Question: Register CALCULATOR PRINTER VERSION 4 BACK NEXT Exercise 3-18 Michelle Walker, M.D., maintains the accounting records of Walker Clinic on a cash basis. During 2020,

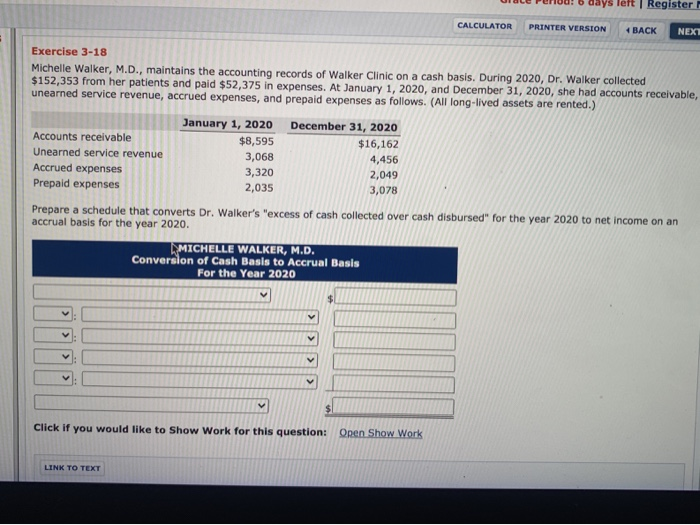

Register CALCULATOR PRINTER VERSION 4 BACK NEXT Exercise 3-18 Michelle Walker, M.D., maintains the accounting records of Walker Clinic on a cash basis. During 2020, Dr. Walker collected $152,353 from her patients and paid $52,375 in expenses. At January 1, 2020, and December 31, 2020, she had accounts receivable, unearned service revenue, accrued expenses, and prepaid expenses as follows. (All long-lived assets are rented.) January 1, 2020 December 31, 2020 Accounts receivable $8,595 $16,162 Unearned service revenue 3,068 4,456 Accrued expenses 3,320 2,049 Prepaid expenses 2,035 3,078 Prepare a schedule that converts Dr. Walker's "excess of cash collected over cash disbursed" for the year 2020 to net income on an accrual basis for the year 2020. MICHELLE WALKER, M.D. Conversion of Cash Basis to Accrual Basis For the Year 2020 $ $1 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts