Question: (Related to Checkpoint 12.1) (Comprehensive problem - calculating project cash flows, NPV, PI, and IRR) Traid Winds Corporasion, a firm in the 34 percent margnal

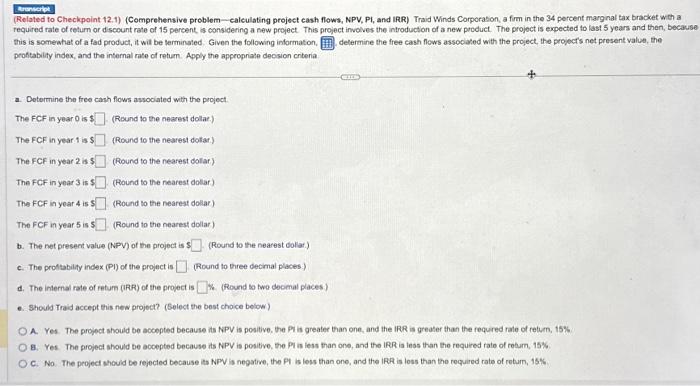

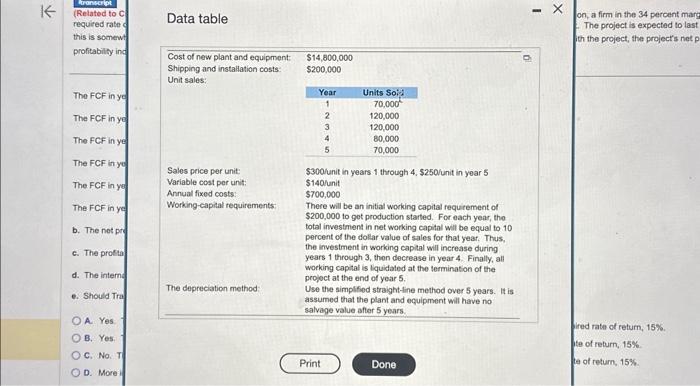

(Related to Checkpoint 12.1) (Comprehensive problem - calculating project cash flows, NPV, PI, and IRR) Traid Winds Corporasion, a firm in the 34 percent margnal tax bracket whi a reguired rate of eetum or discount rate of 15 percent, is considering a new project. This project involves the introducton of a new product. The project is expected to last 5 years and then, because this is someahat of a fad product, it wit be lerminsted. Given the following informaton, delermine the free cash flows associated with the project, the project's net present value, the proftability index, and the internal rate of return. Apply the appropriate deosion criteria a. Determine the free canh flows associated with the project. The FCF in year 0 is \$ (Round to the nearest dollar.) The FCF in year 1 is $ (Round to the nearest dotar.) The FCF in year 2 is $ (Round to the nearest dollar) The FCF in year 3 is $ (Hound to the nearest dolar) The FCF in year 4 is 5 (Round to the nearest dollar) The FCF in year 5 is 5 (Round to the nearest dollar) b. The net present value (NPV) of the project is : (Round to the nearest dolat.) c. The proftabilfy index (PI) of the project is (Round to three decimal places) d. The inlernal rate of retum (IRR) of the project is \&. (Round to two decmal places) e. Should Traid accept this new project? (Select the best choce bolow) A. Yes. The propect should be aocopted because it NPV is positive. the Pi is greater than one, and the IRR is greater than the requred rale of return, 15\% 8. Yes. The project should be accepted because it NPPV is positive, the PI is iest than one, and the lRR ia leos than the required rato of retum, 15\%. c. No. The project should be rejected because is NPV is negative, the PI is less than one, and the IRR is loss than the requirod rato of roturn, 15%. Data table on, a firm in the 34 percent mary the project is expected to last

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts