Question: (Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net

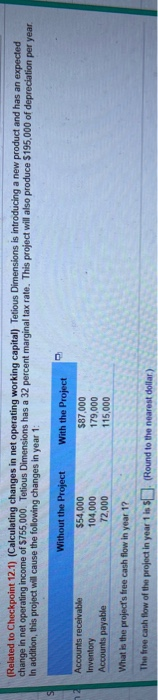

(Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net operating income of $755,000 Tetious Dimensions has a 32 percent marginal tax rate. This project will also produce $195,000 of depreciation per year In addition, this project will cause the following changes in year 1: Without the Project With the Project Accounts receivable Inventory Accounts payable $54,000 104,000 72,000 $87,000 179,000 115,000 What is the project's free cash flow in year 1? The tree cash flow of the project in year 1in (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts