Question: (Related to Checkpoint 13.1) (Forecasting cash flows using the expected value) Koch Transportation is contemplating the acquisition of LH Transport, a competing trucking firm Koch's

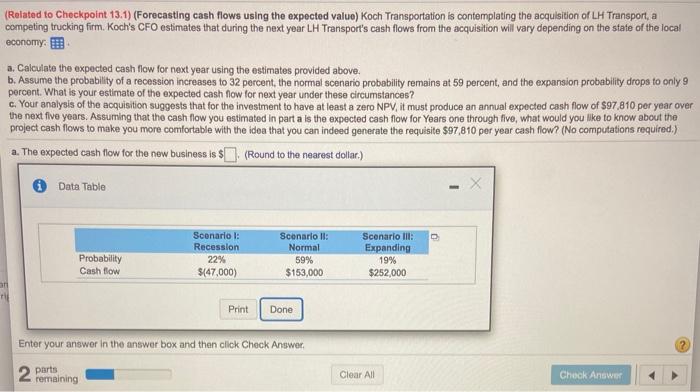

(Related to Checkpoint 13.1) (Forecasting cash flows using the expected value) Koch Transportation is contemplating the acquisition of LH Transport, a competing trucking firm Koch's CFO estimates that during the next year LH Transport's cash flows from the acquisition will vary depending on the state of the local economy a. Calculate the expected cash flow for next year using the estimates provided above. b. Assume the probability of a recession increases to 32 percent, the normal scenario probability remains at 59 percent, and the expansion probability drops to only 9 C. Your analysis of the acquisition suggests that for the investment to have at least a zero NPV it must produce an annual expected cash flow of $97,810 per year over the next five years. Assuming that the cash flow you estimated in part a is the expected cash flow for Years one through five, what would you like to know about the project cash flows to make you more comfortable with the idea that you can indeed generate the requisite $97,810 per year cash flow? (No computations required.) a. The expected cash flow for the new business is $. (Round to the nearest dollar.) Data Table Probability Cash flow Scenario : Recession 22% $147,000) Scenario ll: Normal 59% $153,000 Scenario Ill: Expanding 19% $252,000 an Print Done Enter your answer in the answer box and then click Check Answer 2 parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts