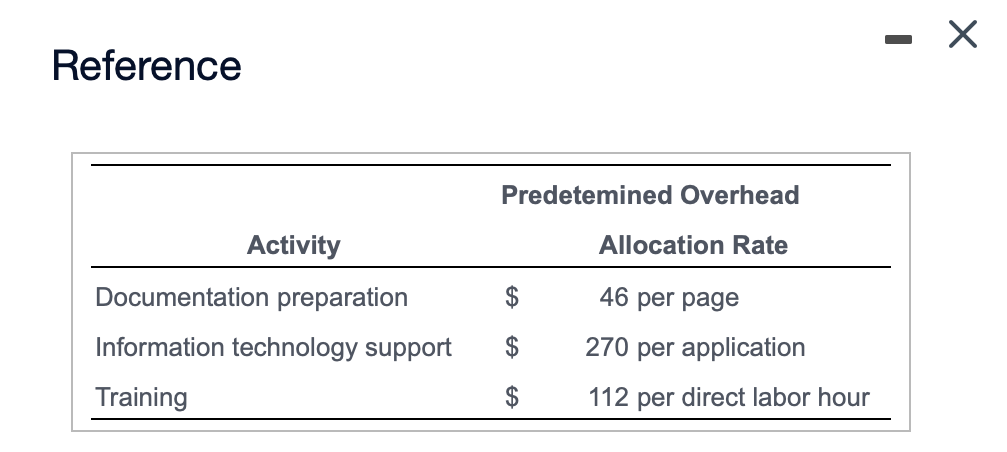

Question: - Reference Predetemined Overhead Activity Allocation Rate 46 per page Documentation preparation Information technology support $ 270 per application Training $ 112 per direct labor

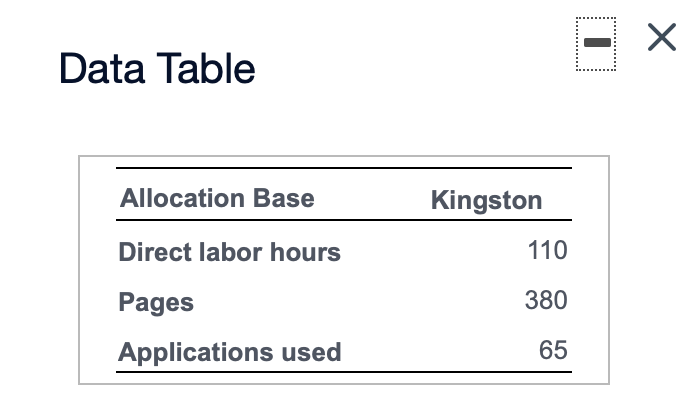

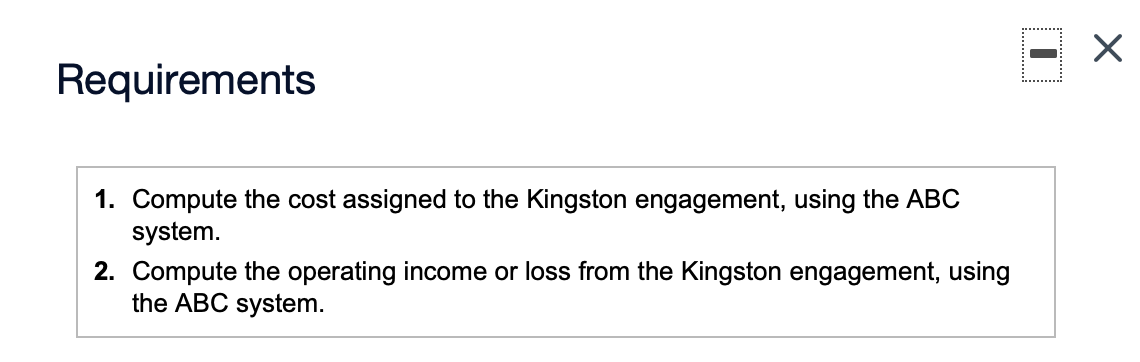

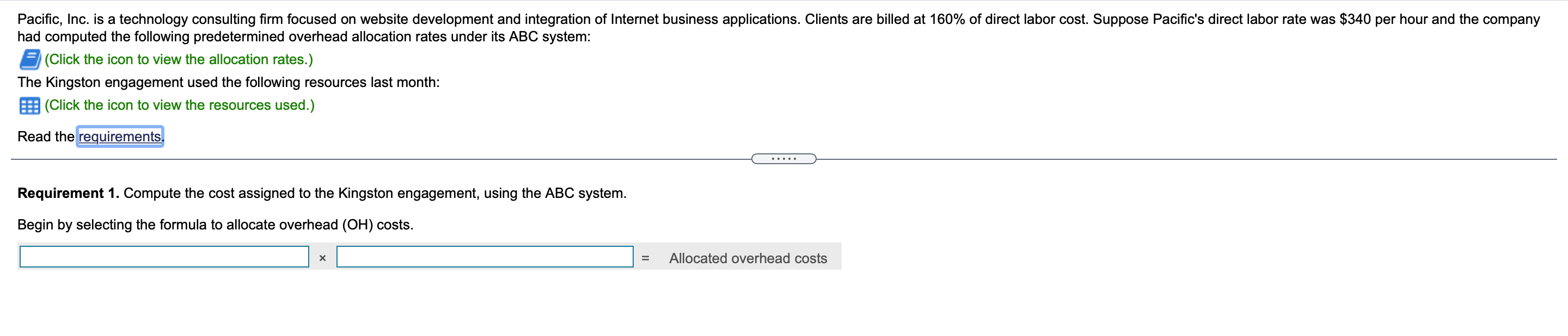

- Reference Predetemined Overhead Activity Allocation Rate 46 per page Documentation preparation Information technology support $ 270 per application Training $ 112 per direct labor hour Data Table Allocation Base Kingston Direct labor hours 110 Pages 380 Applications used 65 Requirements 1. Compute the cost assigned to the Kingston engagement, using the ABC system. 2. Compute the operating income or loss from the Kingston engagement, using the ABC system. Pacific, Inc. is a technology consulting firm focused on website development and integration of Internet business applications. Clients are billed at 160% of direct labor cost. Suppose Pacific's direct labor rate was $340 per hour and the company had computed the following predetermined overhead allocation rates under its ABC system: 2 (Click the icon to view the allocation rates.) The Kingston engagement used the following resources last month: (Click the icon to view the resources used.) Read the requirements. Requirement 1. Compute the cost assigned to the Kingston engagement, using the ABC system. Begin by selecting the formula to allocate overhead (OH) costs. = Allocated overhead costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts