Question: ( Related to Checkpoint 4 . 4 ) ( Analyzing market value ) Greene, Inc. ' s balance sheet indicates that the book value of

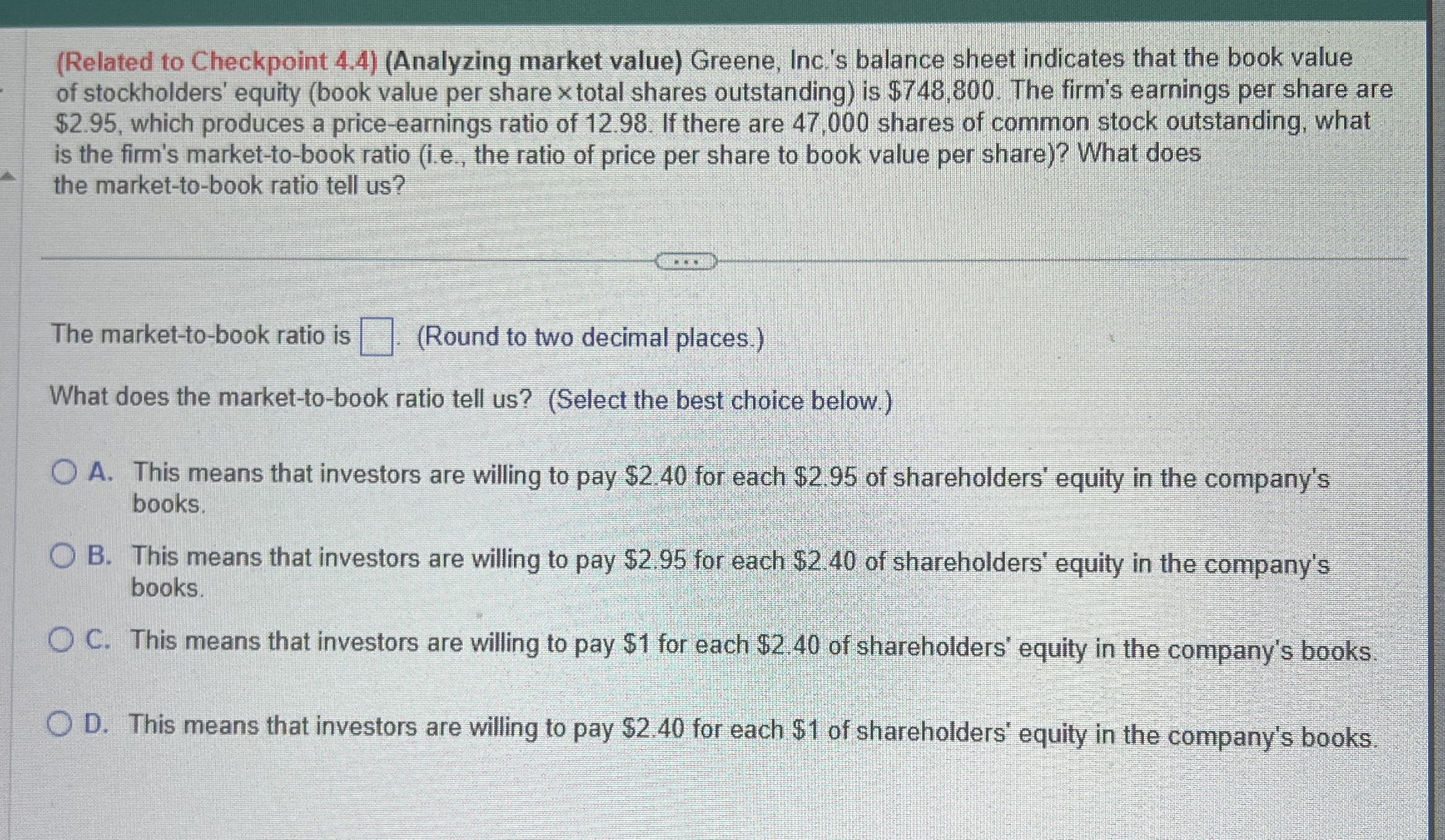

Related to Checkpoint Analyzing market value Greene, Inc.s balance sheet indicates that the book value

of stockholders' equity book value per share total shares outstanding is $ The firm's earnings per share are

$ which produces a priceearnings ratio of If there are shares of common stock outstanding, what

is the firm's markettobook ratio ie the ratio of price per share to book value per share What does

the markettobook ratio tell us

The markettobook ratio is

Round to two decimal places.

What does the markettobook ratio tell usSelect the best choice below.

A This means that investors are willing to pay $ for each $ of shareholders' equity in the company's

books.

B This means that investors are willing to pay $ for each $ of shareholders' equity in the company's

books.

C This means that investors are willing to pay $ for each $ of shareholders' equity in the company's books.

D This means that investors are willing to pay $ for each $ of shareholders' equity in the company's books.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock