Question: (Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net

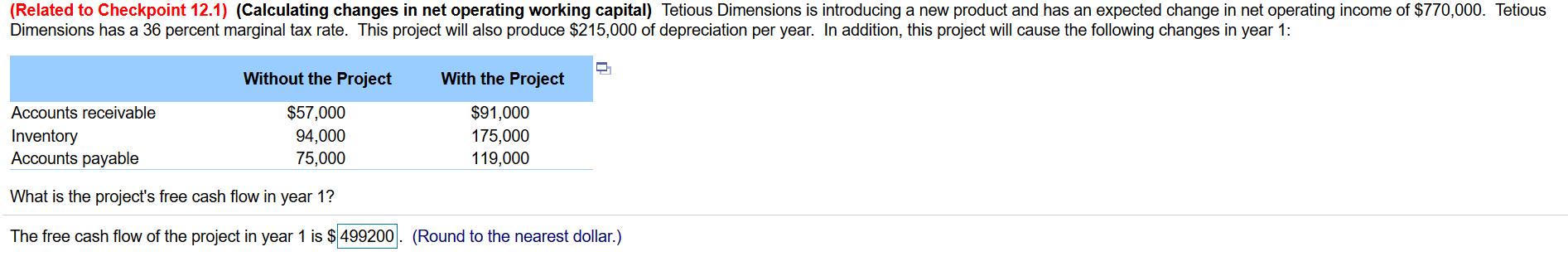

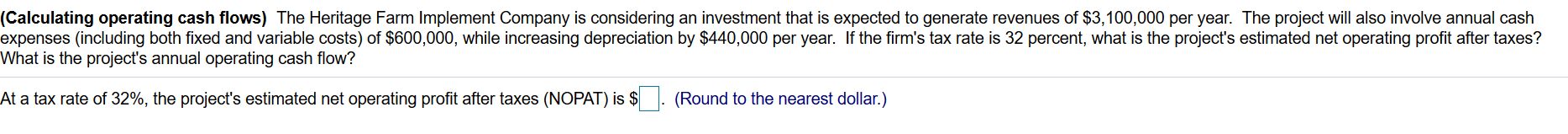

(Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net operating income of $770,000. Tetious Dimensions has a 36 percent marginal tax rate. This project will also produce $215,000 of depreciation per year. In addition, this project will cause the following changes in year 1: Without the Project With the Project Accounts receivable Inventory Accounts payable $57,000 94,000 75,000 $91,000 175,000 119,000 What is the project's free cash flow in year 1? The free cash flow of the project in year 1 is $ 499200. (Round to the nearest dollar.) (Calculating operating cash flows) The Heritage Farm Implement Company is considering an investment that is expected to generate revenues of $3,100,000 per year. The project will also involve annual cash expenses (including both fixed and variable costs) of $600,000, while increasing depreciation by $440,000 per year. If the firm's tax rate is 32 percent, what is the project's estimated net operating profit after taxes? What is the project's annual operating cash flow? At a tax rate of 32%, the project's estimated net operating profit after taxes (NOPAT) is $ . (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts