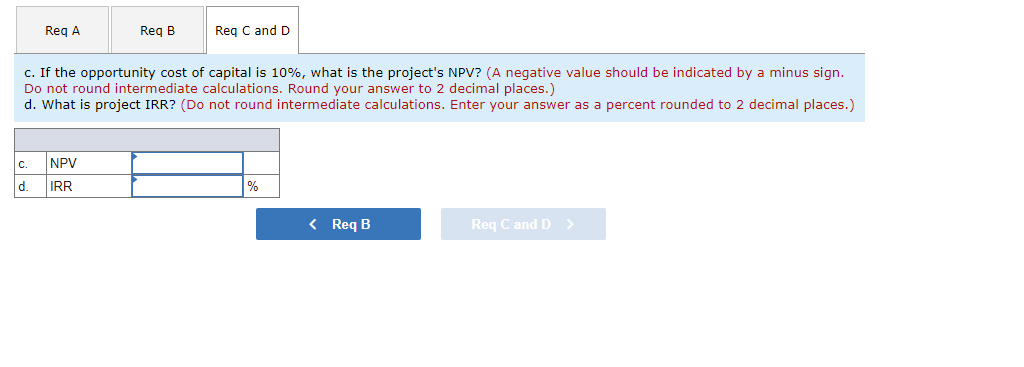

Question: Reg A Reg B Reg C and D c. If the opportunity cost of capital is 10%, what is the project's NPV? (A negative value

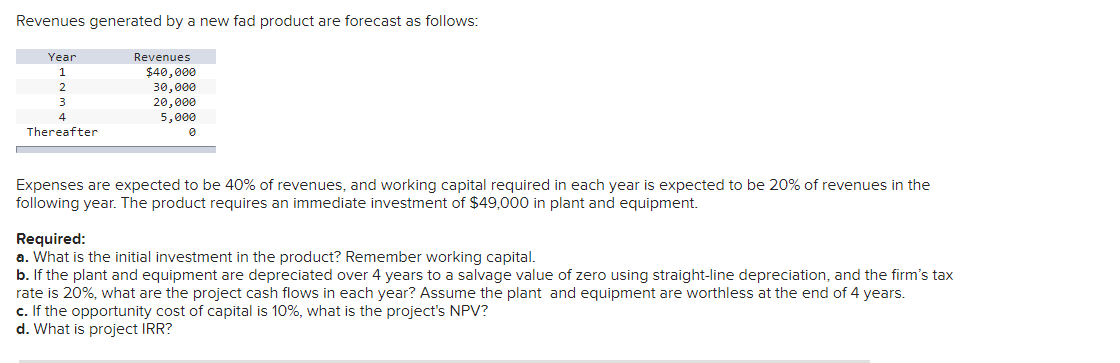

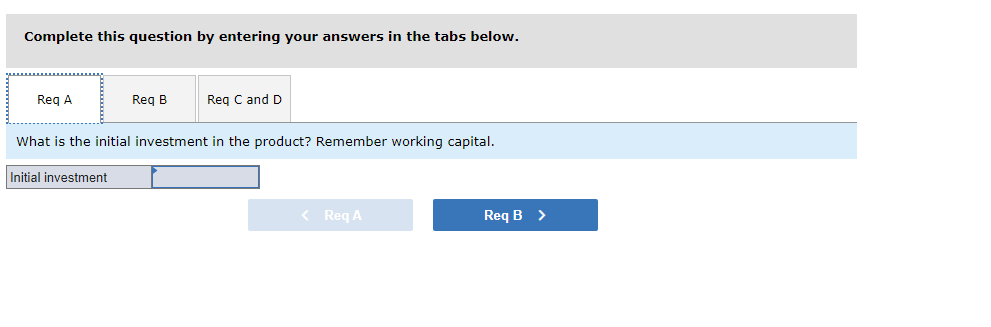

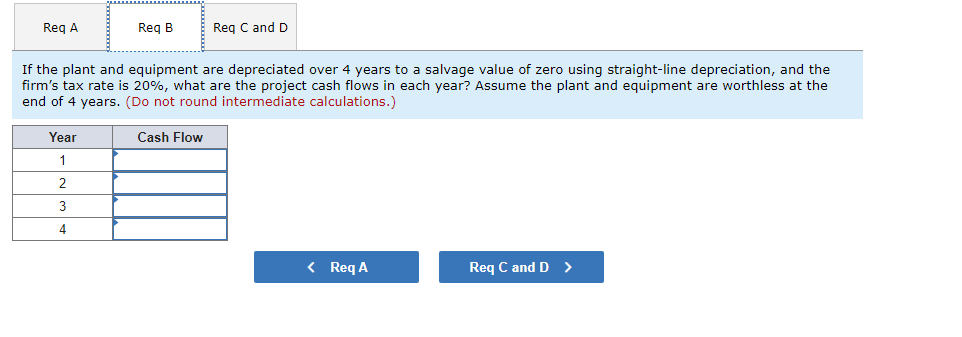

Reg A Reg B Reg C and D c. If the opportunity cost of capital is 10%, what is the project's NPV? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What is project IRR? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) C NPV d. IRR % Reg A Reg B Reg C and D If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. (Do not round intermediate calculations.) Year Cash Flow 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts