Question: In July year 1, a company sold goods at VAT rate with a net value of $200,000, goods exempt from VAT with a value

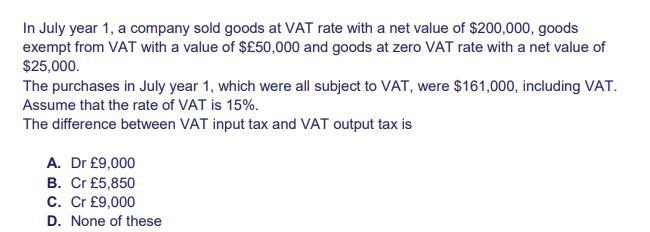

In July year 1, a company sold goods at VAT rate with a net value of $200,000, goods exempt from VAT with a value of $50,000 and goods at zero VAT rate with a net value of $25,000. The purchases in July year 1, which were all subject to VAT, were $161,000, including VAT. Assume that the rate of VAT is 15%. The difference between VAT input tax and VAT output tax is A. Dr 9,000 B. Cr 5,850 C. Cr 9,000 D. None of these

Step by Step Solution

3.56 Rating (187 Votes )

There are 3 Steps involved in it

B5850 EXPLANATION The calculation for the difference between VAT input tax and VAT output tax is as ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635d8ff18678d_176774.pdf

180 KBs PDF File

635d8ff18678d_176774.docx

120 KBs Word File