Question: (Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net

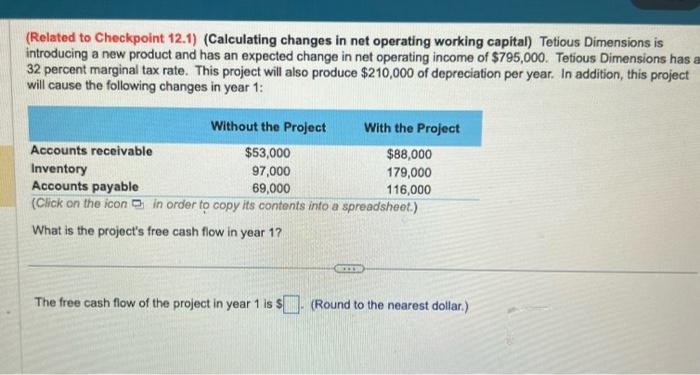

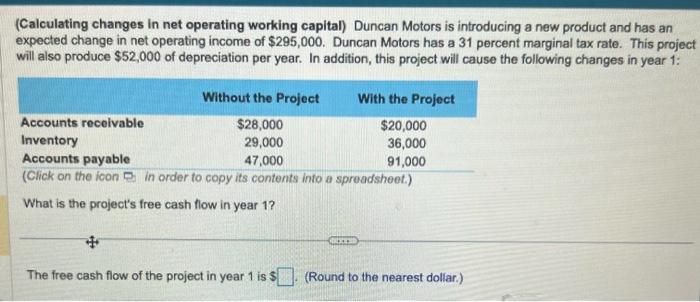

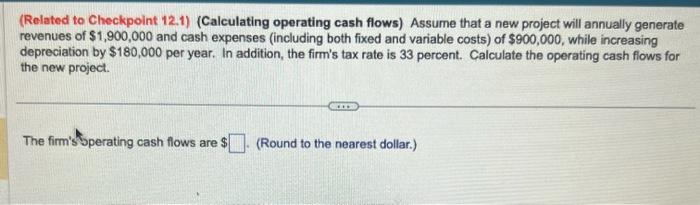

(Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net operating income of $795,000. Tetious Dimensions has 32 percent marginal tax rate. This project will also produce $210,000 of depreciation per year. In addition, this project will cause the following changes in year 1 : What is the project's free cash flow in year 1? The free cash flow of the project in year 1 is $ (Round to the nearest dollar.) (Calculating changes in net operating working capital) Duncan Motors is introducing a new product and has an expected change in net operating income of $295,000. Duncan Motors has a 31 percent marginal tax rate. This project will also produce $52,000 of depreciation per year. In addition, this project will cause the following changes in year 1 : What is the project's free cash flow in year 1? The free cash flow of the project in year 1 is $ (Round to the nearest doliar.) (Related to Checkpoint 12.1) (Calculating operating cash flows) Assume that a new project will annually generate revenues of $1,900,000 and cash expenses (including both fixed and variable costs) of $900,000, while increasing depreciation by $180,000 per year. In addition, the firm's tax rate is 33 percent. Calculate the operating cash flows for the new project. The firm's Sperating cash flows are $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts